Building e-commerce competencies, an in-house content creation studio, and a first foray into direct-to-consumer (D2C) retailing

Intellectual

Capital

Financial

Capital

The acceleration in digital adoption over the past year has been a shot in the arm for our digital ambitions. We are integrating and ramping up capabilities across different aspects of our business, with a focus on building relevant digital platforms for the future and stronger Social and Relationship Capital through partnerships and more meaningful consumer connect. We are also investing in building internal capabilities and Intellectual Capital through focused talent, trainings, and infrastructure.

Our independent e-commerce business unit in India has separate P&L accountability and fully functional capabilities across sales, marketing, innovation, supply chain, and finance. This allows us the agility and consumer focus required to win in this fast-evolving space. We are targeting growth from e-commerce-focused product innovation and digital native brands. Some of our new products focused for this format have done especially well, like the HIT Anti- mosquito Racquet, Godrej aer matic, and Godrej protekt masks.

In Indonesia, our e-commerce business grew 4X post-COVID-19. We have significantly scaled up our investments in key platforms backed by strong joint business partnering, new product launches, strong cataloguing and store management, and a steep jump in leveraging analytics. Driving focused digital activities both on platform and off platforms helps create seamless consumer experiences: from awareness in digital to purchase in e-commerce. Stella Smart Matic Parfumist, for example, was launched exclusively on Shopee. Our new Saniter brand levered digital technology to generate stronger sales through e-commerce. We have also started developing e-commerce-only products to cater to the big segments online, starting with the HIT Anti-mosquito Racquet.

Our Africa cluster has evolved its structure from a digital-first marketing function to an ‘e-business’ function, which combines digital marketing and e-commerce in a holistic approach to leverage and scale our digital capabilities. We are now building dedicated e-business teams across all our key markets and a central team to drive our overall e-business strategy for the cluster.

In the USA, e-commerce is now nearly 3 per cent of our business in an acceleration made possible by the investments and groundwork in previous years.

We have set up a new e-commerce team in Latin America and are investing in multiple ways to grow our presence on different digital platforms and marketplaces.

E-commerce activations

for our products in

Latin America

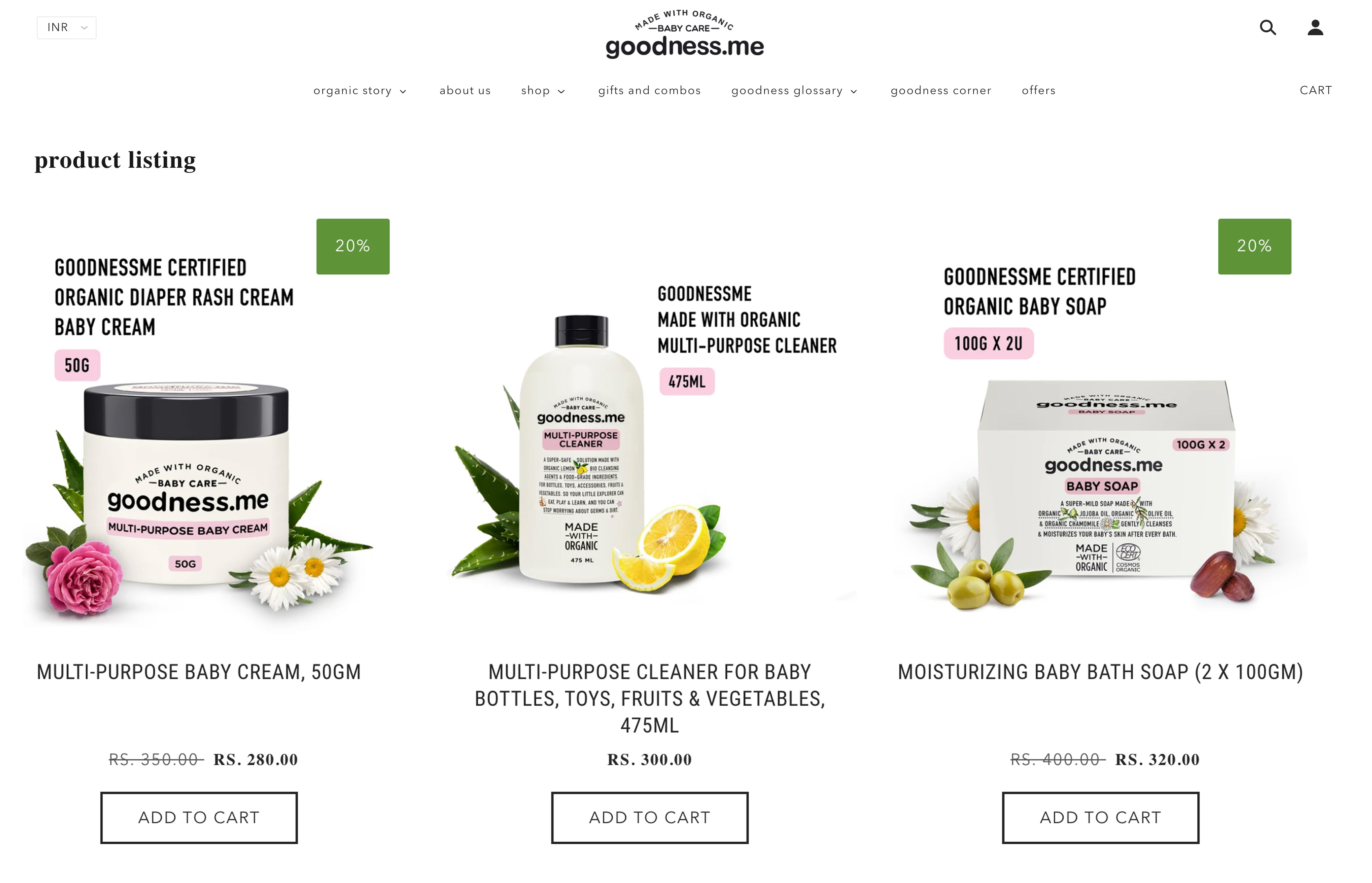

Our new D2C platform for

goodness.me in India

In line with our increased focus on building first-party data and the need to have a complete view of a consumer’s purchase journey, we successfully launched a new adjacent business channel for D2C in India in 2019. Cinthol and Godrej aer were amongst our first brands to introduce D2C platforms. This year, we added D2C channels for BBLUNT, goodness.me, and Godrej Professional.

Following the pandemic, consumer trends like online shopping have accelerated with significant momentum. More consumers are now turning to online shopping and choosing to interact with brands directly through their D2C channels. The traction has been very encouraging, and we have been able to derive learnings across multiple brands and categories. Our return on ad spend has been very encouraging. We have also experimented with the exclusive launch of some of our new variants on these platforms to positive consumer response.

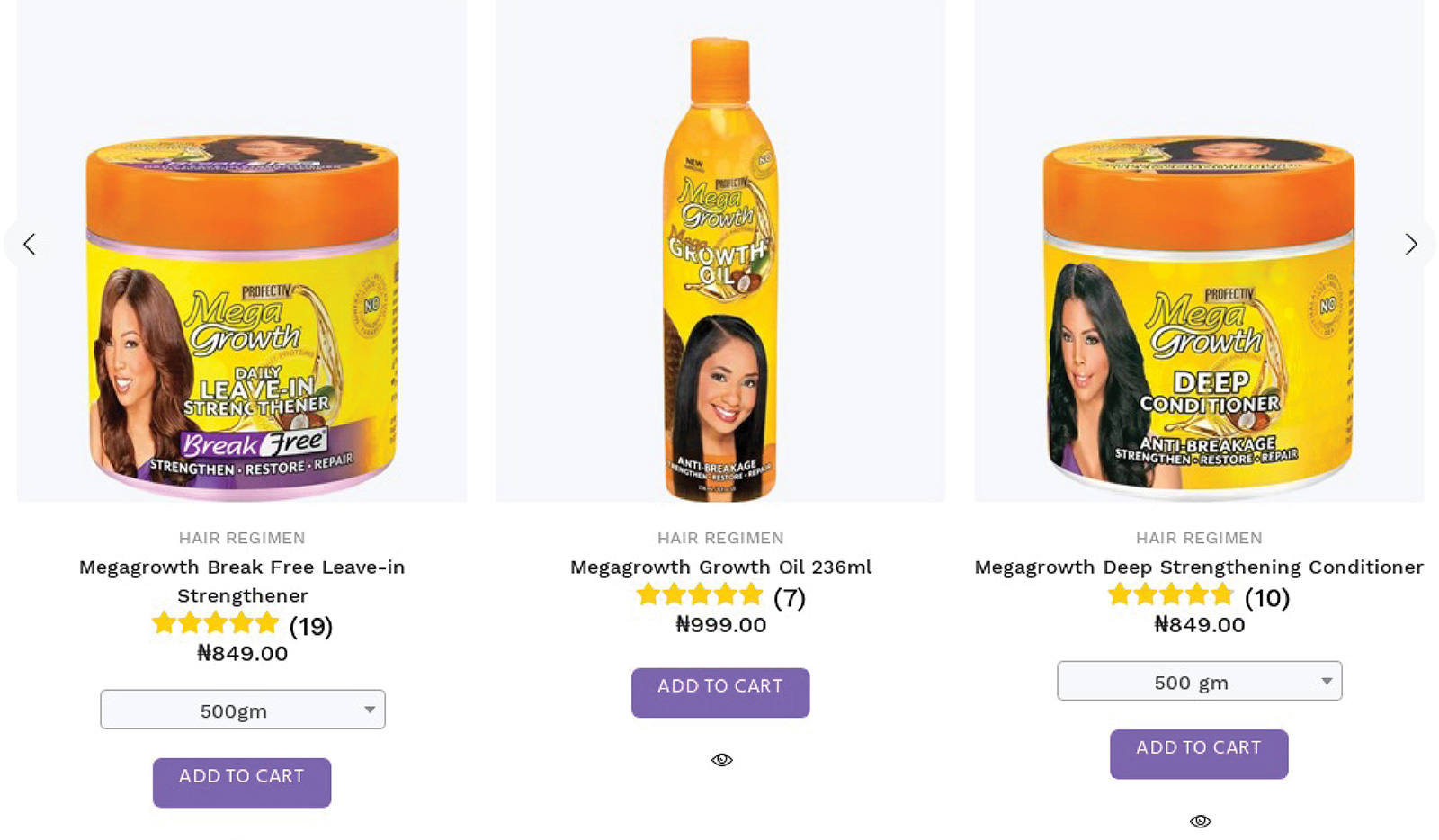

In Africa, with offline markets closing down, our team quickly tested and launched a D2C platform in Nigeria. It has delivered upwards of USD 2,50,000 in top line sales since July 2020 with an impressive 20 per cent repeat customer rate.

It has also clocked upwards of 10 per cent saliency in the launch of premium new products across categories. We will leverage this extensively to test and launch new products and gather customer intelligence going forward. This learning from Nigeria will help us launch our D2C platform for South Africa.

Our new D2C platform

in Nigeria

In the past year, we have collected data from across multiple platforms through our in-house cloud-based data management system in India. We now have over 10 million first-party data points from consumers and users. We aim to scale this to over 15 million by the end of March 2022.

These rich and actionable insights based on audience interests, shopping/purchase behaviour, demography, appography, and location history are critical for us.

In the past couple of months, we have piloted a few campaigns through our data management platform to further enhance consumer data and measure the effectiveness of campaigns based on sharp audience segments.

We also work very closely with partners with rich data signals (second-party) to identify life stage, user intent, and location and to enhance consumer experience by providing relevant and personalised messaging.

The exponential increase in time spent on social media and content platforms in the past year focused on the importance of digital brand advocacy. We have leveraged this to make digital brand advocacy a key pillar in our overall marketing and communication strategy.

In India, we partnered with Bollywood celebrities like Karan Johar and Neha Dhupia on Godrej Expert Rich Crème to establish the ease of colouring at home when salons were shut. We tailor our approach-based focus markets and partner with regional content creators on YouTube and social media platforms.

We have leveraged large digital content platforms like Glamrs (Indian beauty, style, fitness, and lifestyle video platform for women) for Godrej Expert and Shitty Ideas Trending (YouTube channel with funny relationship sketches) for Goodknight. Food has been a big trend this year, and therefore, we partnered with celebrity chefs.

We also used mommy networks to build expertise and credentials for relevant brands and travel influencers to build Cinthol’s ‘alive is awesome’ philosophy.

In Africa, our categories are heavily driven by visual content and influencers. We plan to scale up our strategy of co-creating content with influencers to enhance believability and impact, while driving new products and styles. We are partnering with influencer marketing specialists across markets and also putting media spends behind this content for more reach.

With online communities becoming the next big thing on the digital platform, we want to scale up our brand communities and tribes. One of our key brand launches this year in Africa will be from a black hair community which we had started building three years ago.

Our other brands will also build communities by using Facebook groups, WhatsApp, etc. Currently, we have stylist Facebook group communities in Kenya, South Africa, and Nigeria with over 60,000 stylists connected through the platform. We will double down on efforts to build these communities and create long- lasting, meaningful relationships with our consumers and partners.