Company's Philosophy on Corporate Governance

The Company is part of the 117-year old Godrej Group which has established a reputation for honesty, integrity and sound governance.

The Company’s philosophy on corporate governance envisages attainment of the highest levels of transparency, accountability and equity in all facets of its operations and in all its interactions with its stakeholders including shareholders, employees, lenders and the government. The Company is committed to achieve and maintain the highest standards of corporate governance. The Company believes that all its actions must serve the underlying goal of enhancing overall stakeholder value over a sustained period of time.

The Company continues to enjoy a corporate governance rating of CGR2+ (pronounced as CGR two plus) and Stakeholder Value Creation and Governance Rating of SVG1 (pronounced as SVG one) assigned by ICRA.

The two ratings evaluate whether a Company is being run on the principles of corporate governance and whether the practices followed by the Company lead to value creation for all its shareholders.

The CGR2 rating is on a rating scale of CGR1 to CGR6, where CGR1 denotes the highest rating. The CGR2+ rating implies that in ICRA’s current opinion, the rated Company has adopted and follows such practices, conventions and codes as would provide its financial stakeholders a high level of assurance on the quality of corporate governance.

The SVG1 rating is on a rating scale of SVG1 to SVG6, where SVG1 denotes the highest rating. The SVG1 rating implies that in ICRA’s current opinion, the Company belongs to the Highest Category on the composite parameters of stakeholder value creation and management as also corporate governance practices.

1. Board of Directors

a) Board Procedures

GCPL currently has a 12-member Board, with 6 Independent Directors. During FY 2014-15, the total strength of the Company’s Board was 14 members, out of which 2 directors resigned with effect from close of business hours on March 31, 2015 including 1 Independent Director. The Independent Directors are eminent professionals from diverse fields, with expertise in finance, information systems, marketing and corporate strategy. None of the Independent Directors have had any material association with the Godrej Group in the past. GCPL’s Board has a lead Independent Director, in line with accepted best practices, to strengthen the focus and quality of discussion at the Board level.

The Board meets at least once in a quarter to review the Company’s quarterly performance and financial results. Board meetings are governed with a structured agenda. The Board periodically reviews the Compliance Reports with respect to laws and regulations applicable to the Company. Before the commencement of the Audit Committee meeting, members of the Audit Committee –

which consists entirely of Independent Directors – have a discussion with the Statutory Auditors, without the presence of the management team or whole-time directors in that meeting. For all major items, comprehensive background information is provided to the Board to enable them to take an informed decision. Once in a year, the Board members participate in a strategy meeting, in which it also interacts with the management team of the Company. The Independent Directors also have a meeting amongst themselves, after which they provide their insights to the entire Board and the management team.

b. Composition of the Board:

The composition of the Board is as under:

Category |

No. of Directors

as at March 31, 2014

|

No. of Directors

as on April 1, 2015

|

(i) Non Independent Directors |

|

|

Executive Chairman |

1 |

1 |

Managing Director

| 1 |

1 |

Executive Director |

1 |

1 |

Other Non-Executive Directors (including 3 promoter directors) |

4 |

3 |

Sub Total |

7 |

6 |

(ii) Independent Directors |

7 |

6 |

Total Strength (i + ii) |

14 |

12 |

c. Other relevant details of the Directors

Name of Director |

Date of Appointment |

Relationship with other Directors |

Category |

Number of Directorships held in Indian Public Limited Companies (including GCPL)* |

Committee Positions including

GCPL

Committee Chairperson

**

|

Committee member (excluding Committee Chairperson)

**

|

|

Mr. Adi Godrej |

November 29, 2000 |

Brother of

Mr. Nadir Godrej, Father of

Ms. Tanya Dubash and Ms. Nisaba Godrej |

Promoter/ Executive /Chairman/

Whole-time |

6

(3)

|

1 |

2 |

Mr. Nadir Godrej |

November 29, 2000 |

Brother of

Mr. Adi Godrej |

Promoter/

Non-Executive |

10

(6)

|

1 |

2 |

Mr. Jamshyd Godrej |

March 1, 2001 |

None |

Promoter/

Non-Executive |

7

(5)

|

1 |

2 |

Ms. Tanya Dubash |

May 2, 2011 |

Daughter of

Mr Adi Godrej, Sister of Ms. Nisaba Godrej |

Promoter/

Non-Executive |

6

(2)

|

None |

1 |

Ms. Nisaba Godrej |

May 2, 2011 |

Daughter of Mr Adi Godrej, Sister of

Ms. Tanya Dubash |

Promoter/ Executive |

2

(1)

|

None |

None |

Mr. Vivek Gambhir |

April 30, 2013 |

None |

Managing Director/ Executive |

2

(1)

|

None |

2 |

|

Mr. Narendra Ambwani

|

May 2, 2011

|

None

|

Non-Executive / Independent

|

5

(3)

|

None

|

5

|

Mr. Bharat Doshi

|

April 1, 2001

|

None

|

Non-Executive / Independent

|

6

(4)

|

1

|

2

|

|

Dr. Omkar Goswami

|

June 18, 2008

|

None

|

Non-Executive/ Independent

|

9

(7)

|

1

|

8

|

|

Mr. Aman Mehta

|

April 26, 2006

|

None

|

Non-Executive/ Independent

|

6

(6)

|

3

|

3

|

|

Mr. D. Shivakumar

|

April 1, 2009

|

None

|

Non-Executive/ Independent

|

2

(1)

|

None

|

2

|

|

Ms. Ireena Vittal

|

April 30, 2013

|

None

|

Non-Executive/ Independent

|

8

(7)

|

None

|

7

|

* Does not include Directorships in Private Companies, Section 8 Companies and Foreign Companies.

** Does not include Chairmanship / Membership in Board Committees other than the Audit Committee, the Shareholders’ Grievance Committee and Chairmanship / Membership in Board Committees in companies other than public limited companies registered in India.

Notes

Figures in brackets denote Directorships in listed companies.

Mr. A. Mahendran, Non-Executive Director, and Prof. Bala Balachandran, Independent Director, have resigned from the Board with effect from close of business hours on March 31, 2015.

d. Re-appointment of Directors liable to retire by rotation

The Board has four Directors whose period of office is liable to be determined for retirement by rotation, and out of these four directors, one-third i.e. one Director shall retire at the Annual General Meeting.

Thus, Mr. Nadir Godrej shall retire at the ensuing Annual General Meeting of the Company, being eligible for re-appointment. His resume is annexed to the notice of the Annual General Meeting.

2. Committees of the Board

The Company has set up an Audit Committee in accordance with Section 177 of the Companies Act, 2013 and Clause 49 of the Listing Agreement. The Stakeholders Relationship Committee formed in accordance with Clause 49 of the Listing Agreement and Section 178 of the Companies Act, 2013 inter alia looks into Investor Grievances. The Company has also introduced a Nomination and Remuneration Committee which is mandatory as per the Companies Act, 2013 and Clause 49 of the Listing Agreement.

The composition of the Committees is as below:

|

Name of the Director

|

Category of the Director

|

Position in the Committee

|

|

Audit Committee

|

Nomination & Remuneration Committee

|

Stakeholders' Relationship Committee

|

|

Mr. Adi Godrej

|

Promoter, Executive

|

None

|

None

|

Member

|

|

Mr. Nadir Godrej

|

Promoter, Non Executive

|

None

|

None

|

Chairman

|

|

Mr. Jamshyd Godrej

|

Promoter, Non Executive

|

None

|

None

|

Member

|

|

Ms. Tanya Dubash

|

Promoter, Non Executive

|

None

|

None

|

None

|

|

Ms. Nisaba Godrej

|

Promoter, Executive

|

None

|

None

|

None

|

|

Mr. A Mahendran*

|

Non Executive

|

None

|

None

|

None

|

|

Mr. Vivek Gambhir

|

Executive

|

None

|

None

|

Member

|

|

Mr. Narendra Ambwani**

|

Independent

|

Member

|

Member

|

None

|

|

Prof. Bala Balachandran*

|

Independent

|

Member

|

Chairman

|

None

|

|

Mr. Bharat Doshi

|

Independent

|

Chairman

|

Member

|

None

|

|

Dr. Omkar Goswami

|

Independent

|

Member

|

Member

|

None

|

|

Mr. Aman Mehta

|

Independent

|

Member

|

Member

|

None

|

|

Mr. D. Shivakumar

|

Independent

|

Member

|

Member

|

None

|

|

Ms. Ireena Vittal

|

Independent

|

Member

|

Member

|

None

|

|

Total Strength of the Committee

|

7

|

7

|

4

|

|

No. of Independent Directors in the Committee

|

7

|

7

|

-

|

|

No. of Non Independent Directors in the Committee

|

-

|

-

|

4

|

* Mr. A Mahendran and Prof. Bala Balachandran resigned from the Board with effect from close of business hours on March 31, 2015.

** Mr. Narendra Ambwani shall be the Chairman of Nomination and Remuneration Committee w.e.f. April 1, 2015, as Prof. Bala Balachandran has resigned from the Board and hence, has ceased to be the member and chairman of the Committee.

Mr. P Ganesh, Executive Vice President (Finance & Commercial) & Company Secretary was the Secretary for all the Board Committees during the FY 2014-15. He has resigned from his position with effect from close of business hours on March 31, 2015. Mr. V Srinivasan has joined as the Chief Financial Officer & Company Secretary from April 1, 2015 and is the Secretary to the Committee w.e.f. April 1, 2015.

3. Attendance details at Board/Committee Meetings and at the last Annual General Meeting

|

Name of Meeting------>

|

Board

|

Audit Committee

|

Nomination & Remuneration Committee

|

Stakeholders' Committee

|

AGM - July 28, 2014

|

|

No of Meetings held-->

|

6

|

5

|

2

|

11

|

|

|

Attendance of the Director

|

|

|

|

|

|

|

Mr. Adi Godrej

|

6

|

NA

|

NA

|

10

|

Yes

|

|

Mr. Jamshyd Godrej

|

4

|

NA

|

NA

|

4

|

Yes

|

|

Mr. Nadir Godrej

|

6

|

NA

|

NA

|

8

|

Yes

|

|

Ms. Tanya Dubash

|

5

|

NA

|

NA

|

NA

|

Yes

|

|

Ms. Nisaba Godrej

|

6

|

NA

|

NA

|

NA

|

Yes

|

|

Mr. A. Mahendran

|

2

|

NA

|

NA

|

NA

|

No

|

|

Mr. Vivek Gambhir

|

5

|

NA

|

NA

|

8

|

Yes

|

|

Mr. Narendra Ambwani

|

3

|

4

|

2

|

NA

|

Yes

|

|

Prof. Bala Balachandran

|

2 (2)

|

2 (3)

|

1 (1)

|

NA

|

Yes

|

|

Mr. Bharat Doshi

|

4 (2)

|

5

|

2

|

NA

|

Yes

|

|

Dr. Omkar Goswami

|

3

|

4

|

2

|

NA

|

Yes

|

|

Mr. Aman Mehta

|

4

|

4 (1)

|

2

|

NA

|

Yes

|

|

Mr. D. Shivakumar

|

3

|

3 (1)

|

1

|

NA

|

Yes

|

|

Ms. Ireena Vittal

|

4

|

5

|

2

|

NA

|

Yes

|

Notes:

1) Board meetings and Audit Committee meetings were held on April 28, 2014; July 28, 2014; November 1, 2014 and February 5, 2015. Additionally, Board meetings were also held on June 23, 2014 and February 11, 2015 and Audit Committee meeting was held on September 30, 2014.

2) The maximum gap between any two Board meetings did not exceed 120 days during the year.

3) Nomination & Remuneration Committee meetings were held on April 28, 2014, and February 5, 2015.

4) Stakeholders' Relationship Committee meetings were held on April 11, 2014; May 16, 2014; June 23, 2014; July 18, 2014; August 19, 2014; October 7, 2014; November 17, 2014; December 22, 2014; January 8, 2015; February 2, 2015 and March 13, 2015.

5) Figures in bracket indicate participation through con call.

6) Leave of absence was granted to the directors whenever they could not be physically present for the Board/Committee meeting.

7) NA indicates not a member of the Committee.

4. Terms of reference of Board Committees

A. Audit Committee:

The terms of reference for the Audit Committee include the matters specified in Section 177 of the Companies Act, 2013 as well as Clause 49 of the Listing Agreement with the Stock Exchanges, such as:

1. Oversight of the Company’s financial reporting process and the disclosure of its financial information to ensure that the financial statement is correct, sufficient and credible.

2. Recommendation for appointment, remuneration and terms of appointment of auditors of the company.

3. Approval of payment to statutory auditors for any other services rendered by the statutory auditors.

4. Reviewing with the management, the Annual Financial Statements and Auditor's Report thereon, before submission to the Board for approval, with particular reference to:

- Matters required to be included in the Director’s Responsibility Statement to be included in the Board’s report in terms of Clause (c) of sub-section 3 of Section 134 of the Companies Act, 2013.

- Changes, if any, in accounting policies and practices and reasons for the same.

- Major accounting entries involving estimates based on the exercise of judgment by management.

- Significant adjustments made in the financial statements arising out of audit findings.

- Compliance with listing and other legal requirements relating to financial statements.

- Disclosure of any related party transactions.

- Qualifications in the draft Audit Report.

5. Reviewing with the management, the quarterly financial statements before submission to the Board for approval.

6. Reviewing with the management, the statement of uses/application of funds raised through an issue (public issue, rights issue, preferential issue, etc.), the statement of funds utilised for purposes other than those stated in the offer document/prospectus/notice and the report submitted by the monitoring agency monitoring the utilisation of proceeds of a public or rights issue, and making appropriate recommendations to the Board to take up steps in this matter.

7. Reviewing and monitoring the auditor’s independence and performance, and effectiveness of audit process.

8. Approval or any subsequent modification of transactions of the Company with related parties.

9. Scrutiny of inter-corporate loans and investments.

10. Valuation of undertakings or assets of the company, wherever it is necessary.

11. Evaluation of internal financial controls and risk management systems.

12. Reviewing with the management, the performance of the Statutory and Internal Auditors, adequacy of the internal control systems.

13. Reviewing the adequacy of Internal Audit function, if any, including the structure of the Internal Audit Department, staffing and seniority of the official heading the department, reporting structure coverage and frequency of internal audit.

14. Discussion with internal auditors of any significant findings and follow up thereon.

15. Reviewing the findings of any internal investigations by the internal auditors into matters where there is suspected fraud or irregularity or a failure of internal control systems of a material nature and reporting the matter to the Board.

16. Discussion with Statutory Auditors before the audit commences, about the nature and scope of audit as well as post-audit discussion to ascertain any area of concern.

17. To look into the reasons for substantial defaults in the payment to the depositors, debenture-holders, shareholders (in case of non-payment of declared dividends) and creditors.

18. To review the functioning of the Whistle Blower mechanism.

19. Approval of appointment of CFO (i.e., the Whole-time Finance Director or any other person heading the finance function or discharging that function) after assessing the qualifications, experience and background, etc. of the candidate.

20. Carrying out any other function as is mentioned in the terms of reference of the Audit Committee.

Explanation (i): The term "related party transactions" shall have the same meaning as provided in Clause 49(VII) of the Listing Agreement.

B. Stakeholders’ Relationship Committee:

The terms of reference of the Stakeholders’ Relationship Committee is redressing grievances of shareholders, debenture-holders and other security holders. The Committee shall consider and resolve the grievances of the security holders of the Company including complaints like transfer of shares, non-receipt of Annual Report and non-receipt of declared dividends as well as those required under Companies Act, 2013.

Details of stakeholder complaints

|

Sr. No.

|

Nature of Complaint/Query

|

Total complaints pending at the beginning of the year

|

Total complaints received during the year

|

Total complaints replied during the year

|

Total complaints pending at the end of the year

|

Complaints not solved to the satisfaction of shareholders

|

|

1.

|

Non- Receipt of Dividend

|

01

|

46

|

47

|

0

|

0

|

|

2.

|

Non Receipt of shares lodged for transfer / exchange

|

01

|

36

|

37

|

0

|

0

|

|

3.

|

Non receipt of Annual Report

|

0

|

21

|

21

|

0

|

0

|

|

4.

|

Others

|

0

|

1

|

1

|

0

|

0

|

|

|

Total

|

02

|

104

|

106

|

0

|

0

|

5. Nomination and Remuneration Committee:

The terms of reference of the Nomination and Remuneration Committee are as below:

- Formulation of criteria for determining qualifications, positive attributes and independence of a Director and recommendation of a policy to the Board, relating to the remuneration of the Directors, key managerial personnel and other employees.

- Formulation of criteria for evaluation of Independent Directors and the Board.

- Devising a policy on Board diversity.

- Identifying people who are qualified to become directors and who may be appointed in senior management in accordance with the criteria laid down, and recommend to the Board their appointment and removal.

6. Remuneration Policy

The Remuneration Policy of the Company has been provided in the Directors’ Report section of the Annual Report as Annexure ‘A’.

Remuneration of Directors:

The details of the remuneration to Directors are as follows:

Crore

|

Name of Director

|

Sitting Fees

|

Commission

|

Salary, Allowances and Benefits

|

Company's contribution to PF

|

PLVR

|

Monetary value of perquisites

|

Total

|

|

Whole-time Directors

|

|

|

|

|

|

|

|

|

Mr. Adi Godrej

|

-

|

-

|

6.30

|

0.16

|

6.08

|

0.64

|

13.18

|

|

Ms. Nisaba Godrej

|

0.00

|

0.00

|

2.62

|

0.12

|

1.74

|

0.01

|

4.49

|

|

Mr. Vivek Gambhir

|

-

|

0.00

|

5.48

|

0.24

|

6.68

|

0.48

|

12.88

|

|

Non Executive Directors

|

|

|

|

|

|

|

|

|

Mr. Jamshyd Godrej

|

0.04

|

0.15

|

|

-

|

-

|

-

|

0.19

|

|

Mr. Nadir Godrej

|

0.06

|

0.15

|

|

-

|

-

|

-

|

0.21

|

|

Ms. Tanya Dubash

|

0.05

|

0.15

|

|

-

|

-

|

-

|

0.20

|

|

Mr. Narendra Ambwani

|

0.04

|

0.15

|

|

-

|

-

|

-

|

0.19

|

|

Mr. Bala Balachandran

|

0.03

|

0.15

|

|

-

|

-

|

-

|

0.18

|

|

Mr. Bharat Doshi

|

0.05

|

0.15

|

|

-

|

-

|

-

|

0.20

|

|

Dr. Omkar Goswami

|

0.04

|

0.15

|

|

-

|

-

|

-

|

0.19

|

|

Mr. A Mahendran

|

0.02

|

0.15

|

|

-

|

-

|

-

|

0.17

|

|

Mr. Aman Mehta

|

0.05

|

0.15

|

|

-

|

-

|

-

|

0.20

|

|

Mr. D Shivakumar

|

0.04

|

0.15

|

|

-

|

-

|

-

|

0.19

|

|

Ms. Ireena Vittal

|

0.05

|

0.15

|

|

-

|

-

|

-

|

0.20

|

|

Total

|

0.48

|

1.65

|

14.40

|

0.52

|

14.50

|

1.13

|

32.68

|

Notes:-

- 1. In the case of Mr. Adi Godrej, salary includes basic salary and various elements of flexible compensation. The monetary value of perquisites includes accommodation, car, electricity expenses, reimbursement of medical/hospitalisation expenses incurred for self and family, medical insurance premium paid by the Company.

- 2. In the case of Ms. Nisaba Godrej and Mr. Vivek Gambhir, salary includes basic salary and various elements of flexible compensation. Additionally, the perquisites received by Mr. Vivek Gambhir include value of stock grants.

- 3. The Performance Linked Variable Remuneration (PLVR) to Mr. Adi Godrej, Ms. Nisaba Godrej and Mr. Vivek Gambhir is the amount payable for FY 2014-15. The same is based on the profitability and optimum utilisation of capital employed over last year.

- 4. The service contract of Mr. Adi Godrej is for a period of three years beginning from April 1, 2013 to March 31, 2016. The contract is terminable with a notice period of three months by either side.

- 5. The service contracts of Ms. Nisaba Godrej, Executive Director, Innovation and Mr. Vivek Gambhir, Managing Director are for a period of three years beginning from July 1, 2013 to June 30, 2016. The contracts are terminable with a notice period of three months by either side.

- 6. All the Independent Directors have been appointed for a period of five years beginning from September 26, 2014 to September 25, 2019. However, Prof. Bala Balachandran has resigned from the Board with effect from close of business hours on March 31, 2015.

- 7. Mr. Vivek Gambhir has been granted stock options the details of which are as follows:

|

Grant year

|

No. of options

|

Options exercised

|

Options outstanding

|

|

2013-14

|

17,778

|

5,926

|

11,852

|

|

2014-15

|

23,118

|

Nil

|

23,118

|

7. General Body Meetings

Details of the last three Annual General Meetings of GCPL are as follows:

|

Date

|

Time

|

Venue

|

Details of Special Resolutions passed

|

|

August 4, 2012

|

3.30 p.m.

|

Y. B. Chavan Centre, General Jagannath Bhosale Marg, Nariman Point, Mumbai – 400021.

|

None

|

|

August 3, 2013

|

3.30 p.m.

|

Y. B. Chavan Centre, General Jagannath Bhosale Marg, Nariman Point, Mumbai – 400021.

|

Reappointment of Mr. Adi Godrej as whole-time Director designated as Chairman for a period of three years from April 1, 2013 to March 31, 2016

|

|

July 28, 2014

|

3.30 pm

|

Y. B. Chavan Centre, General Jagannath Bhosale Marg, Nariman Point, Mumbai – 400021.

|

Payment of commission on profits to Non-Executive Directors at a rate not exceeding 1% of the net profits of the Company in any financial year (computed in the manner provided in Section 197 and 198 of the Companies Act, 2013) or ₹ 15 lacs per director per annum, whichever is lower

|

8. Postal Ballot

During FY 2014-2015, pursuant to the provisions of Section 110 of the Companies Act, 2013 read with Rule 22 of the Companies (Management and Administration) Rules, 2014 and any other applicable provisions of Companies Act, 2013, two special resolutions were passed by the members through postal ballot for adoption of new articles of Association of the Company incorporating the provisions of Companies Act, 2013 and making Private Placement of NCD’s up to an amount of ₹ 300 crore.

The notice of the postal ballot dated August 20, 2014 was sent to all shareholders of the Company along with postage prepaid envelopes. Mr. Kalidas Vanjpe, Practicing Company Secretary, was appointed as the Scrutiniser for the Postal Ballot, and submitted his report to Mr. Adi Godrej, Chairman. The results of the Postal Ballot were announced on September 23, 2014 and the details are as follows:

|

Detail of Agenda

|

Adoption of new Articals of Association of the Company inter alia incorporating the provisions of Companies Acts, 2013

|

|

Resolution Required

|

Special

|

|

Mode of voting

|

E-voting / Physical Postal Ballot

|

|

Promoter/Public

|

No. of Shares held

(1)

|

No. of Votes poiled

(2)

|

% of Votes Polled on outstanding shares

(3)=[(2)/(1)]*100

|

No. of Votes - in favour

(4)

|

No. of Votes - in against

(5)

|

% of Votes in favour on votes polled

(6)=[(4)/(2)]*100

|

% of Votes against on votes polled

(7)=[(5)/(2)]*100

|

|

Promoter and Promoter Group

|

215,496,082

|

215,496,082

|

100.00%

|

215,496,082

|

-

|

100.00%

|

0.00%

|

|

Public - Institution holders

|

106,435,758

|

66,361,111

|

62.35%

|

66,161,454

|

199,657

|

99.70%

|

0.30%

|

|

Public - Other

|

18,511,127

|

165,000

|

0.89%

|

162,695

|

2,305

|

98.60%

|

1.40%

|

|

Total

|

340,442,967

|

282,022,193

|

82.84%

|

281,820,231

|

201,962

|

99.93%

|

0.07%

|

|

Detail of Agenda

|

Private placement of Non-convertible Debentures upto an amount of Rs. 300 crore

|

|

Resolution Required

|

Special

|

|

Mode of voting

|

E-voting / Physical Postal Ballot

|

|

Promoter/Public

|

No. of Shares held

(1)

|

No. of Votes poiled

(2)

|

% of Votes Polled on outstanding shares

(3)=[(2)/(1)]*100

|

No. of Votes - in favour

(4)

|

No. of Votes - in against

(5)

|

% of Votes in favour on votes polled

(6)=[(4)/(2)]*100

|

% of Votes against on votes polled

(7)=[(5)/(2)]*100

|

|

Promoter and Promoter Group

|

215,496,082

|

215,496,082

|

100.00%

|

215,496,082

|

-

|

100.00%

|

0.00%

|

|

Public - Institution holders

|

106,435,758

|

66,685,282

|

62.65%

|

66,684,742

|

540

|

100.00%

|

0.00%

|

|

Public - Other

|

18,511,127

|

165,000

|

0.89%

|

157,932

|

7,068

|

95.72%

|

4.28%

|

|

Total

|

340,442,967

|

282,346,364

|

82.93%

|

282,338,756

|

7,608

|

100.00%

|

0.00%

|

9. Disclosures

a) Materially significant related party transaction that may potentially conflict with the Company’s interest

During FY 2014-15, there were no materially significant related party transactions, i.e. the Company’s material transactions with its subsidiaries, promoters, Directors, management, relatives, etc. which may have potential conflict with the interests of Company at large. Attention of members is drawn to disclosures of transactions with related parties, as set out in Notes to Accounts.

b) Details of non-compliance

There has not been any non-compliance of mandatory requirements, expected of the Company. No penalties or strictures were imposed on the Company by the Stock Exchanges, SEBI or any statutory authority for matters related to capital markets during the last three years.

c) Whistle Blower policy

With a view to establish a mechanism for protecting employees reporting unethical behaviour, frauds or violation of Company’s Code of Conduct, the Board of Directors have adopted a Whistle Blower policy. No person has been denied access to the Audit Committee.

d) Details of Shares held by the Directors and Dividend paid to them

|

Name of Director

|

Shares held as on March 31, 2015

|

Dividend paid during the year (INR)

|

|

Mr. Adi Godrej

|

500

|

2,625

|

|

Mr. Jamshyd Godrej*

|

1,606,808

|

4,820,424

|

|

Mr. Nadir Godrej**

|

1,551,178

|

8,143,685

|

|

Ms. Tanya Dubash

|

1,071,054

|

5,623,033

|

|

Ms. Nisaba Godrej

|

1,071,061

|

5,623,070

|

|

Mr. Narendra Ambwani

|

1,000

|

5,250

|

|

Mr. Bala Balachandran

|

Nil

|

Nil

|

|

Mr. Bharat Doshi

|

13,714

|

71,999

|

|

Mr. Vivek Gambhir

|

5,926

|

17,778

|

|

Dr. Omkar Goswami

|

Nil

|

Nil

|

|

Mr. A. Mahendran

|

Nil

|

13,98,130

|

|

Mr. Aman Mehta

|

Nil

|

Nil

|

|

Mr. D. Shivakumar

|

Nil

|

Nil

|

|

Ms. Ireena Vittal

|

Nil

|

Nil

|

Note : - *Held with others as Trustee of Raika Godrej Family Trust.

- **Includes 633,724 shares held on behalf of his son.

Under the Employee Stock Grant Scheme of the Company, Mr. Vivek Gambhir holds 34,970 options convertible into equivalent equity shares on their vesting and exercise. The options will vest in tranches and the same has to be exercised within one month of the respective vesting dates.

e) Policy to prevent sexual harassment at the workplace

The Company is committed to creating and maintaining an atmosphere in which employees can work together, without fear of sexual harassment, exploitation or intimidation. Every employee is made aware that the Company is strongly opposed to sexual harassment and that such behaviour is prohibited both, by law and by the Godrej Group. To redress complaints of sexual harassment, a Complaint Committee for the Group has been formed, which is headed by Ms. Tanya Dubash, Director.

f) Details of compliance with mandatory requirements

|

Particulars

|

Clause no.

|

Compliance Status

(Yes / No / NA)

|

|

I. Board of Directors

|

49 II

|

|

|

(A) Composition of Board

|

49 II A

|

Yes

|

|

(B) Independent Directors

|

49 II B

|

Yes

|

|

(C) Non-Executive Director's

compensation &

disclosures

|

49 II C

|

Yes

|

|

(D) Other provisions as to

Board and Committees

|

49 II D

|

Yes

|

|

(E) Code of Conduct

|

49 II E

|

Yes

|

|

(F) Whistle Blower Policy

|

49 II F

|

Yes

|

|

II. Audit Committee

|

49 III

|

|

|

(A) Qualified & Independent

Audit Committee

|

49 (III A)

|

Yes

|

|

(B) Meeting of Audit

Committee

|

49 (III B)

|

Yes

|

|

(C) Powers of Audit

Committee

|

49 (III C)

|

Yes

|

|

(D) Role of Audit Committee

|

49 (III D)

|

Yes

|

|

(E) Review of Information by

Audit Committee

|

49 (III E)

|

Yes

|

|

III. Nomination and Remuneration Committee

|

49 (IV)

|

Yes

|

|

IV. Subsidiary Companies

|

49 (V)

|

Yes

|

|

V. Risk Management

|

49 (VI)

|

Yes

|

|

VI. Related Party Transactions

|

49 (VII)

|

Yes

|

|

VII. Disclosures

|

49 (VIII)

|

|

|

(A) Related party transactions

|

49 (VIII A)

|

Yes

|

|

(B) Disclosure of Accounting

treatment*

|

49 (VIII B)

|

Yes

|

|

(C) Remuneration of Directors

|

49 (VIII C)

|

Yes

|

|

(D) Management

|

49 (VIII D)

|

Yes

|

|

(E) Shareholders

|

49 (VIII E)

|

Yes

|

|

(F) Proceeds from

public issues, rights

issues, preferential

issues etc.

|

49 (VIII I)

|

NA

|

|

VIII. CEO/CFO Certification

|

49 (IX)

|

Yes

|

|

IX.Report on Corporate

Governance

|

49 (X)

|

Yes

|

|

X. Compliance

|

49 (XI)

|

Yes

|

*Refer to Note 12 in the Financial Statements for the year ended March 31, 2015 for Management explanation on Accounting Treatment.

10. Means of Communication

GCPL has sent the Chairman’s statement and unaudited financial results for the half-year ended September 30, 2014 to all shareholders. Moreover, GCPL has its own website, www.godrejcp.com. All vital information relating to the Company and its performance, including quarterly results, press releases and performance updates / corporate presentations are posted on the website. The quarterly, half-yearly and annual results of the Company’s performance are generally published in leading English dailies such as The Economic Times, Business Line, Mint and also in the Marathi newspaper Maharashtra Times. The Chairman holds conference calls/ meetings with financial analysts once in a quarter, and their transcripts are posted on the website soon after.

The Company files its quarterly results on the NSE Electronic Application Processing System (NEAPS). The quarterly results of the Company are also available on the website of BSE Limited and National Stock Exchange of India Limited, viz. www.bseindia.com and www.nseindia.com, respectively.

11. Management

a) Management Discussion and Analysis:

The Management Discussion & Analysis forms a part of the Directors’ Report and has been covered in the Directors’ Report and Management Discussion & Analysis section of the Annual Report.

b) Disclosures by Management to the Board:

All details relating to financial and commercial transactions, where Directors may have a potential interest, are provided to the Board and the interested Directors neither participate in the discussion, nor do they vote on such matters.

12. Declaration by Managing Director on compliance with Code of Conduct

The declaration by the Managing Director pursuant to Clause 49(II)(E) of the Listing Agreement, stating that all the Board Members and senior management personnel have affirmed their compliance with the said Code of Conduct for the year ended March 31, 2015, is annexed to the Corporate Governance Report.

13. Auditor's Certificate on Corporate Governance

As stipulated in Clause 49 of the Listing Agreement, the auditor’s certificate regarding compliance of conditions of corporate governance is annexed to the Directors’ Report.

14. General Shareholder Information

a) Annual General Meeting:

Date and time : Wednesday, July 29, 2015

at 3.30 p.m.

Venue : Y. B. Chavan Centre,

General Jagannath Bhosale Marg,

Nariman Point,

Mumbai – 400 021

b) Financial Calendar:

|

Financial year

|

April 1 to March 31

|

|

Board Meeting for consideration of unaudited quarterly results

|

Within 45 days from the end of the quarter as stipulated under the Listing Agreement with the Stock Exchanges.

|

|

Board meeting for consideration of Audited results

|

Within two months from the end of the last quarter as stipulated under the Listing Agreement with the Stock Exchanges

|

c) Book Closure:

There was an annual book closure on December 24, 2014 pursuant to Clause 16 of the Listing Agreement. There will be no book closure at the time of the Annual General Meeting.

d) Dividends for Financial Year 2014-15:

|

Dividend Type

|

Declared at

Board Meeting Dated

|

Dividend rate per share on shares of face value INR 1 each

|

Record Date

|

|

1st Interim for FY 2014-15

|

July 28, 2014

|

₹ 1.00

|

August 4, 2014

|

|

2nd Interim for FY 2014-15

|

November 1, 2014

|

₹ 1.00

|

November 12,2014

|

|

3rd Interim for FY 2014-15

|

February 5, 2015

|

₹ 1.00

|

February 13, 2015

|

|

4th Interim for FY 2014-15

|

April 28, 2015

|

₹ 2.50

|

May 6, 2015

|

|

TOTAL

|

|

₹ 5.50

|

|

e) Listing:

The Company’s shares are listed and traded on the following Stock Exchanges:

|

Name & Address of the stock exchange

|

Stock/Scrip Code

|

ISIN number for NSDL/CDSL

|

|

BSE Limited

Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai 400001

|

532424

|

INE102D01028.

|

|

The National Stock

Exchange of India Limited, Exchange Plaza,

Bandra-Kurla Complex, Bandra (East), Mumbai 400051

|

GODREJCP

|

The privately placed Non-Convertible Debentures are listed on the Wholesale Debt Market Segment of the National Stock Exchange of India Limited.

|

ISIN for Privately Placed Debentures NSDL & CDSL (₹ 250 crore issued in October 2014)

|

INE102D08114

|

f) Market Price Data:

The monthly high and low prices of GCPL at BSE Limited and the NSE Limited for the year ended March 31, 2015, are as under:

|

Month

|

|

Price in BSE

|

|

Price in NSE

|

|

|

|

High

(`)

|

Low

(`)

|

High

(`)

|

Low

(`)

|

|

Apr-14

|

958.45

|

770.50

|

915.00

|

775.20

|

|

May-14

|

848.90

|

742.05

|

848.95

|

740.00

|

|

Jun-14

|

969.70

|

782.25

|

903.70

|

781.05

|

|

Jul-14

|

872.65

|

790.00

|

880.00

|

791.55

|

|

Aug-14

|

1000.00

|

830.00

|

1003.00

|

830.005

|

|

Sep-14

|

1117.60

|

969.00

|

1119.00

|

967.40

|

|

Oct-14

|

1043.80

|

870.00

|

1044.80

|

862.05

|

|

Nov-14

|

995.00

|

923.00

|

997.00

|

921.15

|

|

Dec-14

|

1028.45

|

830.00

|

1029.25

|

835.15

|

|

Jan-15

|

1134.40

|

944.10

|

1141.20

|

949.25

|

|

Feb-15

|

1195.00

|

1022.50

|

1203.90

|

1022.25

|

|

Mar-15

|

1225.00

|

1025.10

|

1227.20

|

1025.05

|

Source: Websites of the respective stock exchanges

Note: High and low are in rupees per traded share

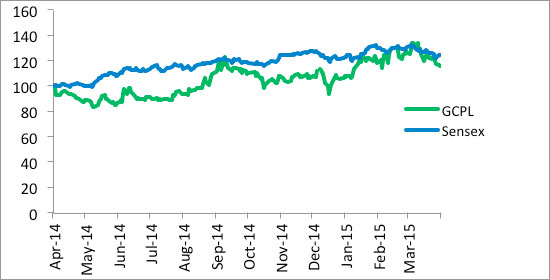

g) GCPL’s share price at the BSE versus the Sensex

GCPL’s share performance compared to the BSE Sensex for FY 2014-15 is as follows:

Note:

Both BSE Sensex and GCPL share price are indexed to 100 at the beginning of the financial year

h) Registrar and Share Transfer Agents:

Computech Sharecap Limited.

147, M.G. Road,

Opp. Jehangir Art Gallery,

Mumbai - 400001.

Tel. No.: +91 22 22635000/01

Fax No. : +91 22 22635005

Email ID: gcpl@computechsharecap.com

Website: www.computechsharecap.com

i) Share Transfer:

GCPL’s share transfers and other related operations are conducted by Computech Sharecap Limited, registered with SEBI as a Category 1 Registrar. Share transfer is normally effected within a maximum of 30 days from the date of receipt, if all the required documentation is submitted.

j) Distribution of Shareholding:

Distribution of shareholding by size class as on March 31, 2015:

|

Number of Shares

|

Number of Shareholders

|

Shareholders %

|

Number of shares held

|

Shareholding %

|

|

1 - 500

|

72,787

|

90.58%

|

8,472,797

|

2.49%

|

|

501 - 1000

|

5,014

|

6.24%

|

3,379,384

|

0.99%

|

|

1001 - 2000

|

1,455

|

1.81%

|

2,047,074

|

0.60%

|

|

2001 - 3000

|

339

|

0.42%

|

839,972

|

0.25%

|

|

3001 - 4000

|

134

|

0.17%

|

480,210

|

0.14%

|

|

4001 - 5000

|

101

|

0.13%

|

464,476

|

0.14%

|

|

5001 - 10000

|

178

|

0.22%

|

1,261,615

|

0.37%

|

|

10001 & above

|

352

|

0.44%

|

323,501,373

|

95.02%

|

|

Total

|

80,360

|

100.00%

|

340,446,901

|

100.00%

|

Distribution of shareholding by ownership as on March 31, 2015:

|

Category

|

Shares held (Nos.)

|

% of holding

|

|

Promoter's Holding

|

|

|

|

Promoters

|

215,496,082

|

63.30%

|

|

Institutional Investors

|

|

|

|

Mutual Funds

|

1,119,963

|

0.33%

|

|

Banks

|

20,489

|

0.01%

|

|

Financial Institutions

|

1,096,184

|

0.32%

|

|

Insurance Companies

|

4,323,787

|

1.27%

|

|

Foreign Institutional Investors

|

97,929,578

|

28.77%

|

|

Others

|

|

|

|

Private Corporate Bodies

|

2,564,247

|

0.75%

|

|

Indian Public

|

16,581,474

|

4.86%

|

|

NRI/OCB's

|

1,315,097

|

0.39%

|

|

Total

|

340,446,901

|

100.00%

|

k) Shares held in physical and dematerialised Form

Breakup of physical and dematerialised shares as on March 31, 2015:

|

|

Number of Shareholdershares

|

%

|

Number of Folios

|

%

|

|

Physical

|

5,775,327

|

1.70%

|

33,832

|

42.10%

|

|

Demat

|

334,671,574

|

98.30%

|

46,528

|

57.90%

|

|

Total

|

340,446,901

|

100.00%

|

80,360

|

100.00%

|

l) Outstanding GDRs/ADRs/warrants /convertible instruments and their impact on equity

GCPL does not have any outstanding GDRs/ADRs/warrants/convertible instruments.

m) Plant locations

The Company’s plants are located in the following states:

|

Name of the State

|

Location of Plant

|

|

Jammu & Kashmir

|

Kathua

|

|

Himachal Pradesh

|

Thana - Baddi, Katha - Baddi

|

|

Sikkim

|

Namchi

|

|

Assam

|

Village Sila - Guwahati, Kalapahar, Lokhra, Guwahati

|

|

Meghalaya

|

Burnihat, Rebhoi District

|

|

Madhya Pradesh

|

Malanpur, District Bhind

|

|

Goa

|

Bardez, Corlim

|

|

Pondicherry

|

Kattukuppam - Manpet Post, Mannadipet Commune

|

|

Tamil Nadu

|

Nedungadu Commune - Karaikal, Thirunallar Commune - Karaikal, Maraimalainagar

|

n) Address for Correspondence:

Members can contact us at our Registered Office:

Godrej Consumer Products Limited,

Pirojshanagar, Eastern Express Highway,

Vikhroli (East), Mumbai 400 079.

Tel. No. : +91 22 25188010/20/30

Fax No. : +91 22 25188040

Email ID: investor.relations@godrejcp.com

Website: www.godrejcp.com

CIN : L24246MH2000PLC129806

Investor correspondence should be addressed to M/s. Computech Sharecap Limited, whose address is provided in this section of the Annual Report.

To allow us to service shareholders with greater speed and efficiency, the Company strongly recommends email-based correspondence on all issues, which do not require signature verification for being processed.

o) National Electronic Clearing Services (NECS) for Payment of Dividend:

The NECS facility administered by RBI ensures faster credit of dividends as dividends are directly credited in electronic form to the bank accounts of the shareholder. Moreover, by availing this facility, shareholders avoid the risk of loss of dividend warrants in transit or fraudulent encashment.

Shareholders holding shares in physical form and who have not opted for NECS may post an NECS declaration form to Computech Sharecap Limited. Shareholders can obtain the NECS declaration form either from GCPL’s registered office, Computech Sharecap Limited or download it from the Investors page on the GCPL corporate website www.godrejcp.com.

Shareholders holding shares in demat form are requested to provide details to NSDL/CDSL through their respective depository participants. It may be noted that if the shareholders holding shares in demat form provide the NECS data directly to the Company, the Company will not be able to act on the same and consequently dividends cannot be remitted through NECS.

p) Consolidation of Shares Under One Folio:

The Company would urge shareholders holding shares of GCPL under different folios to consolidate the shares under one folio. This would substantially reduce paperwork and transaction costs, and benefit both, shareholders and the Company. Shareholders can do so by writing to the registrar with details on folio numbers, order of names, shares held under each folio and the folio under which all shareholding should be consolidated. Share certificates need not be sent.

Declaration by the Managing Director

I, Vivek Gambhir, Managing Director of Godrej Consumer Products Limited (GCPL) hereby confirm pursuant to Clause 49(II)(E) of the Listing Agreement that:

The Board of Directors of GCPL has laid down a Code of Conduct for all the Board members and senior management of the Company. The said Code of Conduct has also been posted on the Investors page of the Company website,www.godrejcp.com

All the Board Members and senior management personnel have affirmed their compliance with the said Code of Conduct for the year ended March 31, 2015.

Vivek Gambhir

Managing Director

Mumbai, April 28, 2015