Risk

management

At GCPL, we have a comprehensive and structured approach to risk management. Across our geographies, we have integrated our approach to risk management into the operating framework and reporting channels of our business. Starting with a Board-level oversight to a dedicated Risk Management Committee and a cross-functional team within the business, we routinely assess risks across the company and all geographies.

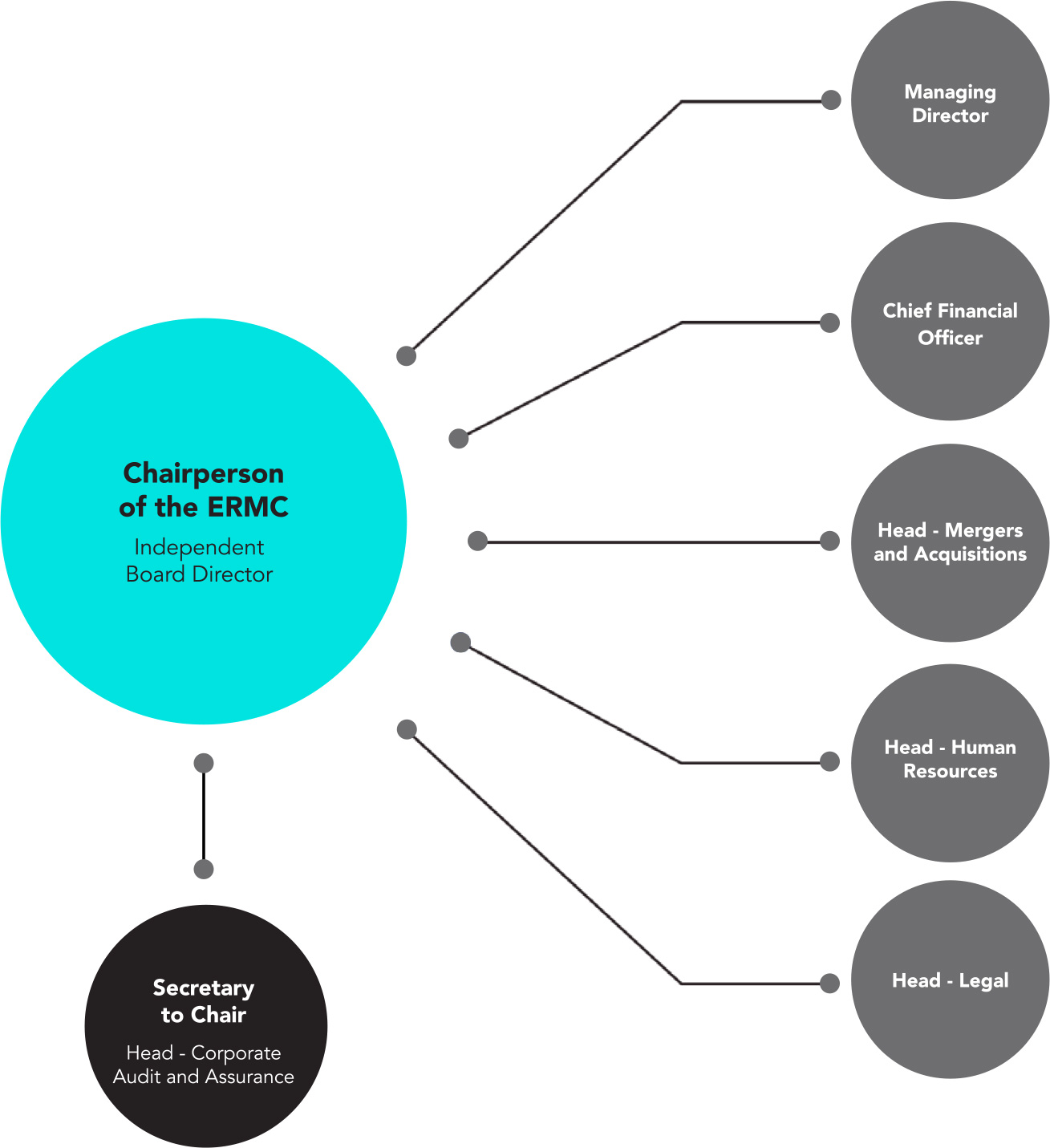

Executive Risk Management Committee

The Executive Risk Management Committee (ERMC) ensures that we follow a structured risk management process. This committee is entrusted with the crucial task of risk identification, assessment, and mitigation for our company across various domains, including strategic, material, operational, transitional, technological, and environmental.

The ERMC shoulders the comprehensive responsibility of monitoring the company’s risk landscape and managing it effectively to ensure a robust and thriving business. This committee remains steadfast in its commitment to uphold transparency and safeguard the interests of the company and its stakeholders.

Structure of the Executive

Risk Management Committee

Based on the recommendations of the Managing Director and CEO or the Chief Financial Officer, the ERMC may nominate or invite additional members/directors, as required, to participate in specific meetings.

The Secretary to the ERMC is the highest-ranking person with a dedicated risk management responsibility at operational and performance levels. The Secretary acts as a Chief Risk Officer and oversees the functioning of the risk management process. The Secretary must ensure that the ERMC meetings are held half-yearly or more frequently, if required.

Approach

We take a proactive approach to risk management, wherein an annual risk identification and assessment process is incorporated in line with our strategic business planning and annual business planning initiatives.

The annual business plan is a foundation for identifying and prioritising risks. Following prioritisation, a risk competency scan is conducted to determine existing management strategies that effectively address material and emerging risks to our business. This scanning process helps in pinpointing opportunities for enhancing risk mitigation.

For each material and emerging risk, the combined outcomes of the existing management strategies and identified improvement opportunities are documented in a formal risk management plan. Subsequently, the assessment of prioritised risks and their mitigation strategies is presented to the Board Risk Management Committee for evaluation and review.

The risk assessment function is structurally independent of business and is overseen and coordinated by the Secretary to the ERMC. The risk assessment outcomes fall under the ownership of the respective business function heads. This collaborative approach ensures a comprehensive and efficient risk management strategy across the organisation.

Risk management approach

Risk review

Risk owners are appointed for material and emerging risks. These risk owners assess, manage, evaluate, and monitor the risks and propose the risk mitigation plan. The implementation of the risk mitigation action plan is agreed upon by the ERMC and Board Committees, and any deviations are discussed with the function heads and Managing Director and CEO.

The risk owners may change over time, depending on their changing roles and responsibilities within the organisation.

On a half-yearly basis, the risk owner formally reports about risk management within their area of operation at the ERMC meetings. This reporting is aimed at assessing how well material risks are being managed and if any additional risk has emerged that can adversely affect business operations. The risk report includes:

- Performance of the function in managing its material risks, considering the mitigation strategies

- Identification of any additional emerging risks

- Definitions of the mitigation strategy for the new material risks

The results of this report are coordinated by the Secretary to the ERMC and are made available for review by the ERMC. The Secretary submits a half-yearly report on risk management for review and appraisal of the ERMC. In addition, every 6 months, based on a pre-specified calendar, a risk owner would formally present the risk management initiatives and status of their area of operation to the ERMC

The ERMC is responsible for:

- Half-yearly reports to the Audit Committee and Risk Management Committee

- Half-yearly review of the risk mitigation status for material and emerging risks

- Annual assessment of risks in line with business/strategic planning

Risk culture

Employees across all levels and geographies have risks as part of their individual goals and performance review. These risks range from measures to reduce occupational health and safety incidents, adherence to regulations and compliance, financial forecasting to reduction of volatile forex exposure. The risk goal weightage for employees ranges from 30% to 60% and is a part of their half-yearly HR employee performance review. Compliance and quality risk assessments are a part of our new product development (NPD) process, and the goal is aligned with the key performance indicators of R&D team members involved in NPDs.

New managers are inducted on Enterprise Risk Management training, which is organised quarterly. They are trained on inputs on risk definition, identification, rating, classification, prioritisation, mitigation, control, and review. Across all manufacturing facilities, we also conduct workshops on occupational health and safety risks and management throughout the year, encompassing over 100% of our manufacturing plant workforce.

Our employees are encouraged to share feedback for continuous improvement in risk management practices. A formal annual NPS survey is conducted across the company for all functions. Risk management is a part of that survey, and the feedback helps us improve our processes and systems.

An annual InTune survey is also conducted across the company seeking suggestions and feedback from all employees. Moreover, emerging risks and development of mitigation measures are discussed in regularly conducted departmental monthly review meetings. The line manager records valid risks identified by team members and communicates them to the Risk Management Committee for further action. At the plant level, we have a mobile app to identify occupational health and safety risks. These risks are tracked, reviewed, and mitigated through the app.

Risk management

| Risk category | Risks description | Risk mitigation | Priority |

|---|---|---|---|

|

Financial |

Forex |

At GCPL, the forex policy is determined by a dedicated Forex Committee. This committee monitors all exposures and guides decisions on open exposures and hedging. The committee meets monthly and provides quarterly reports to the Board on forex exposures. |

High |

|

Supply chain |

Commodity price volatility |

Our primary commitment remains to serve the needs of our consumers above all else. In challenging times, we continue to work in their best interest and have passed on only a fraction of the increased input costs to them. Additionally, we have consistently maintained the quality standards of our products, refusing to compromise on quality in the face of rising input costs. To further mitigate this risk, we are actively working to secure high-quality palm oil from various regions and geographies, thereby reducing our dependency on major palm oil markets. |

High |

|

Operational |

Occupational health and safety |

This is a high-priority area for us. We have a dedicated Human Rights Policy, strong standard operating procedures to ensure the highest adherence to health and safety, and a governance mechanism to ensure any incidents are duly investigated and resolved for the future. We ensure a periodic review of safety procedures, and the Central Safety Committee and committees at plants review monthly data for occupational health and safety. |

High |

|

Economic |

Hyperinflation and |

We are strategically utilising our manufacturing capabilities and human resources in regions experiencing hyperinflation to lower our production costs. Simultaneously, we are investing in local procurement initiatives to reduce reliance on imports and minimise the impact of global supply chain disruptions. By supporting the local economy, we aim to foster economic stability and contribute to the well-being of the communities we serve. |

Medium |

|

Financial |

Changing consumer preferences |

We have conducted Life Cycle Assessment of more than 50% of our products (with a plan to cover 80% by 2025) to assess where in the value chain can our products be more sustainable on all environmental fronts: energy, water, plastic, and waste. We are working on the findings of the reports to make our products demonstrably greener. A great example of our green product is our innovative powder-to-liquid Magic handwash. It is the world’s most affordable handwash. It uses half the plastic packaging compared to a regular handwash refill and only a quarter of the fuel to be transported. We are also working, finding, and testing alternate packaging materials and increasing the use of post-consumer recycled plastic to move away from virgin plastic. |

Medium |

|

Regulatory |

Evolving regulations |

We have the highest levels of statutory compliance and ensure all regulations and laws of the land are adhered to. We have an internal system called Legatrix that helps all manufacturing units monitor adherence to compliance and regulations. It enables management with a one-stop view of the organisation’s compliances and control mechanism through comprehensive compliance dashboards and provides necessary information at the operating level by creating a comprehensive matrix on laws and their management. Further, our Corporate Affairs, Legal, and Audit teams are consistently communicating with key government departments and industry bodies to track new and emerging regulations. They routinely assess and analyse regulations to evaluate how these will impact business and mitigation for the same. |

Low |

Emerging risks

1. Climate change

Climate change is a critical challenge facing our planet, with its impact already being felt worldwide. Businesses and economies are particularly vulnerable to climate-related risks, such as supply chain disruptions, increased insurance premiums, and regulatory penalties. Our largest pool of consumers are in tropical countries such as India, Indonesia, and Africa, and all of these countries are witnessing significant impacts of climate change—unpredictable weather and scanty or excessive rainfall.

To address this challenge, a collaborative effort is required from all stakeholders, including businesses, policymakers, and society at large. We need to work together to transition to a low-carbon future by integrating technology, the economy, and society.

Technological advancements in renewable energy, energy efficiency, and carbon capture and storage are essential for reducing our reliance on fossil fuels and mitigating the impacts of climate change. However, technology alone is not sufficient. Policies and regulations that incentivise sustainable practices and reduce carbon footprint are also necessary, such as carbon pricing, renewable energy mandates, and building codes that promote energy efficiency.

Raising awareness and engaging society at large in this transition to a low-carbon future are also critical.

This can be achieved by conducting education and outreach programmes, as well as through public-private partnerships that bring together businesses, governments, and civil society organisations to work towards a shared goal. Overall, addressing climate change requires a multifaceted approach that integrates technology, the economy and society. By collaborating, we can build a more sustainable and resilient tomorrow for ourselves and future generations.

Impact of climate change risk

By conducting a thorough scenario analysis using the Task Force on Climate-related Financial Disclosures (TCFD) framework, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational locations at Karaikal, Katha, and Guwahati. This analysis was conducted by examining key parameters such as temperature, water scarcity, and precipitation, all of which will have a crucial role in shaping the impact of climate change on our business.

Our analysis was conducted within the context of two Shared Socioeconomic Pathways (SSPs), namely SSP-1 and SSP-5. By considering both scenarios, we could fully explore the range of potential climate change-associated outcomes and gain a comprehensive understanding of how our business may be affected.

Mitigation action

We have conducted a risk assessment based on the recommendations of TCFD to identify climate-related risks and develop effective strategies for their long-term mitigation. Furthermore, we have optimised our processes to reduce our carbon footprint and work towards achieving our goal of net zero emissions.

We support TCFD and have recently concluded

a climate-related risks assessment

2. Cybersecurity risk

Cybersecurity refers to the protection of computer systems, networks, and electronic data from theft, damage, or unauthorised access. As FMCG companies are becoming increasingly dependent on digital technology and online platforms, they are increasingly being exposed to cyber threats, which has made cybersecurity an emerging risk.

We often store large amounts of sensitive data, including financial information, customer data, and proprietary technology. We also rely on online platforms to connect with customers and suppliers, conduct transactions, and manage their supply chains. This makes us targets for cybercriminals who seek to steal data, disrupt operations, or extort money.

Cyber threats can come in many forms, such as phishing attacks, malware, ransomware, and denial-of-service attacks. These attacks can cause substantial damage to FMCG companies, including loss of revenue, damage to reputation, and legal liabilities.

Impact of cybersecurity risk

1. A cybersecurity breach can disrupt operations, leading to delayed shipments, lost sales, and decreased productivity.

2. A cybersecurity breach can lead to financial losses due to theft of sensitive data, disruption of operations, and the cost of repairing and recovering from the attack.

3. GCPL being customer-centric, places a high weightage on brand reputation to attract and retain customers. A cybersecurity breach can erode customer trust and damage brand reputation.

4. A cybersecurity breach can result in legal liability if the company is found to be negligent in protecting customer data or if it violates data protection regulations.

5. GCPL relies on proprietary technology, manufacturing processes, and recipes to differentiate their products from competitors. A cybersecurity breach can result in the theft of valuable intellectual property.

Mitigation of risks

While developing robust cybersecurity strategies that incorporate risk assessment, threat monitoring, incident response plans, and employee training, we regularly update our cybersecurity systems and infrastructure to keep up with the evolving threat landscape. By taking proactive measures to protect our digital assets, we mitigate the risk of cyberattacks and safeguard their reputation and financial well-being. We have implemented a cutting-edge disaster recovery solution that is both robust and fully automated, ensuring that our operations remain resilient even in the face of unforeseen disasters.

We have bolstered our security measures to offer enhanced protection for our endpoints, email and internet security, particularly in the context of a work-from-home scenario. Our teams can control, monitor, and log all access to protected assets. We have defined and enforced secure change control and configuration management processes. We have trained all our employees in incident-handling and contingency plans.

Further mitigation measures include advanced web security for work-from-home scenarios, perimeter intrusion prevention, perimeter firewalls, application firewalls, internal firewalls, and advanced server security.

We have crafted a robust Information Security Policy based on risk approach that implements, operates, monitors, reviews, maintains, and improves our information security. It encompasses people, process, and technology.

With these advanced technologies in place, our organisation can confidently navigate any challenge and safeguard against potential threats, all while maintaining seamless productivity and efficiency.

Read our Information

Security Policy

Our security systems are

ISO 27001:2022 certified

Our TCFD Report

Climate change poses severe risks to the global economy, entailing adverse financial impacts to all. Climate change also brings several opportunities that entities, including organisations, can leverage. Markets, investors, and consumers require clear, comprehensive, and high-quality information about these risks and opportunities to make relevant investment decisions. For a consumer goods enterprise like ours, climate-related risks and opportunities majorly stem from drivers such as a change in climate extremes, increasing frequency and severity of climate disasters, global and national policy shift towards a low-carbon economy, emerging technologies, and changes in consumer perception towards carbon and water-intensive products across the lifecycle.

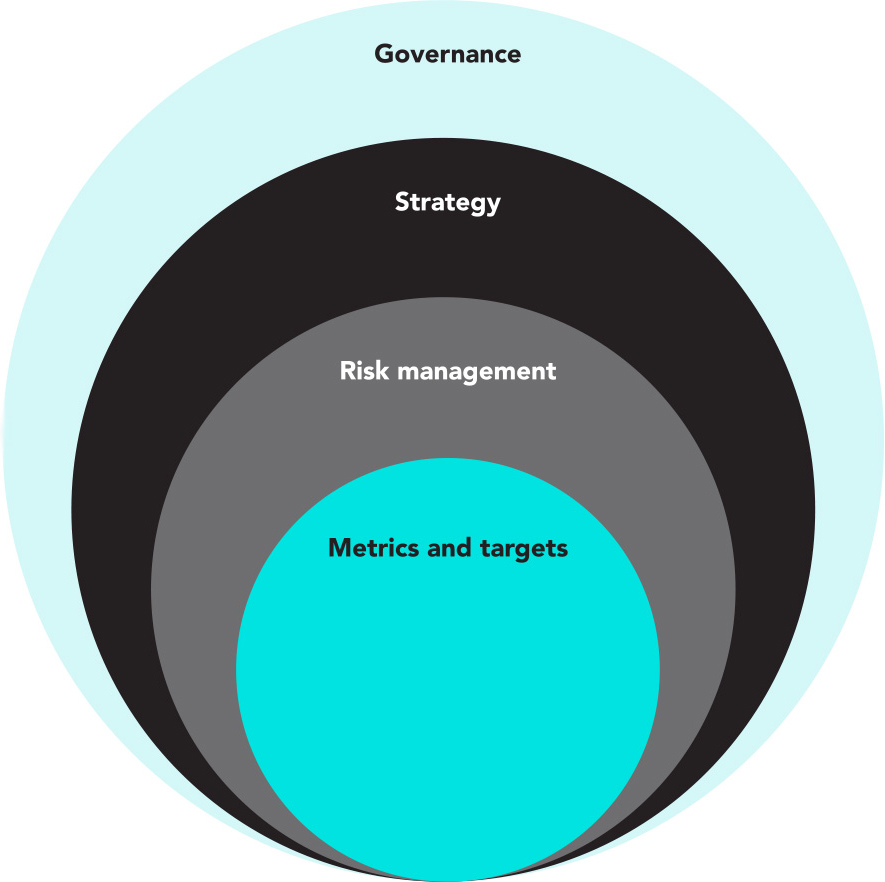

The TCFD framework recommends climate-related financial disclosures for supporting enterprises in better communicating the threats emerging from climate change and strategies to mitigate the same. These disclosures provided by organisations position them as market leaders through effective communication to concerned stakeholders and help them in strengthening their business strategy for efficient risk mitigation and resource allocation. The framework is structured across four pillars, namely governance, strategy, risk management, and metrics and targets. Within these four pillars, there are 11 recommended disclosures. These disclosures help investors or any other stakeholder to understand how companies address climate-related risks and opportunities.

As a company, we have regularly reported on our strategies towards climate change

through Integrated Annual Reports, and Carbon Disclosure Project (CDP) and Dow Jones Sustainability Index (DJSI) disclosures, which continue to strengthen the gaps in climate and water-related disclosures as per industry standards. We understand the growing importance of aligning our disclosures to the TCFD framework. In the current reporting cycle, we are disclosing climate change-related information on climate governance; processes to identify, assess, and manage climate change risks and opportunities; strategies to safeguard business performance; climate change scenario analysis as a forward-looking business strategy; and lastly, the metrics and the targets. Details about the aforementioned disclosures are provided in subsequent chapters. Further, we are also in the process of publishing our first standalone TCFD report.

Governance

We have a well-defined governance structure, covering the Board and management, to address emerging risks such as climate change.

The key stakeholders proactively engage and strategise on these emerging risks. The governance structure is presented in Figure 1.

The TCFD framework recommendations

Governance

Report on the organisation’s governance mechanism around climate-related risks and opportunities

Strategy

Report potential impacts of climate-related risks and opportunities on the business, strategy, and financial planning where it’s material

Risk management

Report how the company

identifies, assesses, and

manages climate-related risks

Metrics and targets

Report the metrics and targets used to assess and manage relevant climate-related risks and opportunities where it’s material

Figure 1: Core elements of recommended climate-related financial disclosures

Board’s role in addressing climate-related risks and opportunities

We have a strong Board-level oversight of climate-related issues in the organisation. The Managing Director and CEO approves climate-related strategies and reviews the sustainability performance through key performance indicators on a quarterly basis. Further, a mid-year review of Annual Operating Plans is also conducted at all levels. We have a Board-level Sustainability Committee headed by the Chair of the Board to oversee the sustainability performance and provide strategic inputs on various climate change-related matters.

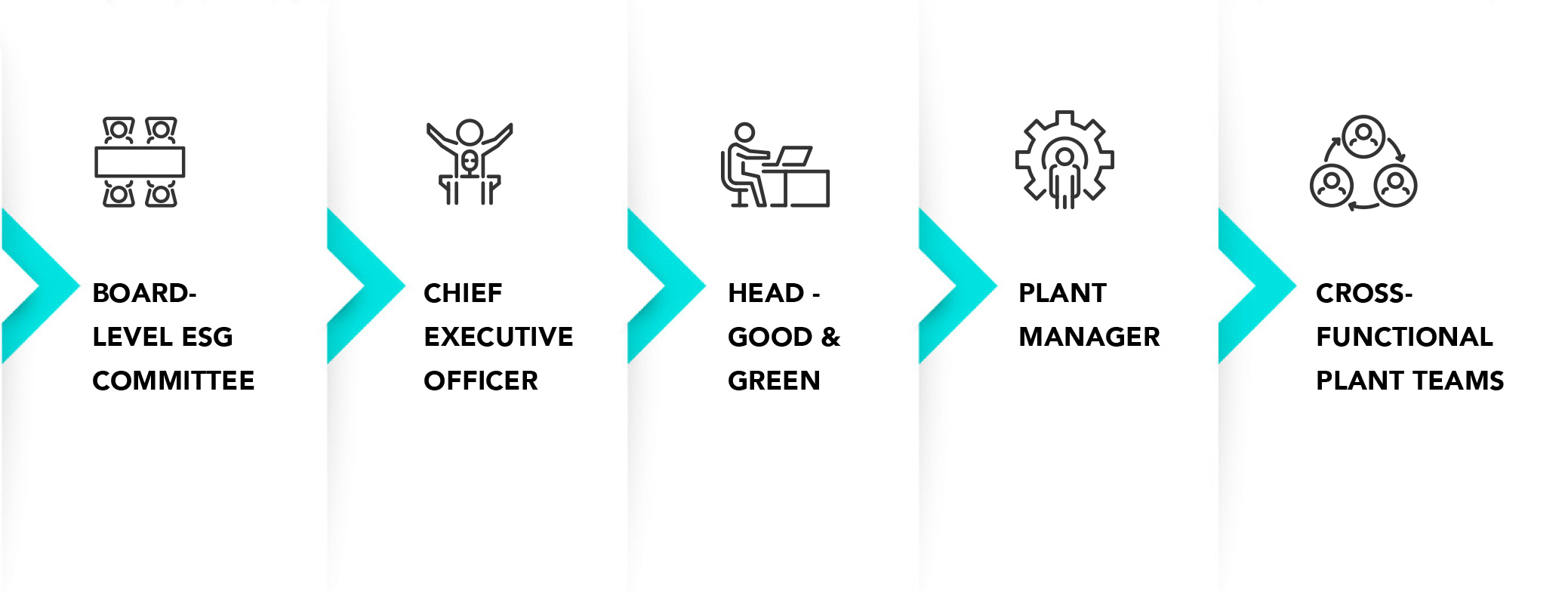

Management’s role in addressing climate-related risks and opportunities

We integrate the oversight of climate-related risks and opportunities into our operations at the plant or facility level. The Operations team at each facility works towards achieving annual sustainability targets, which contribute to long-term climate action goals.

In India, our operations are headquartered in Mumbai, with production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has

a Green Champion to coordinate with the respective factory teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related measures, such as implementation of energy efficiency in operations and renewable energy projects. We have a cloud-based monitoring platform to capture and monitor sustainability-related data to furnish performance reports on a monthly basis.

In India, our operations are headquartered in Mumbai, with production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has a Green Champion to coordinate with the respective factory teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related measures, such as implementation of energy efficiency in operations and renewable energy projects. We have a cloud-based monitoring platform to capture and monitor sustainability-related data to furnish performance reports on a monthly basis.

Governance structure

Figure 2: Governance structure

In addition to incentives, GCPL provides quarterly awards at the company level and annual awards at the group level, where the best-performing individuals and teams on sustainability are recognised. The following members are entitled to these incentives:

| Entitled to incentive | Incentivisation details |

|---|---|

|

Head - Good & Green |

Green goals are set at the Godrej Group level and best-performing companies are recognised during the annual awards. The Head of Good & Green is responsible for overseeing the performance on GCPL’s climate change goals. |

|

Business Unit Manager |

Business Unit Managers are rewarded based on their performance against goals established at the beginning of each financial year for the plant’s performance in operations and climate action. |

|

Green Champion |

Green Champions are rewarded for projects undertaken to address climate change issues. |

|

Process Operation Manager |

Operation Managers are rewarded for improvements in manufacturing process to reduce emission intensity. |

Strategy

We have established systems to interlink climate change to the business strategy. Processes exist for identifying risks and opportunities that have substantive financial impacts and for integrating the same into the Enterprise Risk Management (ERM) framework. In this reporting period, we conducted a scenario analysis to bolster our climate change strategy.

The climate change scenario analysis is a process for examining the likely future to assess risks and opportunities arising from climate change. A scenario is a hypothetical situation that describes a pathway to a particular future outcome. The TCFD framework recommends organisations to consider a set of scenarios, including one aligned with the 2015 Paris Agreement (1.5°C future). Organisations are also recommended to consider a business-as-usual (BAU) scenario where physical risks such as increased flooding, heat waves, and water scarcity dominate. Transitional risks and opportunities for an organisation emerge from shifting to a low-carbon economy. We have considered two SSPs that are provided by the International Panel on Climate Change. Descriptions of the two SSPs are provided below.

We have utilised SSP-1 (which aligns with RCP-2.6) and SSP-5 (which aligns with RCP-8.5) pathways, with a time period of 2030, as most development plans, including the Sustainable Development Goals, are aligned to the target year 2030.

SSP

SSP-1

Sustainability: Taking the Green Road (Low challenges to mitigation and adaptation)

SSP-5

Fossil-fueled development: Taking the Highway (High challenges to mitigation, low challenges to adaptation)

Narrative

This is the Paris Agreement-aligned scenario where the world shifts towards sustainable development, improved global commons management, reduced inequality, and low material growth.

This is the BAU scenario, where investments towards sustainability plateau, economic development staggers, and environmental degradation increases.

The physical risk scenario analysis was conducted by modelling water scarcity, temperature, and precipitation variables for SSP-1 and SSP-5. Recognised tools such as the World Bank Climate Change Knowledge Portal and WRI Aqueduct were used for collecting data for the period of 2020-39.

Through the scenario analysis, we have identified prioritised facilities that are likely to witness severe physical impacts of climate change. These prioritised locations are in Katha, Puducherry, Guwahati, and Karaikal.

Way forward for

addressing physical risks

As a starting point for climate strategy on mitigation and adaptation, Katha, Karaikal, Guwahati, and Puducherry will be considered for further detailed assessments to identify cluster/facility-specific hotspots. This will help the company strengthen supplier engagement, reduce greenhouse gas (GHG) emissions across the value chain, and consequently reduce operational and reputational risks.

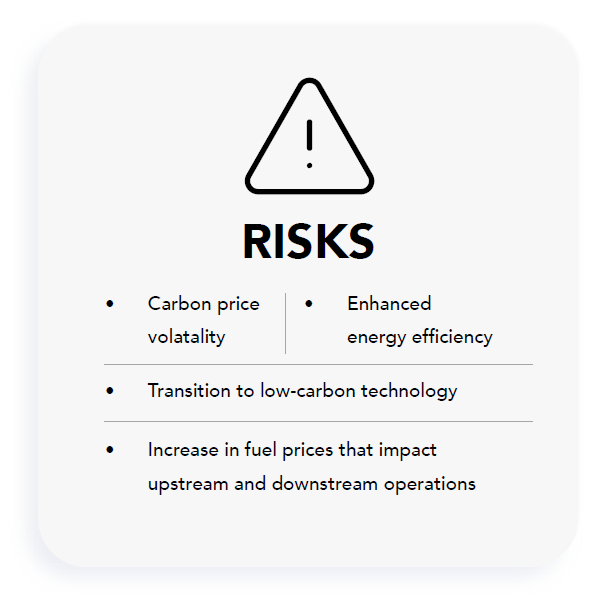

The transition risk scenario analysis was conducted through a sectoral review to assess potential risks and opportunities. Further, the EnROADS Simulator (developed by MIT Sloan and Climate Interactive) was used to model low-carbon economies

that align with the Well Below 2 Degrees (WB2DS) and 1.5°C futuristic situations. The following risks and opportunities were identified through the transition risk scenario analysis:

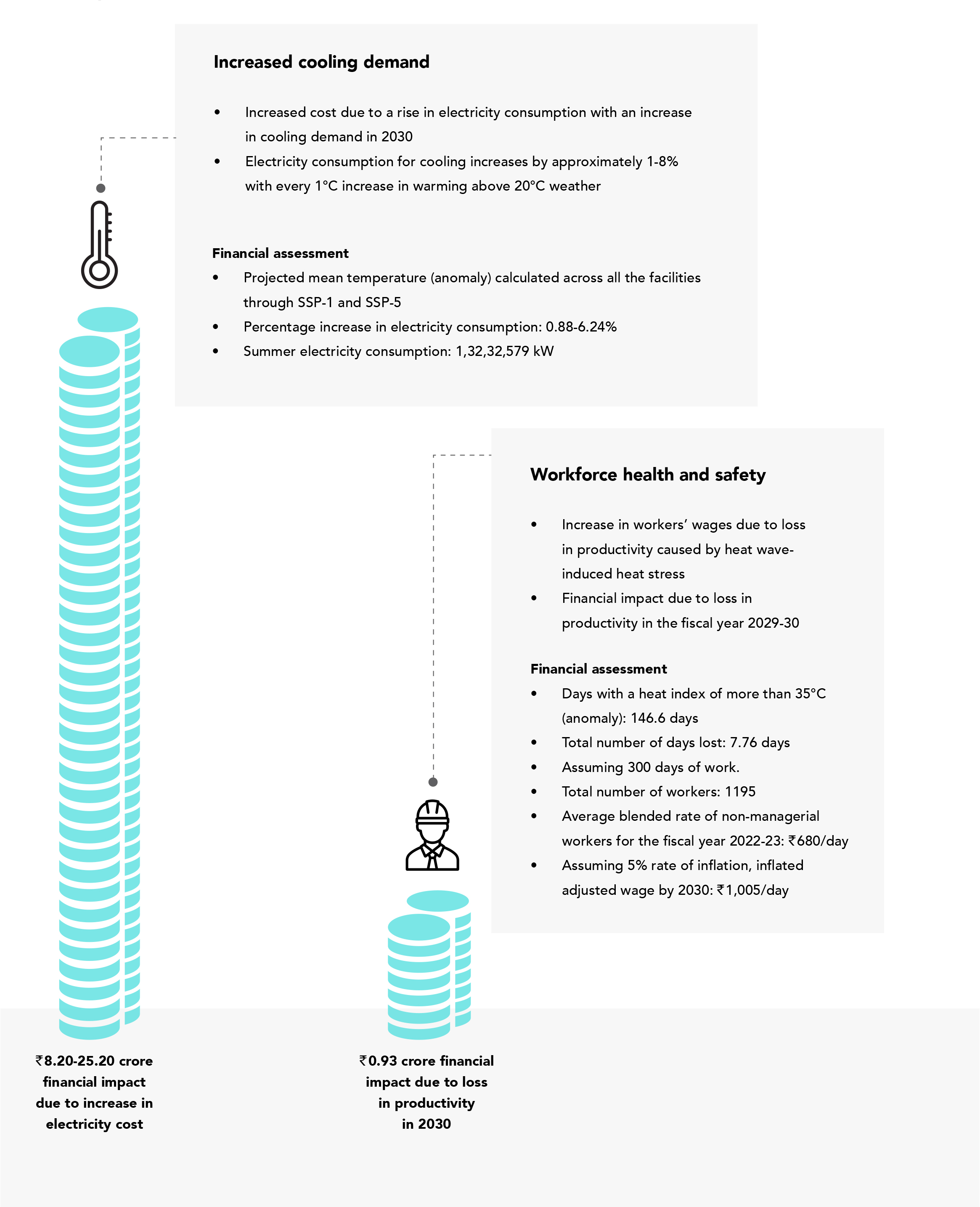

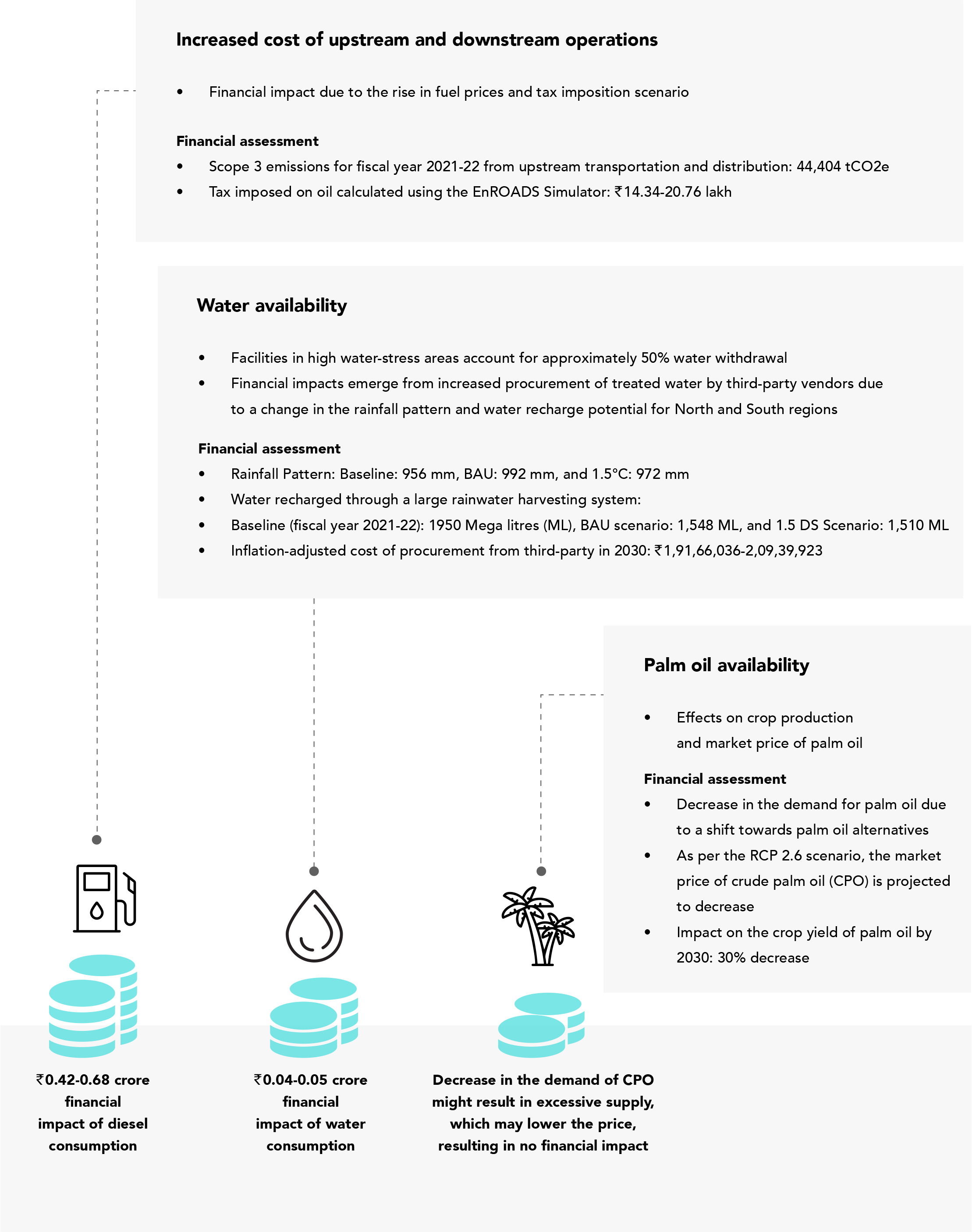

The identified physical and transition risks pose financial implications on the consumer goods sector. We have further evaluated the financial impacts of the prioritised risks.

Specific risks with substantive financial impacts are summarised on the next page.

Financial impact of climate-related risks

Figure 3: Financial impact of climate-related risks on the company

Risk management

Risk management extends from materiality assessment wherein material issues are identified through stakeholder engagement and secondary research. Our materiality analysis uses the methodology of identifying issues across 6 capitals, followed by engagement with 450+ key stakeholders on material issues and finally, the development of a materiality matrix by using a specialised tool for issue prioritisation. All stakeholder groups play a significant role in influencing our overall performance and operations.

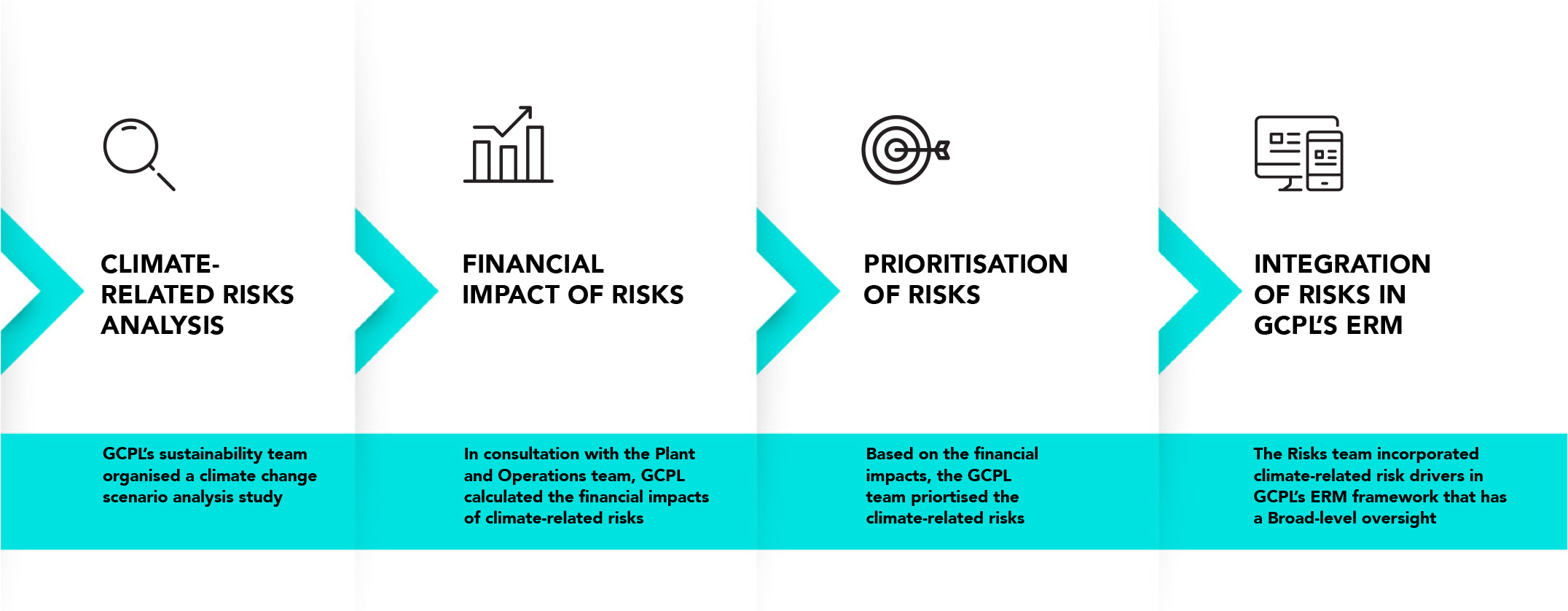

Climate change is one of the material issues identified through the materiality analysis exercise. This material topic is also a part of our ERM. Following the identification of key material topics through materiality assessment, our Board-level Risk Management Committee and Risk Management team oversee the risks and mitigation measures. Our risk identification and management processes are integrated with the business strategy. We identify risks through analytical techniques such as scenario analysis. Probability and impacts are assessed qualitatively and quantitatively, and action plans are developed for risk management.

The risk mitigation plans are presented to the Board-level Committee for their inputs, which are incorporated into the mitigation plan from time to time. Climate change-related risks are assessed along with other business risks, and the identified risks are classified into short-term (1-3 years), medium-term (3-5 years), and long-term (5-7 years).

The risk mitigation strategy translates to action plans made at two levels:

- Business level: We develop our sustainability strategy at the business level to manage major risks such as climate change and water-related risks. Progress on risk mitigation is monitored on daily, monthly, quarterly, half-yearly, and an annual basis.

- Site/plant level: The business strategy is cascaded down to the plant level, and an action plan is created for every plant. Daily and monthly meetings are conducted, and the progress is reviewed.

We have established a comprehensive and structured approach to risk management. It involves a Board-level oversight to a dedicated Risk Management Committee and a cross-functional team within the business to routinely assess risks across the company.

Through informal forums, discussions, and annual planning conferences, we regularly seek feedback from employees to improve the risk management practices. For understanding climate-related risks and developing mitigation measures, regular open forums and monthly review meetings are held.

Integrating climate-related risks in GCPL’s ERM system

Metrics and targets

We identify, record, and monitor key performance metrics authentically, which helps in analysing the organisation’s operational performance and establishing goals and targets to enhance them further. We maintain a robust data management system to record our performance and take strategic decisions accordingly.

In line with our Group’s vision and goals, we have established five goals, called ‘Greener India Targets’, which are expected to be achieved by the year 2025-26.

Below is the list of goals, our approach towards achieving them, and our performance in achieving them so far during the reporting period:

| Focus area | Goal | Approach | FY 2022-23 performance |

|---|---|---|---|

|

Energy |

|

|

|

|

Emissions |

|

|

|

|

Water |

|

|

|

|

Waste |

|

|

|