Integrating our go-to-market approach and leveraging technology for strategic decision-making

Intellectual

Capital

Manufactured

Capital

Social &

Relationship

Capital

Financial

Capital

Our agile go-to-market approach is the backbone of our business. We are leveraging data and technology, innovating for local contexts, and building more agility across multiple routes-to-markets to serve our consumers with greater purpose and focus.

We will continue to invest in enhancing our Intellectual Capital, making our Manufactured Capital more agile, and creating joint value with our partners to maximise Social and Relationship Capital. This, in turn, will translate into stronger Financial Capital value.

Innovations and start-up efforts in FMCG last mile distribution have been altering the overall sales and distribution landscape over the past couple of years. Shifts in consumer behaviour and digital acceleration following the COVID-19 pandemic have only added to this, opening up significant opportunities to scale, transform, and make our sales organisation more future-ready.

We are adapting and innovating, leveraging technology across our operations, and building new capabilities, especially the muscle to be more agile. Our approach hinges on close connect with our markets, consumers, partners, and communities, to understand and better serve evolving needs.

Channels

of the future

New technologies are transforming the sales and distribution landscape. Additionally, e-commerce has seen strong growth across India, Indonesia, and the USA, and modern trade, Cash & Carry, and, more recently, eB2B continue to grow. COVID-19 has accelerated digital adoption across shoppers, retailers, and the FMCG network.

In India and Indonesia, it has also refocused attention on the role of traditional kirana or neighbourhood convenience stores. Similarly, in Africa, we have seen the acceleration of proximity shopping to overcome the challenges of the pandemic. This has reinforced the importance of last mile distribution. New models will now be omni-channel, straddling a pyramid of online and offline.

In Bangladesh, the focus continues to be on building the traditional kirana backbone, since e-commerce is still at a very nascent stage and modern trade is only limited to urban centres. In Sri Lanka, we continue to focus on all channels, including traditional, modern trade, and, more recently, the e-commerce channel too, which is seeing exponential growth.

Akhil Chandra, Business Head of

Godrej Indonesia, joins his team in

the market to launch our new products

Nisaba Godrej, our Chairperson and Managing Director, spends time with

our team in the market in Delhi, India,

to understand how channels are evolving

Shopper

behaviour

Social distancing has become a norm, and in-person shopping trips have significantly reduced following multiple lockdowns. In India and Indonesia, modern trade stores were directly impacted due to a drop in footfalls. Simultaneously, volatility was observed in the assortment mix, with consumer preferences shifting towards hygiene and essential products and larger value packs.

In Africa, consumers also shifted to multicategory store formats from exclusive beauty stores. Women reduced their dependence on salons and shifted to more do-it-yourself and maintenance products across hair categories, like braids and twists, and maintenance hair care products. While the demand for hygiene products spiked, it was more for multi-purpose products. Consumers opted for smaller packs to minimise outlay, given financial stress.

Consumers in the USA shifted significantly towards e-commerce and multi-category retail, and beauty-focused retail declined sharply. Shopper behaviour saw a shift to fewer shopping trips and consolidated buying. Women also switched more to do-it-yourself or at-home options for personal and hair care products.

While some of these shifts began easing during the latter part of the year, they will remain relevant given the continuing impact of the pandemic.

Partnerships

The interdependencies of our networks, which are always important, were highlighted. For the system to deliver successfully, we need all partners to be enabled and benefited.

The shortage of manpower on ground was one of the biggest challenges. In India, from salespeople to delivery personnel, the feet on street reduced everywhere due to reverse migration from cities to villages. From a low of 60 per cent manpower in April 2020, we recovered close to 90 per cent in June.

This significantly impacted our urban channel, and reaching out to retailers remotely became critical. Our distributors were also adversely impacted with uncertainties around the business impacting return on investment.

Sunil Kataria, CEO of our India and SAARC business,

in conversation with our team members and trade partners

Across Indonesia, Africa, and the USA too, our suppliers, distributors, wholesalers, modern trade customers, and salon partners were all adversely affected by business uncertainty. We have and continue to partner closely with them on win-win solutions and turning these crises into opportunities.

In India, we continue to focus on deepening penetration in traditional trade. Along with this, we are strengthening growth in newly acquired stores through an assortment mix. In urban India, future store expansion will be through opportunity-based micro-segmentation. Rural penetration will continue to be critical. We aim to expand our total reach from 6 million outlets to 7 million outlets in the next two years.

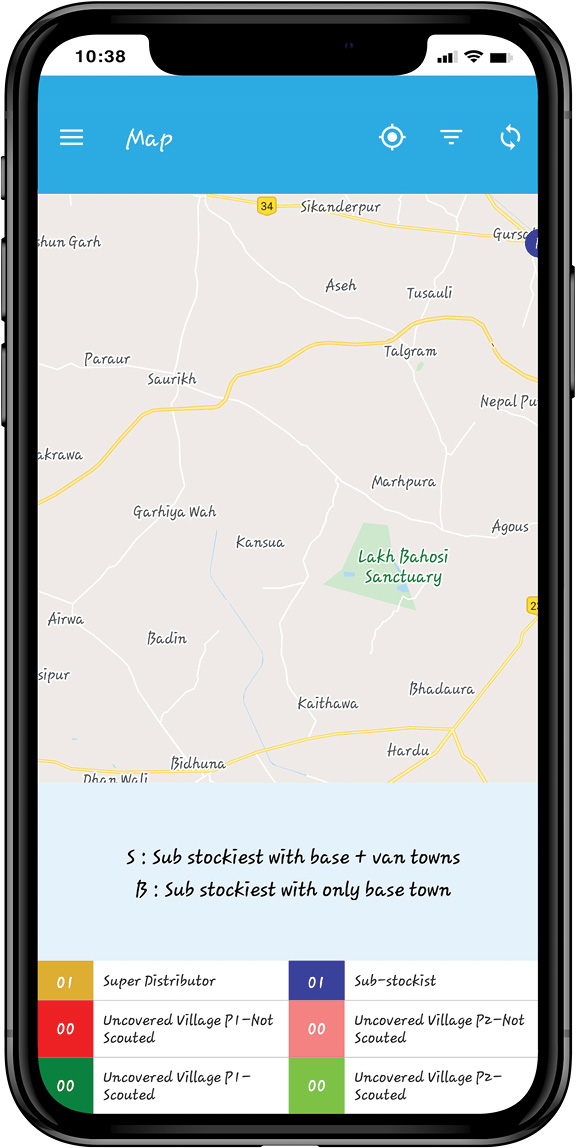

In the past year, we have grown our rural sub-stockist network by 30 per cent, on the back of our counter sub-stockist strategy. The strategy has been aided by tech enablement of our frontline rural salesmen through an in-house app called QUEST. The app has guided them to priority villages which they need to survey and appoint as the new sub-stockists. We have also leveraged external partnerships in rural India and worked closely with an emerging player in the rural eB2B space. The partnership has helped us reach villages with a population below 3,000, where we don’t reach directly through our sub-stockist network. This has significantly complemented our rural distribution. The pilot in Maharashtra has been expanded and is now well established in Madhya Pradesh and some states in south India, with a plan to expand in the north in the coming year.

To strengthen our in-market execution, we started tracking tertiary sales in rural areas, measuring sales from sub-stockists to rural retailers, and using that as a key performance indicator for rural sales team members. This makes us one of the first FMCG companies that not only tracks tertiary sales, but also uses it as a crucial performance KPI for our rural sales ecosystem.

‘Mission Mukhiya’ led by

our Bihar Sales team helped

reach rural consumers

Our new QUEST mobile app

designed to aid interim sales

representatives in rural India

We have a strategic, focused approach to conquer ‘micro markets’. Through extensive data and analytics, we have defined and segmented micro markets (usually, a specific cluster of districts) for each of our brands. This helps in prioritising marketing and distribution efforts. We can now track performance and provide actionable insights at granular levels.

Tapping into the emerging opportunity of a growing chemist channel remains a key strategic lever for us. Towards this goal, we have created a strong distributor network of pharma/OTC distributors and through them created a new revenue stream. This channel fits well into our plans for our hygiene portfolio and its new NPDs.

Our Bangladesh team is expanding direct reach to 1,00,000 outlets and driving salesforce automation through handheld devices for salespeople. Our focus remains on becoming one of the top FMCG companies in terms of reach. We are also piloting various tech-based interventions to increase our width of sales in the stores that we reach. This will help us in improving our returns tremendously.

In Sri Lanka, the team is building its own distribution network, which is backed by a cloud-based distributor management system and salesforce automation. Our focus is to ensure that we reach a good mix of traditional and modern trade stores across the country.

In Indonesia, we significantly accelerated our go-to-market transformation. Our efforts on route-to-market consolidation in the previous year have stabilised well. Direct distribution, through active registered outlets, in Indonesia continued to grow strongly to reach nearly 1,60,000 outlets. This was fuelled by strong reach expansion led by two key initiatives - dedicated salesmen to add and nurture new outlets, and motorist salesmen to identify and further expand last mile distribution. In addition to this, our existing distribution base too billed frequently. We have also expanded alternate channel distribution in pharma and health and beauty, which have strong synergies with our baby care and hair colour portfolios.

Going forward, we will continue the momentum on distribution expansion and double down on new outlets while maximising throughput from our existing distribution base.

We are ramping up our go-to-market efforts across Africa. In Nigeria, where trade is largely unorganised and wholesale-led, we are scaling up our last mile distribution through van models, sub-distributor models, and salon advocacy.

We have also had some other experiments with breakout success this year. We launched a direct-to-consumer (D2C) channel aimed at seeding new products, experimenting with untested price points and product bundles, leveraging consumer analytics, and potentially providing distribution in white space regions with retailers coming onto the platform.

We also launched a door-to-door (D2D) sampling drive to build demand and educate consumers on our recently launched household insecticides portfolio. This resulted in a significant shift in our non-wholesale channel contribution. We will continue the momentum in Nigeria and strengthen fundamentals at an accelerated pace in South Africa and Kenya to unlock the full potential over the next few years.

Go-to-market activations for

our hair extension brands in

South Africa

A key highlight for us this year in the USA was the Darling–Walmart partnership. We forayed into hair extensions with an exclusive launch at Walmart.

Hair extensions is a USD 1 billion market in the USA, and this provides us a tremendous opportunity with significant consumer synergies. We are the only hair extensions and hair care player to cater to the African community in the USA.

Improving efficiencies

We are driving efficiency across the value chain and improving sales productivity by leveraging analytics and technology. In particular, improving assortment and reducing sales losses through auto replenishment and enhancing salesforce effectiveness through technology will be critical levers of future growth.

Building an

omni-channel play

Given the changing shopper trends and environments, we are ramping up capabilities to service the demands of an omni-channel play. Externally, this translates into servicing and solving for channel conflicts. Internally, it means putting the right team structure in place to service this channel with agility.

Exploring new

go-to-market formats

The many disruptions through COVID-19 encouraged experimentation and new go-to-market formats and opportunities. In India, we introduced new projects to explore emergent models like outreach to building apartment complexes, D2C disruptor partnerships (like with Swiggy and Zomato), remote ordering through telecalling and SMS/WhatsApp, and third-party options for delivery-to-trade.

Gojek and Kereta Commuter

Indonesia partnerships for

our Saniter brand

Experimenting with new partnerships

and delivery-to-trade options for

Goodknight Power Shots in Nigeria

and Magic in South Africa

Online consumer

interactions in India

and Africa

In Indonesia, we tested alternate B2B models like web-based-ordering for outlets, product delivery via logistics providers, and alternate B2C models around last mile delivery to customers.

In Nigeria, we explored the D2C channel with strong wins, particularly given the overall shopper preference for online purchasing that they could trust.

Across India and Africa, we also went completely online with our consumer/stylist research interactions, enabling a strong pulse of the emerging trends in the market and translating them to agile actions.

Transforming

modern trade

Modern trade is a key driver of growth across geographies, and we aim to ramp this up. Building blocks include account and portfolio prioritisation, chain state group prioritisation, category management, fill rate improvement, and strong partnerships with customers through joint business planning.

In India, we are accelerating joint business planning in pharmacy chains, even as the shopper environment evolves into pharmacy + OTC + FMCG personal care. Our teams are sharing and learning from our Indonesia and Latin America businesses on category management. We are also investing in developing modern tradespecific analytics and shopper marketing capabilities.

Sri Lanka boasts of a strong modern tradedriven FMCG space, and our objective remains to ensure we optimise our efforts to ensure that we take full advantage of the opportunities through driving visibility, focused marketing interventions, in-store sampling, etc. We also aim at deepening our partnerships with chains through strong mutual plans.

Modern trade accounts for nearly 70 per cent of our business in Indonesia. We continued our long-term journey to drive modern trade excellence, with a continued thrust on strategic investments, prioritising winning accounts, which was particularly relevant with shopper shifts post-COVID-19, and focusing on joint business partnerships, which was crucial to win in an unprecedented macro environment. This resulted in a successful foray into the hygiene category. Our Saniter brand ramp up was primarily driven by modern trade and crossed unprecedented milestones.

Given modern trade continues to be key, particularly in South Africa, we are leveraging availability, strong in-store presence, and competitive pricing to build on the opportunity.

Our entire business in the USA is modern trade led, with the channel split into retail and beauty stores. We continue to leverage strong channel partnerships and jointbusiness planning to drive distribution and new products listing, compelling in-store presence and competitive pricing.

Building on

the salon channel

The restructuring of our salon channel in Africa will be a big focus. Salon partnership programmes are key to building influence and generating demand in hair care.

Inside our Darling

Professional Stylists’

Academy in Nigeria

Training and capability building

for frontline teams

Equipping our team members to best service the changing landscape is critical. We continue to drive multiple capability building initiatives, which were enhanced over the past year and were moved online.

In India, our in-house training academy, the ‘Godrej Sales Academy’, moved completely online to encourage easy access and onthe-go learning.

In other geographies too, we have leveraged online training modules for continuous skillset improvement in a tough macro environment, while also focusing on team engagement and motivation.

E-commerce represents strong opportunities to win in a fast-growing channel, while leveraging its unique reach to bring innovative products and brands to market.

To capitalise on this, we have set up an independent e-commerce business unit in India with separate P&L accountability and fully functional capabilities across sales, marketing, innovation, supply chain, and finance. This structure will deliver the agility and consumer focus required to win in this fast-evolving space.

Underpinning this, we are building a strong data backbone to leverage the data-rich environment of e-commerce and drive our efficiency and effectiveness across the board. We are targeting growth from e-commerce-focused product innovation and digital native brands.

Some of our new products focused on this format have done especially well, like the HIT Anti-mosquito Racquet, Godrej aer matic, and Godrej protekt masks.

Through joint business planning, promotion strategies, and online content, we have made significant upgrades to our capabilities, which are yielding results in terms of on-platform conversion rates and off-takes.

Our e-commerce business in Indonesia grew 4X post-COVID-19. We have significantly scaled up our efforts and investments with a focus on winning platforms backed by strong joint business partnering, big bang new product launches like Saniter, strong cataloguing and store management, investments with robust returns, and a step jump in leveraging analytics.

Our newly launched

D2C channel in Nigeria

In the USA, our efforts to strengthen e-commerce fundamentals paid off with the business growing at a break-out pace to become nearly 3 per cent of our overall USA business this year.

E-commerce in Africa has significant headroom for growth, particularly in the fashion and beauty segments. Given limited resident traffic on third-party platforms in Africa (unlike in India, Indonesia, and the USA), we launched our own D2C platform in Nigeria.

This has been more than just a sales channel, with significant upsides to leverage, like the immediate availability of new products, controlled brand building, consumer data, seeding new products, ability to cross-sell/upsell, experiment with untested product bundles and price points, media attribution and efficiency assessment, and opportunities for focused consumer research.

We have set up a new e-commerce team in Latin America and are investing multiple ways to grow our presence on different digital platforms and marketplaces.

We have integrated different technology solutions across the value chain in India, starting with our salespeople on ground, through our many channel partners. Predictive analytics enables our urban salespeople to sell the right assortment in a store. We are moving our distributor billing software and handheld terminals to cloud-based servers to bring in more agility to the sales ecosystem. We have completed cloud transformation for our rural business and we plan to cover our urban business in the coming year too. We are currently exploring the usage of GPS locations to drive in-market execution of our sales team both in urban and rural markets.

Analytics is also helping us improve distributor replenishment by minimising sales losses due to stock-outs.

Our micro-marketing approach in India helps combat inefficiencies and focuses spending on targeted markets, rather than spreading it thin across larger segments. Over the past year, we leveraged these capabilities for focused rural marketing initiatives.

For example, our ‘Magic dangal’ drive, on protekt Magic hand wash in rural markets, focused on driving hand wash education, along with canter activations and D2D sampling, coupled with building mass awareness through television, print, and extensive rural retail visibility.

Given the growth trends in hair colours in rural markets, we enhanced our product reach through direct and indirect distribution. We activated largescale wholesale programmes in key states and changed our television channel mix. Mehendi has higher appeal in rural India, and so, we launched Nupur Mehendi at r10. Because hair colouring picks up in the festive season, and with beauty salons still not fully operational, we helped educate rural consumers on do-it-yourself beauty products through local celebrity and multiple micro-influencer partnerships.

Technology continues to play a key role in improving field-force productivity in our Indonesia business. Hand-held terminals guide and track on-ground decision-making, and analytics and dashboards help drive sharper execution. Regional distributors are connected and serviced through an online portal with simplified e-claim settlements. A trade spend optimiser tool helps drive return on in-store investments for modern trade. We will continue to integrate technology across all execution touch points. We have also built stronger visibility in e-commerce analytics on Amazon, which we are translating into action points.

In SAARC, we are leveraging potential tech partnerships and analytics to help augment our traditional trade expansion through systems like cloud-based DMS, micro targeting, SOQ, and TPM. Through this, we want to ensure that our primary aim remains to expand distribution in traditional trade in both Bangladesh and Sri Lanka and drive efficiencies as well as leverage penetrated stores by expansion.

In Africa, salesforce automation has helped expand coverage and improve brand visibility across the sub-continent. Following the roll-out across the general trade and salon channels, the focus will now be on scaling up distribution, extracting efficiencies, and building accountability. We have also leveraged technology in consumer insighting, like taking consumer insights from the D2C channel in Nigeria to product bundles and price points that can work, and shifting to virtual consumer and stylist interactions to continue having a strong pulse of the on-ground trends and for agile action planning.

We ramped up channel partner engagement significantly over the past year, even as distribution networks broke down. One of our foremost priories was to ensure the health and safety of our partners and their networks.

In India, we introduced COVID-19 medical insurance and life insurance for our salespeople and distributor staff in extended networks, reaching 7,500 members. We have a comprehensive approach to improve return on investment for our distributors to enhance engagement.

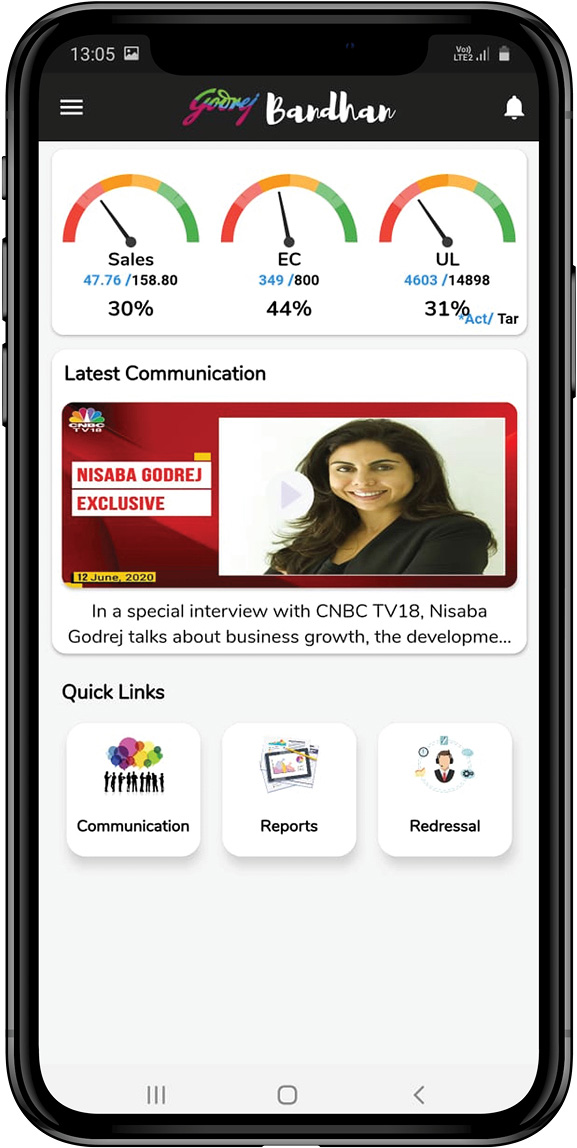

To increase digital connect, we also introduced an industry first, an Android app called ‘Bandhan’, a one stop for all GCPL-related information, communication updates, and trainings for all our distributors.

Connecting with partners

in India through our Bandhan app

Online hair and makeup

trainings for our partners in Chile

Partnering with Walmart

in the USA to launch

our Darling hair extensions brand

Our regional distributor network in Indonesia contributes a significant share to the business. We are exploring different ways to enhance these partnerships, including leveraging technology for better efficiencies.

Salons and stylists are our key partners in the hair care category in Africa. In addition to initiating training programmes for stylists, which help them become selfemployed, we are scaling up salon connect programmes to drive penetration and usage and build engagement and advocacy.

Our partnership with Walmart in the USA marked an exclusive foray into hair extensions for both Godrej and Walmart. Walmart offers a significant distribution network and unparalleled shopper footprint, and we have strong consumer understanding as the only hair extension brand in the USA with African roots and the only player with an integrated hair care portfolio. This provides a great opportunity for a lasting win-win partnership, unlocking tremendous value for the overall category while serving our consumers.