Share with us your reflections on how GCPL performed in fiscal year 2022-23, against the backdrop of the global macroeconomic and political crises.

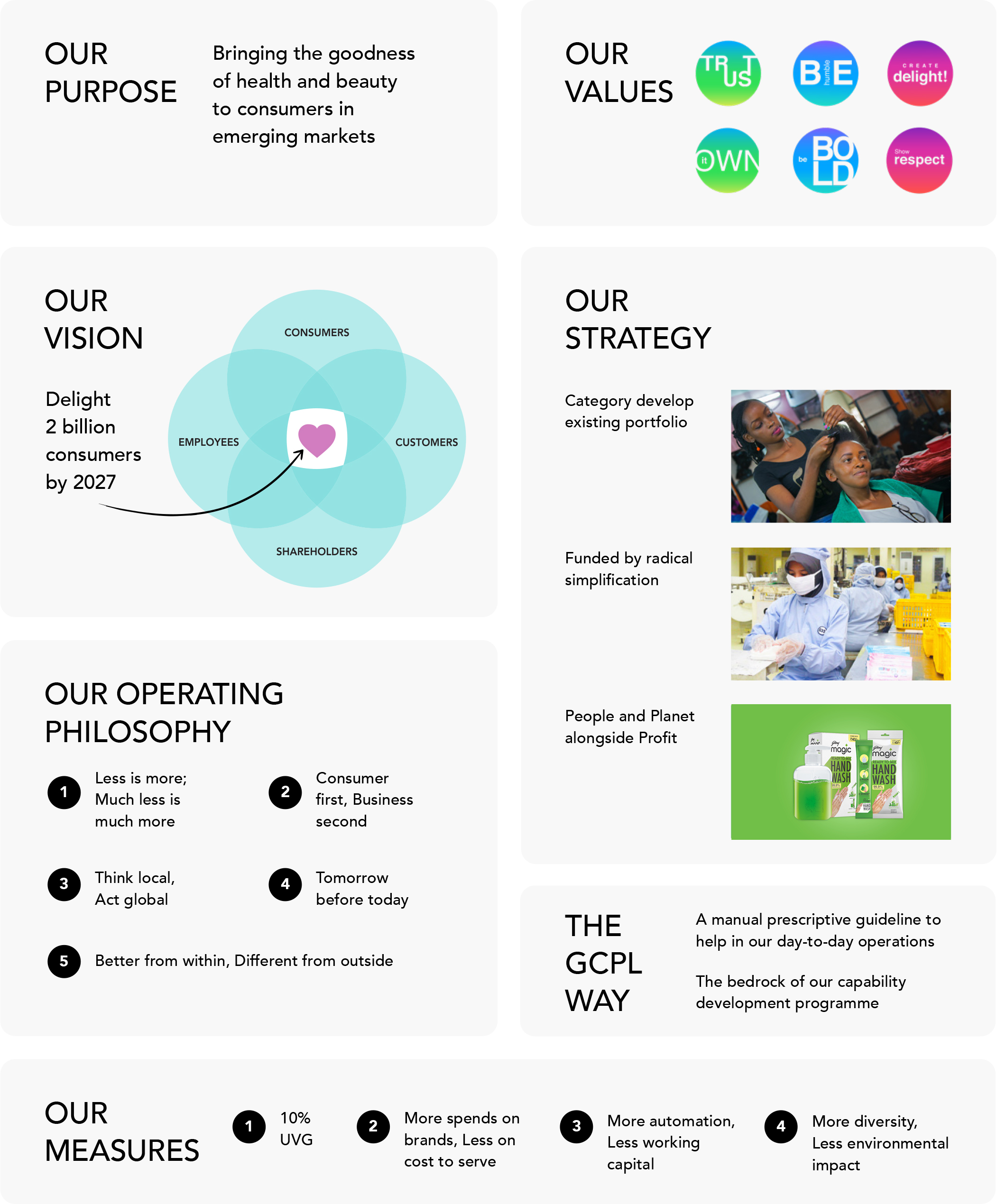

In December 2021, we articulated our strategy, which is to focus on category development driven by product innovation, relevance building, creating access and marketing investments; and to fund it through a digitally enabled radical simplification of our company. We will do this while continuing to live

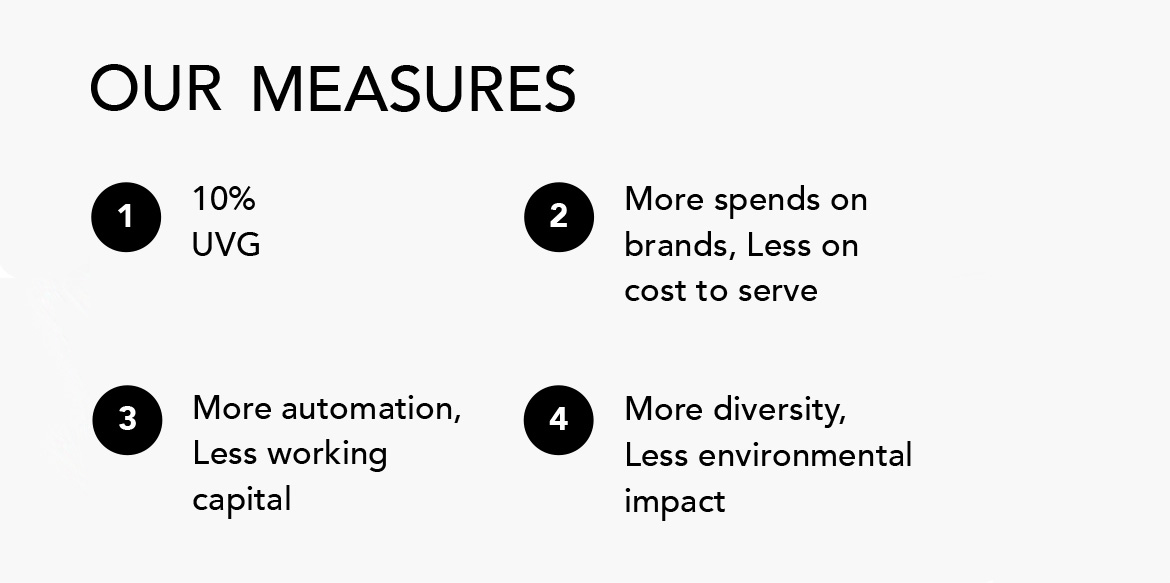

In December 2021, we articulated our strategy, which is to focus on category development driven by product innovation, relevance building, creating access and marketing investments; and to fund it through a digitally enabled radical simplification of our company. We will do this while continuing to live our values and place our people and the planet alongside profits. Our measure of medium-term success is the double-digit volume growth ambition we have set ourselves.

How does this translate for our business in the short term? Our strategy led to a plan for fiscal year 2022-23 that we crafted back in January 2022. We were already on a high inflationary wicket at that point and our aim was to bring the business back to at least moderate volume growth, ensure reasonable price growth, good gross margin improvement, and moderate EBITDA growth, given increased media investments.

Then, in February 2022, the Ukraine war unfolded into what has been a classic black swan event. In a situation like this, it isn’t just the volatility that hits, there is also the fact that you just don’t know how to respond. We couldn’t have predicted back then just how long or far reaching the impact would be.

The GCPL strategic narrative, which links our purpose, vision, strategy,

and operating philosophy, guides our choices and ways of working

Sharing our purpose and strategy with our Indonesia team at a town

hall when our global management committee visited Jakarta

The question we asked ourselves as a leadership team was: We have just crafted our plans for the year. How do we face this black swan event?

The answer ended up being simple. We stick to our strategy, because this isn’t a strategy for the next 6 months or even a year. We believe it will hold for the next couple of decades. Like we have since learned, it’s not strategy unless it tests your resolve.

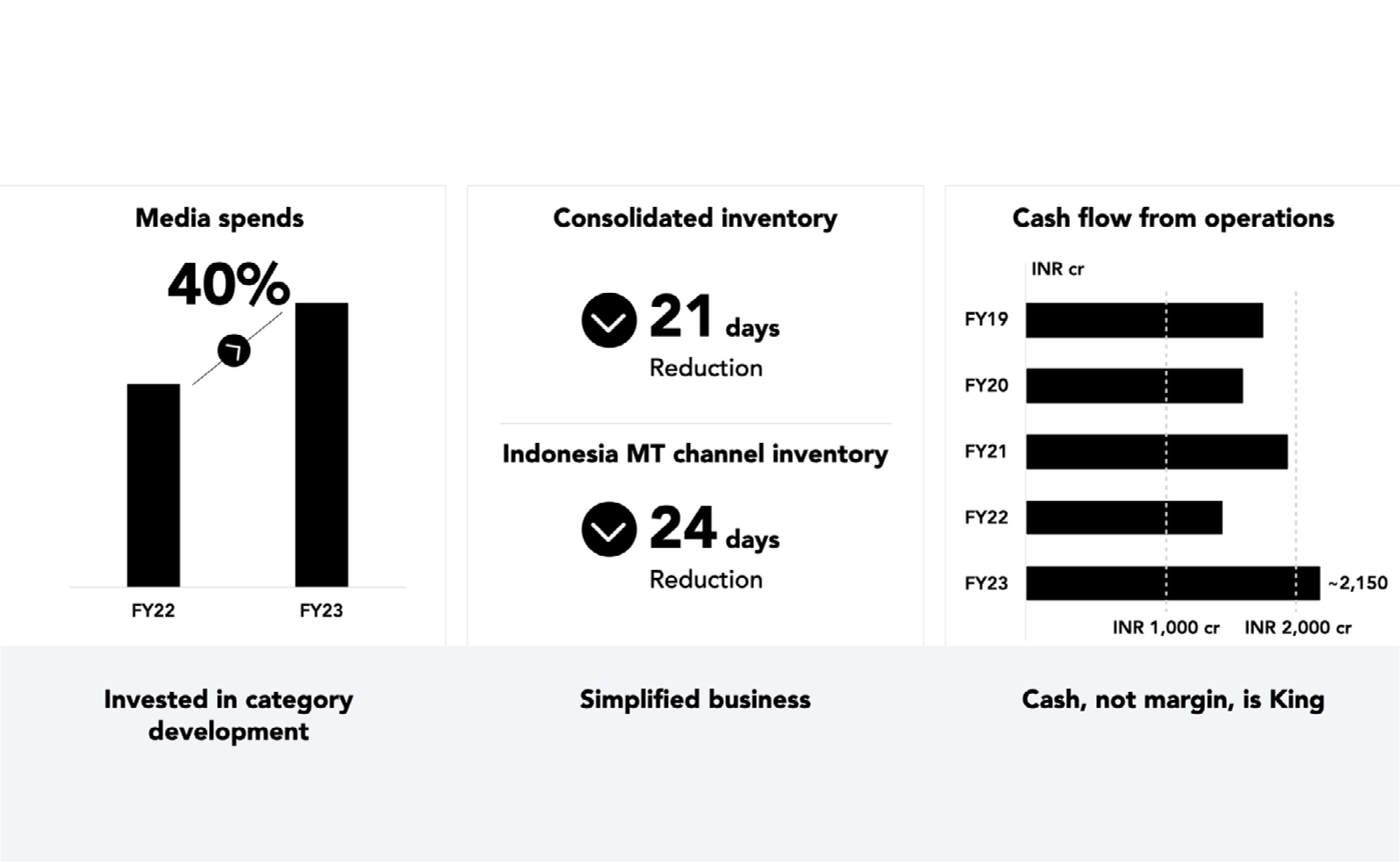

So, in a year of hyperinflation, we increased media investments by 40% and invested in market development. We took hard calls on simplifying our business. Take inventory for example. Consolidated inventory reduced by 21 days, and in our Indonesia business, Modern Trade channel inventory reduced by 24 days. Similarly, for other aspects like new product development or people and efficiencies.

Simplification in a time of volatility has consequences, so we shifted the focal metrics from margins to cash flow from operations. We knew that it would be difficult to get the margins we were aiming for with the kind of costs and pressures underway. Given these choices, it ended up being a year of two halves and we saw progressively stronger performance each quarter, closing out with a very strong fourth quarter. It was a record year in terms of cash flow from operations, something that was in the making for a few quarters.

How do you deal with a black swan event?

You stick to the strategy

In the fourth quarter in India, our India branded business delivered strong growth of 16%, with Household Insecticides growing at 14%. It was heartening that much of this broad-based sales growth came from volume growth (13% underlying volume growth) and that categories like Hair Colour and Air Care have delivered explosive growth. Profitability also increased sharply with gross margins of 56.2% and EBITDA margins of 26.6%. This is despite a 51% increase in media spends.

We feel much more confident about the improvement we are seeing in our core business in Indonesia. Sales growth excluding Hygiene in the fourth quarter was at 11% in constant currency terms and EBITDA margins are now at 21.5%. While Africa had a slightly slower close to the year at 8% sales growth, it has been largely due to demonetisation in Nigeria, and we do not see this impacting performance going forward, which has otherwise been quite strong.

Sharing my reflections on our strategy and

performance at our Annual Analyst Meet in Mumbai

You have said that category development

is at the heart of your strategy.

Why is this so important and what

progress have you made on this journey?

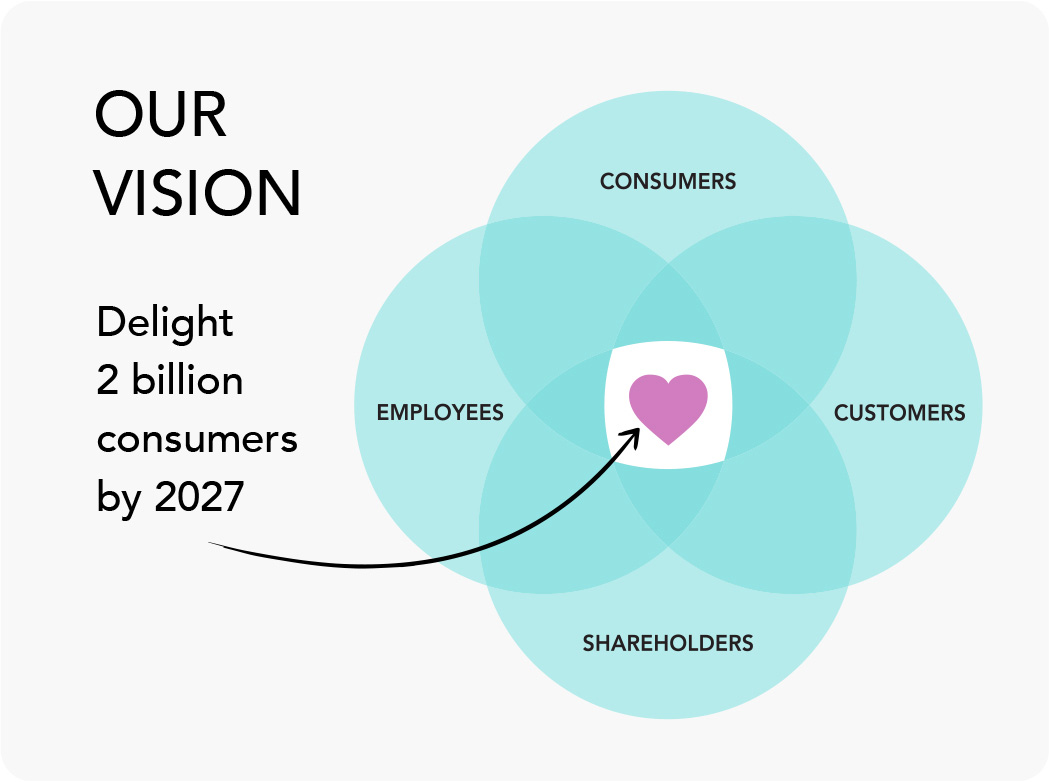

Category development is about driving relevance for a category—why people should adopt the category. It is different from gaining market share. Here, you are basically marketing the category and not just the brand. Our vision is to delight 2 billion consumers globally by 2027, and category development will power that. If you look at the key markets that we operate in—India, Indonesia, Nigeria, Bangladesh, they are all at the cusp of explosive Home and Personal Care growth. The categories we operate in are still underdeveloped and while the reason for that is in part, the income and spending power of people in these economies, it is also about what companies like ours do to develop these categories.

Our category development playbook has three key levers. The first, is building relevance. Let’s look at Air Care, where we have gained market share and grown penetration. The insight we worked on is that this category is typically adopted when guests come home. Guests are also likely to gossip about you when your back is turned, and this comes together in the idea of ‘talking rooms’ which are featured in the campaigns in India and Indonesia.

The second, is investing in our brands. We deliberately chose to increase our investments in brand building last year at a time when others were reducing it. Consequently, our share of voice in India has increased by over 1,400 bps in the last 2 years.

And the third, is creating access. One of our biggest successes recently is the ₹15 Godrej Expert Rich Creme hair colour in a sachet in India, which provided a fillip to a category that had somewhat slowed down pace and is now back to galloping. In February, we introduced two innovations in Household Insecticides, Goodknight Mini and HIT No-gas Spray, aimed at democratising mosquito repellents and creating access for the category in India.

We are ramping up distribution. In our new FMCG business in Africa for example, we have increased direct coverage by 1.8x in Nigeria and 2x in Kenya over the last year. In India and Indonesia, we are building strong internal capabilities in household sampling and putting the necessary enablers in place to grow this. Last year, we sampled 3 million households in India and we plan to sample 6 million in the year ahead in India and another 3 million in Indonesia. In India, we have also started focusing on rural wall painting to reach media dark consumers and consumers who are otherwise difficult to reach through traditional media channels.

We continue to scale our internal capabilities for market development. The work on our global categories of Household Insecticides, Hair Colour and Air Care is spearhead by a best-in-class Global Category and Innovation team, which is mining and testing centralised strategies on product development, innovation and brand communication. For our Goodknight brand for example, we have the same relevant insight across India, Indonesia and Nigeria, of mothers being afraid of mosquitos disturbing their children’s sleep and yet worried about using a product like coils. We tested the same creative idea across these markets and it has worked well.

As we centralise and leverage synergies for R&D and marketing, we are also setting up Godrej International, a dedicated team to scale up global exports and serve world class product mixes. We have consolidated small country operations, both flag and distributor models, with the intent to expand to over 120 countries and double the business in 3 years (~USD 70 million in fiscal year 2022-23).

How are you going about ‘radical simplification’

as you call it, to reduce controllable costs and

fund category development?

Our game plan is to fuel category development by simplifying our operations and cutting down on what we call ‘controllable costs’ (costs which consumers don’t see), and investing that in costs that consumers do see, like material costs and media, and some parts of distribution costs.

A good example of how we are doing this is in our Indonesia business, where we simplified our sales and distribution system, moving from a three-tier distribution system to a two-tier one in 4 months. Roughly 30% of our sales would come from direct distribution through 60,000 outlets, in a system which had heavy overheads and high-cost operations. Rajesh Sethuraman, our new CEO for the business, took a call shortly after joining to change this. In what

was a difficult year, the team moved with admirable speed and boldness to shift to a distribution system which is similar to what we have in India.

In a similar vein, in Nigeria and West Africa, under the guidance of Dharnesh Gordhon, CEO of our Godrej Africa, USA and Middle East business, we are exiting direct distribution and will move to a single distribution partner. In Nigeria, this has doubled the number of outlets we reach overnight, increased our warehouse footprint from the one we had to 23, reduced lead times by 4x, and offered better working capital management. While this may not be cost dilutive in the short run, it will certainly be growth accretive. We are reasonably certain that in a year this will be margin accretive.

The other area that we are simplifying is supply chain and we are doing this by consolidating manufacturing. We are seeing explosive wet hair growth in Africa, so we want to shift more of our manufacturing base from the USA into Nigeria, where we are already manufacturing some of these products. This should result in lower net manufacturing cost and simplify our USA business to a marketing and distribution focused business. The higher US dollar availability in Nigeria will also help lower forex expenses.

Rajesh Sethuraman and our Godrej Indonesia team led a bold

simplification of our sales and distribution system, moving from

a three-tier distribution system to a two-tier one in 4 months

We are working on various ways to integrate technology in decision making and simplify how we do business; moving to algorithms over judgement as an approach for greater accuracy. I am particularly happy about media planning and how we have shifted to running media on an algorithmic model, focused on minimising cost per reach and cost per incremental reach. In financial forecasting we are finding a top-down financial forecasting model far more accurate than the bottom-up approach we had been using.

In line with our shift to lighter manufacturing and distribution models, we are also creating global shared services in finance, supply chain, human resources and global exports, allowing us to leverage synergies of scale and expertise.

We are starting to see the results of some of these initiatives, and in fiscal year 2022-23 we clocked controllable cost savings of 150 bps.

In Nigeria, we are shifting our distribution

model to partner with a single large national

distributor and capitalise on their reach

How is GCPL refreshing its approach to

people and personal growth to continue to

attract and develop top talent globally?

We have a fantastic team; highly driven, capable, and most of all, people who truly live the Godrej way. Our global leadership team has spent a large part of the year travelling across various countries to spend time with our people, learn from insights and drive change. We have enjoyed travelling together as a team a few times a year, spending time on our collective reflections and leadership approach, and working with the local teams to ideate and problem solve. We spent time in Jakarta in August, in Kenya in December and in Mumbai in April.

We have been thinking quite deeply about the importance of nurturing leaders who fundamentally connect with our purpose at GCPL and helping them think through how to create a tangible legacy and impact in the roles that they serve. In April this year, along with the time we typically spend discussing annual plans, we spent a day with 60 of our most senior leaders from across the globe to reflect on and craft our personal leadership stories, anchored to our role of enabling GCPL to live its purpose. Listening to people share that day really reinforced my belief in the potential we have to build on, and the gratitude to be part of this journey.

We are setting the bar unrelentingly high on talent; ensuring that top talent has richer, more meaningful jobs, with market-leading opportunities for value creation through our performance-linked rewards schemes. We have found listening to the wisdom of crowds also very valuable to hire the right talent from outside Godrej, and, in what has made me particularly happy, re-hire great talent back.

Crafting and sharing our leadership

stories at the GCPL Global

Leadership Meet in Mumbai

I enjoy the time I get to spend in conversation with our

interns and younger team members; they can really

push the boundaries on how we are thinking

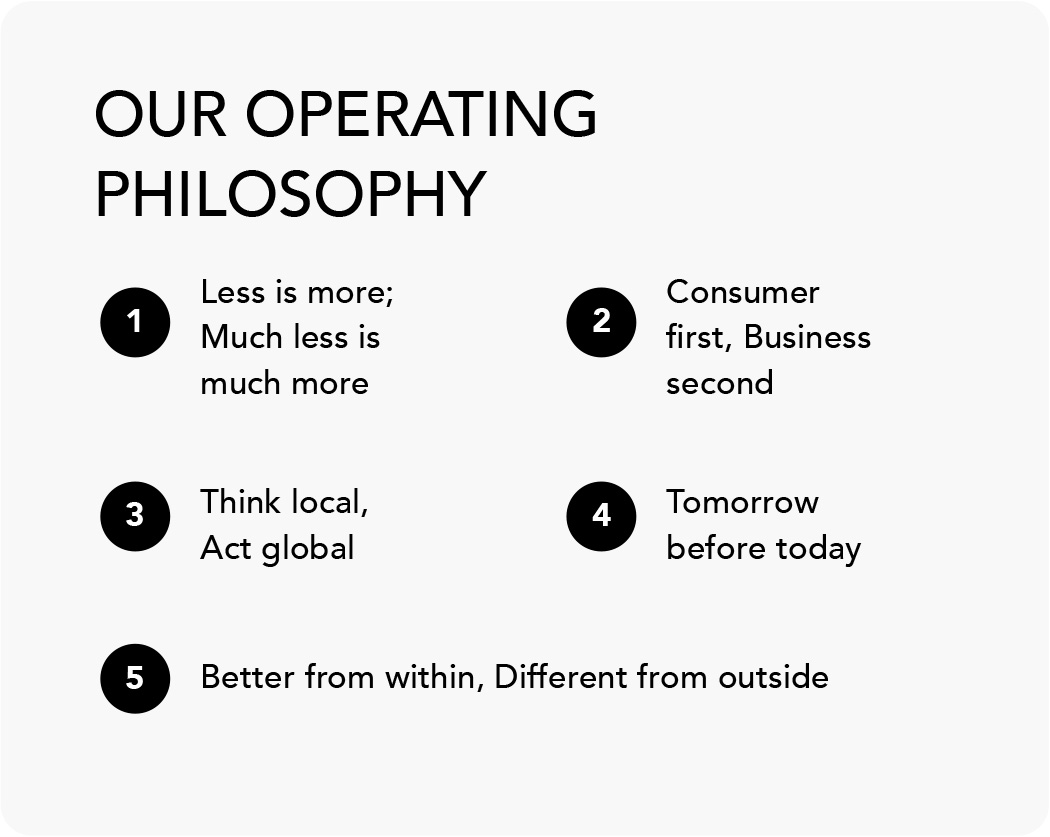

Developing best-in-class functional expertise is a critical imperative and I am personally overseeing a lot of the work in this area. We have set up the Business Learning Academy to facilitate functional learning by building programmes, products, technologies and mechanisms that make delivery of results fast and effective. The bedrock of this functional learning is what we call the ‘GCPL Codebooks’, a set of codified principles which detail the GCPL ‘Beliefs’ and ‘Actions’ in a series of key functional areas. This has been put together by functional experts from across our teams and in action, is streamlining our ways of working globally. This is complemented by customised leadership development

journeys for key individuals and cohorts, where we are leveraging multidisciplinary elements for immersive experiences.

Being diverse and inclusive is core to who we are at Godrej and we are committed to exploring how we can build more equitable opportunities. In India, we are experimenting with Project NEO. Designed as an alternative hiring pathway for people from diverse work backgrounds, NEO attracted over 6,500 applications last year, and offered learning and insights into how we can rethink our hiring approach. We will take it global now. In our Africa business, scaling the representation of local talent in management is key and we have steadily

improved this over the last few years. Women representation continues to be a focus globally. One of the challenges we face is representation in functions like sales and manufacturing in India where women are typically under-represented in the workforce. Through Aarambh, a focused initiative to hire women for entry-level sales roles in India, our team aims to double the number of women in sales in India to 100 in the next 2 years. Our leadership team continues to be responsible for making this change possible by deepening their commitment to become better allies to under-represented groups in our teams and the industry at large.

Cascading the GCPL Codebooks and

ways of working across our teams;

sharing perspectives and best practices

The World Economic Forum’s Global Risks Report 2023

has featured the failure to mitigate climate change in

the top 5 risks both for the short-term and the long-

term. Where is GCPL in its climate change journey and

what are your future ESG ambitions?

Climate and environmental risks are slowly moving from being a distant possibility to becoming a pressing reality. Impacts of climate change on the global economy are still undervalued, and our preparedness to tackle them will be a critical differentiating factor.

At GCPL, we have taken concerted steps to comprehend the financial and physical impacts of climate change on our operations. Following a meticulous climate risks scenario analysis based on the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, we have integrated climate-related risks into our enterprise risk management strategy.

We are tracking these risks closely and developing robust mitigation strategies.

There is more ground for us to cover and so, we are stepping up our commitments. We have set science-based targets in line with the initiative to help limit global warming well below 2 Degrees Scenario. While these goals are ambitious, we have seen progress. Over 31% of our energy is sourced from renewables and our emission intensity has reduced by nearly half from 2010. We have also set a Scope 1 and 2 net zero commitment by 2035 that is crafted on a science-based approach. Additionally, we maintain a steadfast commitment to sending zero waste to landfills.

We recognise that climate change and nature loss, especially water loss, are closely linked. These issues collectively threaten food security, livelihoods, and amplify the impacts of natural disasters. To address this, we have invested in afforestation programmes and carbon sequestration initiatives within our watershed projects. This not only helps conserve water and store carbon, but also revitalises ecosystems, preserves biodiversity and improves livelihoods for local communities. Our watershed initiative recharges over six times the water we use at GCPL.

Product innovation is another area of focus. We aspire to delight our customers with new ranges of products at a green discount. Our reconstituted product portfolio is a good example. Our Magic handwash and Magic bodywash products are in a powder-to-liquid or liquid concentrate format This innovation reduces transportation weight, resulting in lower fuel consumption and decreased emissions. Moreover, our reconstituted products require 84% less plastic packaging, further reducing waste and aiding in building a more sustainable supply chain.

Our sustainable efforts also extend to our suppliers. The regular assessment of the ESG performance of our suppliers, sharing industry best practices, and capacity building are core aspects of our Sustainable Supply Chain Policy.

We want to break the stereotype that eco-friendly products and packaging cater only to a niche market. We strongly believe in making sustainable products accessible to everyone. So, we are committed to pricing

our innovative, eco-friendly products at a green discount, not a premium, making sustainable choices more appealing and affordable. Our ESG ambitions are shaped by the belief that every step we take towards sustainability today will pave the way for a more inclusive and greener world tomorrow.

Our reconstituted product portfolio of Magic handwash

and bodywash require 84% less plastic packaging and

help build a more sustainable supply chain

Several recent investor surveys indicate that

environmental and governance issues often take

precedence over social issues in ESG investment

considerations. How is GCPL ensuring that aspects of

human rights and CSR are not overlooked?

At GCPL, we firmly believe that environmental and governance issues cannot eclipse the importance of social concerns within ESG considerations. Upholding human rights and fulfilling our Corporate Social Responsibility (CSR) is at the heart of our ethos.

We have devised a multi-pronged systemic strategy to ensure the comprehensive integration of human rights throughout our business. This starts with the GCPL Board of Directors providing oversight and trickles down to implementation by the Operations teams.

Our Audit teams continually monitor our compliance, while our HR supports this initiative across all levels.

In fiscal year 2022-23, we took proactive measures to further embed this commitment in our company culture. We conducted a thorough self-assessment at our plants and locations in India and Indonesia, covering 93% of our blue collar workforce. Any identified gaps were immediately addressed, with steps taken to fortify labour contracts for contract workers in India.

Our CSR initiatives have been equally impactful and the EMBED (Elimination of Mosquito Borne Endemic Diseases) programme being a good example. Since 2016, EMBED has been supporting the Government of India’s mission to eliminate malaria by 2030. Despite being preventable, malaria continues to be a significant health burden in India, accounting for 85% of the malaria cases in Southeast Asia.

EMBED has made a difference in the lives of over 28.2 million people at high risk for malaria. These individuals, most of whom reside in disadvantaged and hard-to-reach

Project EMBED has made a difference in the lives of over

28.2 million people at high risk for malaria

communities, have directly benefited from our initiative. In our rural malaria project alone, we have achieved the target of zero malaria cases in 4 out of 9 districts. Moreover, the expansion of EMBED to an urban dengue programme in 9 Indian cities has shown a promising reduction in dengue cases by 36%.

Beyond public health, we also acknowledge our role in community waste management. As a global FMCG company, we are committed to reducing waste across our value chain and contributing positively

to the communities we operate in. Our approach extends beyond compliance with Indian EPR laws to collect 100% of the plastic waste we generate annually. In line with the principles of a circular economy, we are supporting communities around our offices and plants to manage their solid waste. Our partnerships with 5 municipal corporations in India have led to the establishment of scientific waste management systems. As a result, we have successfully diverted over 2,300 MT of waste from landfills in fiscal year 2022-23.

Going forward, our key leaders, including myself, will have specific ESG-linked goals in our annual plans. Performance against these goals will impact our variable pay. We believe that leading by example will help foster a culture of accountability and commitment towards our ESG ambitions.

Through our various initiatives we have successfully diverted

over 2,300 MT of waste from landfills in fiscal year 2022-23

Previous