A Letter to

Our Shareholders

Dear shareholders,

Thank you for your continued belief in GCPL and taking the time to read this note.

Overall, I believe fiscal year 2022-23 was a moderate year of performance, but a strong year of strategic transformation. At value and volume growths of 8% and -1% respectively, and with PAT remaining flat, we were far off our targets for the year. However, we were happier with our performance in the second half, with quarter four ending on a strong note.

Category development continues to be at the heart of our strategy, and even in a difficult year of cost inflation we

continued our increased and strong investments behind brands. One of the best examples is Air Care. We have pivoted this in India and Indonesia on the insight that the category is adopted when guests visit you at home.

Category development continues to be at the heart of our strategy, and even in a difficult year of cost inflation we continued our increased and strong investments behind brands. One of the best examples is Air Care. We have pivoted this in India and Indonesia on the insight that the category is adopted when guests visit you at home.

We are also driving relevance of our brands by enhancing access through the creation of value packs and improving distribution through educative sampling.

I have often commented that working with Sudhir is such a learning experience that I feel like I am getting a second MBA. It is a pleasure to see the superb clarity of thought and deep execution capabilities that he and the team have.

I am very excited about the potential of our recent acquisition of the FMCG business of Raymond Consumer Care. The deodorant opportunity in India is significant. Raymond is a leading player in the Deodorants and Sexual Wellness categories in India with brands like Park Avenue and KamaSutra. So, through this, we are also increasing the number of categories we play in in India, and to categories with the potential to deliver double-digit multi-decade growth.

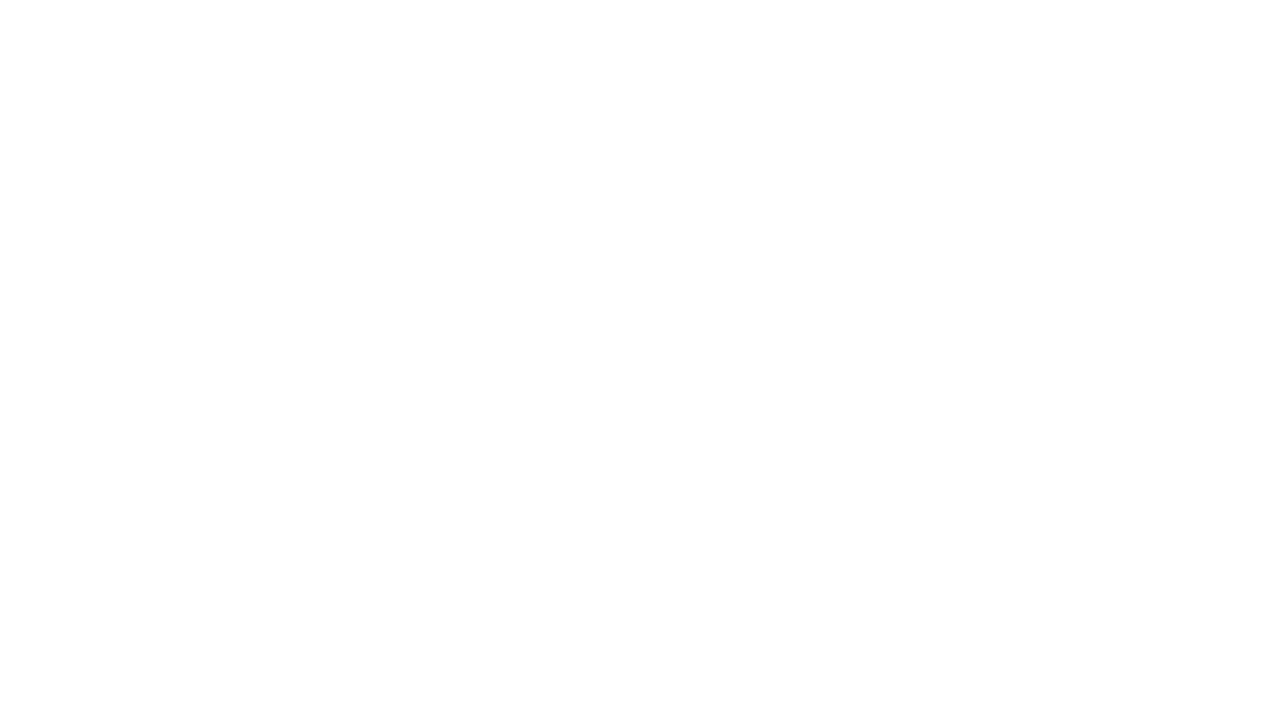

At our analyst meet in May, I shared my excitement and how perspectives from the past can give you some thoughts for the future. For me, it goes back to the story of how we acquired our Goodknight brand.

In 1994, Transelektra, an insecticides company, which made the Goodknight and HIT brands, was up for sale. Hindustan Lever was keen to acquire it, but the deal was held up and the owner didn’t want to wait longer. So, my father, Adi, was approached by Uday Kotak, the banker overseeing the transaction, with the offer. He needed to

decide in a week, which didn’t leave much time for due diligence. But he was excited by the category and the potential, so he made an offer for ₹100 crore, and asked Uday to buy 10% of the company, and the then CEO, to buy 5%, and said he would loan them the money. That was the due diligence he built in. A year later, we entered a joint venture with Sara Lee and sold 51% of the business for ₹100 core, the same amount we had paid for acquiring the whole company.

We went on to invest in and grow our Household Insecticides business over the decades. It was a separate business from GCPL till 2010, when we acquired Sara Lee’s stake and merged the business into GCPL. We believe this business has an implied value of around ₹30,000 crore today, based on the current GCPL market cap, with an underlying 30% CAGR on value creation.

I hope that we can tell the stories of the choices we are making today with similar pride when we look back on them a few decades later.

While growth in our Africa business has been good over the last few years, we need to be more strategic about some of the structural issues and forex management. The team has several projects underway to simplify and strengthen the business in the long run. In Indonesia, as part of our efforts to simplify sales and distribution, we have implemented a stronger structure for General Trade and moved from a direct distribution model to a distributor-led model.

As I do every year, I would like to share my perspectives on what I believe could have been better, what went well, and what we need to do going forward.

Goodknight was acquired in 1994 and then acquired again and merged in 2010.

We believe this business has an implied value of around ₹30,000 crore today, based

on the current GCPL market cap, with an underlying 30% CAGR on value creation.

Spending time across our global markets in India, Indonesia, and Africa,

engaging with our team members, consumers, vendors, and partners.

Welcoming the Raymond team to Godrej and sharing

perspectives on the significant opportunities we see ahead.

What could have

been better

Indonesia had a disappointing year. Value (excluding the Hygiene business) and EBITDA growth was weak. However, with trade and inventory issues behind us and investments in a new General Trade structure and media, I am hopeful for a good year ahead. While our Africa business continued with its positive topline trajectory, we need to improve forex

management, which has impacted the bottom line by over 100 bps this year. This will be a key area of focus for the team, along with projects to simplify how we do business.

Household Insecticides, our biggest category, did not meet our growth aspirations.

It is critical that we are able to drive category adoption and penetration for long-term sustainable growth. Performance has now picked up and continues to improve, with growth in the teens in the fourth quarter. The new launches of Goodknight Mini Liquid Vapouriser and HIT No-gas Spray, aimed at democratising mosquito repellents, are being received well.

What went well

Despite all the macroeconomic uncertainty, your company delivered on a lot of what we set out to do. It was a year of two halves, with progressively stronger performance each quarter and closing with a strong fourth quarter. We made good progress against some of the key priorities we had outlined. On the category front, Personal Care in India grew by 19%, continuing its solid trajectory. From a geography perspective, our India and Africa operations delivered healthy double-digit growth.

Our big hits were in Hair Colour and Air Fresheners in India, the FMCG business in Africa, and inventory and cost management. Consolidated inventory reduced by 21 days and we delivered 150 bps of controllable cost savings. Consequently, it was a record year in terms of cash flow from operations.

On the category front, our

big hits were in Hair Colour

and Air Freshners in India.

Brand building requires investments, and we are being deliberate about continuing to make these investments for the longer term. Despite the hyperinflation this year, we increased media investments by 40% and invested in market development. The results are very encouraging and our share of voice in India has increased by over 1,400 bps in the last 3 years.

Ensuring that we continue to make our products affordable and accessible is critical.

One way we do is through the creation of value packs, like with Godrej Expert Rich Crème, where the smaller pack is priced at ₹15.

We are using educative, door-to-door product sampling to better understand consumer perception of our brands and use this to enhance existing products and develop new ones. We covered 3 million households in India last year, with a plan to ramp this up to 6 million next year.

What do we

need to do now?

Our leadership team is driving a very clear focus on our strategy and the double-digit volume growth ambition we have set ourselves. We will focus on scaling up Household Insecticides performance and the growth of the Indonesia business. Margins and forex management will be the focus in Africa. Through the use of digital technology and automation, we are reimagining and radically simplifying how we work. The aim is to become leaner and to create the cost efficiencies needed to fuel our growth strategy.

We are committed to delivering business growth while becoming more sustainable and inclusive in our approach.

Grooming women leaders and ensuring adequate representation continues to be a key priority. We have set specific goals and regularly review progress, while ensuring we make the necessary changes to support women at the workplace.

We recognise that shifts must happen across levels. When Shalini Puchalapalli, Managing Director and Country Head for Google Customer Solutions, joins the GCPL Board of Directors in November 2023, she will be the sixth woman director on the Board, taking women representation to 50%. I am very proud of this important step in our journey to ensure equitable gender representation at the most senior levels of leadership. Women represent 47% of our total workforce at GCPL, but only 25% of senior leadership. We are making targeted efforts to take this up to 30% in senior leadership in the next few years through various hiring and development initiatives.

Given the nature of our business in Africa, building representation of local ethnic talent in management and key functions is critical. We have 90% representation in Marketing, 71% in Finance, and 76% in Manufacturing.

Representation in senior leadership roles has increased from 33% in fiscal year 2021-22 to 40% in fiscal year 2022-23.

Over the years, we have introduced various policy changes to become more inclusive for our LGBTQ+ colleagues, but the translation from advocacy into hiring remains slow.

Sustainability is core to our strategy and operating model and we are embedding it across various aspects of our business. Our sustainability vision, roadmap, and action plan for 2025, which is overseen by the Sustainability Council at our Board of Directors, is aligned with the World Business Council for Sustainable Development’s 9 pathways for the sustainable transformation of businesses. These pathways, in turn, tie in with the UN’s Sustainable Development Goals which are aimed at helping solve ‘wicked’ social and environmental problems.

Shalini Puchalapalli, Managing Director and Country Head for Google Customer

Solutions, who joins the GCPL Board of Directors in November 2023, will be the

sixth woman director on the Board, taking our women representation to 50%.

As part of our CSR initiatives, we continued to scale up our Elimination of Mosquito Borne Endemic Diseases (EMBED) programme in partnership with the governments of Madhya Pradesh, Uttar Pradesh, and Chhattisgarh. Since 2015 we have helped make 1,598 villages malaria-free, and are now also addressing dengue and chikungunya in 9 cities. We have scaled up our waste management and plastics programmes to 5 cities.

We ensured over 2,300 MT of waste has been recycled over the past year, partnered with local authorities to strengthen waste management systems, and invested in the well-being of waste workers.

I am particularly energised by our recently articulated ambition to be net zero by 2035. It reinforces our commitment to putting people and planet alongside profit.

With the launch of Magic Body Wash, our reconstitution portfolio is growing. We believe this portfolio will enable us to democratise access to health and hygiene products while also and importantly, offering a green discount to our consumers.

Manch, our employee resource group for

women in sales roles in India, leverages

the power of collective action to help

make our workforce more inclusive.

On behalf of the GCPL Board and Management Committee, I want to take this opportunity to say a very special thank you to our incredible team members; for their passion and leadership, which allows us to build a more purposeful GCPL.

To all our customers, business partners, shareholders, investors, and communities, our deep gratitude for your support through the years. We will continue to count on your partnership as we take GCPL to a new level of ambition and achievement.

Nisaba Godrej

We continue to scale up EMBED in

partnership with the governments of

Madhya Pradesh, Uttar Pradesh, and

Chhattisgarh, and since 2015 we have

helped make 1,598 villages malaria-free.