1. REVIEW OF OPERATIONS

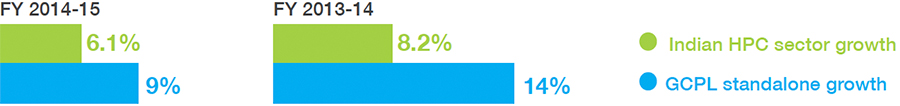

Your Company has continued to grow ahead of the overall FMCG sector, as well as home and personal care categories that it participates in, despite a challenging macro environment.

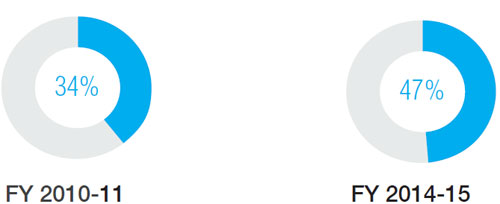

Godrej Consumer Products Limited’s (“GCPL”) expanding footprint is driven by a focused 3x3 strategy – a presence in three business categories (personal care, hair care and home care) in three geographies (Asia, Africa and Latin America) – to become an emerging markets FMCG leader. Despite challenges across geographies, its businesses have performed well, with the company's salience of international revenues at 47%.

GCPL’s focus has been to accelerate innovation and back new products with strong marketing investments. In the past year, GCPL made several new launches in its domestic and international businesses, expected to further enhance the company's competitiveness, improve the equity of its brands and drive increased penetration and consumption. Over 40% of GCPL’s growth now comes from new products and renovations. It was also the highest ranked Indian company (at number 24) on Forbes’ list of the ‘World’s 100 Most Innovative Growth Companies 2015’, for the second year in a row.

Today, your Company is one of the largest household and personal care companies in India; the leader in hair colour, household insecticides and liquid detergents, the number two player in toilet soaps and a fast-growing new entrant in air care. Significant marketing investments have driven higher consumption and penetration across the board. GCPL’s superior global supply chain and future-ready sales organisation leverage the latest technology for sharper execution and better decision making, thus strengthening market positions.

Your Company was ranked the number 1 FMCG Company to work for in the ‘Great Place to Work – Best Workplaces in India 2014’ list; its eleventh consecutive year on the list. It was also ranked number 14 on the ‘Great Place to Work – Best Workplaces in Asia 2014’ list and ranked among the ‘Aon Hewitt Best Employers in India – 2015’ survey.

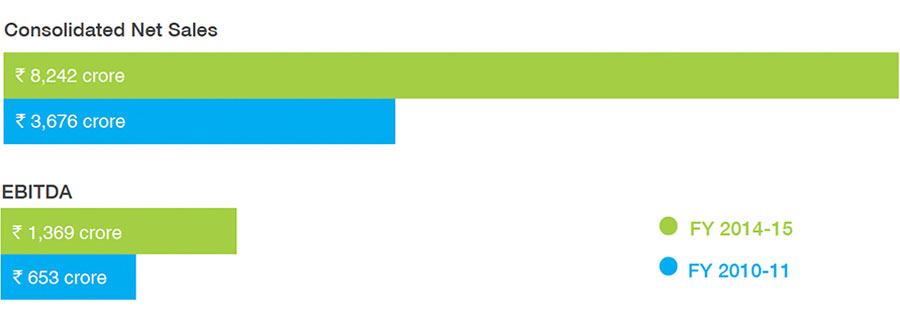

Your Company’s financial performance for the year under review is summarised below:

Figures in Rs. Crore

Financials |

Consolidated |

Standalone |

Abridged Profit and Loss Statement |

FY 2014-15 |

FY 2013-14 |

FY 2014-15 |

FY 2013-14 |

Net Sales |

8242.20 |

7582.57 |

4369.25 |

4024.74 |

Other Operating Income |

34.16 |

19.84 |

60.55 |

55.10 |

Total Income from Operations |

8276.36 |

7602.41 |

4429.80 |

4079.84 |

Total Expenses other than Depreciation & Finance Cost |

6907.80 |

6418.88 |

3590.13 |

3326.87 |

Profit from Operations be fore Other Income, Finance Cost, Exceptional Items & Depreciation |

1368.56 |

1183.53 |

839.67 |

752.97 |

Depreciation |

90.78 |

81.85 |

41.67 |

35.52 |

Profit from Operations be fore Other Income, Finance Cost & Exceptional Items |

1277.78 |

1101.68 |

798.00 |

717.45 |

Foreign Exchange Gain / (Loss) |

(3.25) |

(26.78) |

2.27 |

(5.94) |

Other Income |

91.51 |

62.71 |

55.24 |

40.00 |

Profit before Finance Costs & Exceptional Items |

1366.04 |

1137.61 |

855.51 |

751.51 |

Finance Cost |

100.15 |

107.37 |

36.92 |

38.52 |

Profit after Finance Costs but before Exceptional Items |

1265.89 |

1030.24 |

818.59 |

712.99 |

Exceptional Items |

(17.17) |

(0.57) |

8.60 |

0.00 |

Profit Before Tax |

1248.72 |

1029.67 |

827.19 |

712.99 |

Tax Expense |

272.29 |

210.37 |

172.74 |

148.15 |

Net Profit after Tax before Minority Interest |

976.43 |

819.30 |

654.45 |

564.84 |

Share of Profit in Associate Company |

0.04 |

(0.05) |

- |

- |

Minority Interest |

(69.35) |

(59.52) |

- |

- |

Net Profit for the period |

907.12 |

759.73 |

654.45 |

564.84 |

2. APPROPRIATION

Your Directors recommend appropriation as under: Rs. Crore

|

GCPL Standalone

|

FY 2014-15

|

FY 2013-14

|

Surplus as at the end of previous year |

1270.33 |

1010.09 |

Add: Net Profit for the year |

654.45 |

564.84 |

Available for appropriation |

1924.78 |

1574.93 |

Add: Transfer to Debenture Redemption Reserve |

20.39 |

(23.53) |

Less: Interim Dividend |

187.24 |

178.70 |

Less: Tax on distributed profits |

36.73 |

30.37 |

Less: Transfer to General Reserve |

- |

56.50 |

Less: Adjustment on amalgamation of Godrej Hygiene Products Limited |

- |

15.50 |

Less: Depreciation Adjustment pursuant to implementation of Schedule II of the Companies Act, 2013 |

0.83 |

- |

Total Appropriation |

204.41 |

304.60 |

Surplus Carried Forward |

1720.37 |

1270.33 |

3. DIVIDEND

For the year 2014-15, four interim dividends were paid on shares of face value Rs. 1/- each, the details of which are mentioned below:

|

Dividend Type

|

Declared at

Board Meeting Dated

|

Dividend rate per

share on shares of face

value Rs. 1 each

|

Record Date

|

1st Interim for FY 2014-15 |

July 28, 2014 |

Rs. 1.00 |

August 4, 2014 |

2nd Interim for FY 2014-15 |

November 1, 2014 |

Rs. 1.00 |

November 12, 2014 |

3rd Interim for FY 2014-15 |

February 5, 2015 |

Rs. 1.00 |

February 13, 2015 |

4th Interim for FY 2014-15 |

April 28, 2015 |

Rs. 2.50 |

May 6, 2015 |

TOTAL |

|

Rs. 5.50 |

|

Your Directors recommend that the aforesaid interim dividends aggregating to ` 5.50/- per equity share be declared as final dividend for the year ended on March 31, 2015.

4. BOARD OF DIRECTORS

Six Board meetings were held during the year. Details of the meetings and the attendance record of the directors are in the Corporate Governance section of the Annual Report.

At the last Annual General Meeting (“AGM”) held on July 28, 2014, Mr. Narendra Ambwani who was earlier appointed as an Independent Director under the provisions of the Listing Agreement retired by rotation and was appointed as an Independent Director for a period of five years till July 27, 2019, in compliance with Clause 49 of the Listing Agreement and the Companies Act, 2013.

The shareholders through a resolution passed by Postal Ballot on September 23, 2014 appointed Prof. Bala Balachandran, Mr. Bharat Doshi, Dr. Omkar Goswami, Mr. Aman Mehta, Mr. D Shivakumar and Ms. Ireena Vittal as Independent Directors for a period of five years from September 26, 2014 till September 25, 2019 in compliance with Clause 49 of the Listing Agreement and the Companies Act, 2013.

Prof. Bala Balachandran and Mr. A Mahendran resigned from the Board with effect from close of business hours on March 31, 2015. The Board of Directors placed on record its appreciation of their individual contributions during their tenure.

All the Independent Directors have given their declaration of independence as required under Section 149(6) of the Companies Act, 2013 and this has been recorded by the Board of Directors.

A familiarisation programme for the Independent Directors was conducted to familiarise them with the company, their roles, rights, responsibilities in the company, nature of the industry in which the company operates, business model of the company, etc.

The same may also be accessed through the following link: http://www.godrejcp.com/Resources/pdf/Familiarisation-Programme-for-Independent-Directors.pdf

In the forthcoming Annual General Meeting, Mr. Nadir Godrej will retire by rotation and being eligible is considered for re-appointment.

Your Company has an Audit Committee in compliance with the Listing Agreement and the provisions of the Companies Act, 2013. The Committee consists entirely of the Independent Directors. The composition of the Committee is given in the Corporate Governance section of the Annual Report.

5. CHANGES IN KEY MANAGERIAL PERSONNEL

Mr. P Ganesh, Executive Vice President (Finance & Commercial) & Company Secretary resigned with effect from close of business hours on March 31, 2015. As a part of talent rotation within the Group, Mr. P Ganesh has moved to another Group Company from April 1, 2015. Mr. V Srinivasan has been appointed as the Chief Financial Officer and Company Secretary of the Company with effect from April 1, 2015.

6. REMUNERATION POLICY

The Company’s Remuneration Policy for Directors, Key Managerial Personnel and other employees is annexed as Annexure ‘A’ to the Directors’ Report. The Company’s total rewards framework aims at holistically utilising elements such as fixed and variable compensation, long-term incentives, benefits and perquisites and non-compensation elements (career development, work-life balance and recognition).

The non-executive directors receive sitting fees and commission in accordance with the provisions of the Companies Act, 2013.

The Company also has a Board Diversity Policy in place and is annexed as Annexure ‘B’. The criteria for determining qualification, positive attributes and independence of directors is as per the Board Diversity Policy, Listing Agreement and Companies Act, 2013.

7. REMUNERATION TO DIRECTORS

The disclosure on the details of remuneration to directors and other employees pursuant to Section 197 read with Rule 5(1) of the Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014 is annexed as Annexure ‘C’. Details of employee remuneration as required under

provisions of Section 197 of the Companies Act, 2013 and Rule 5(2) & 5(3) of Companies (Appointment and Remuneration of Managerial Personnel) Rules,

2014 are available at the Registered Office of the Company during working hours before 21 days of the Annual General Meeting and shall be made available

to any shareholder on request. Such details are also available on your Company’s website in the Annual Report section of the Investor’s page.

Mr. Adi Godrej, Chairman; Ms. Nisaba Godrej, Executive Director, Innovation and Mr. Vivek Gambhir, Managing Director receive remuneration from your Company. Mr. Adi

| 19 Godrej receives commission from your Company’s holding company viz. Godrej & Boyce Manufacturing Company Limited.

8. PERFORMANCE EVALUATION OF THE BOARD OF DIRECTORS, ITS INDIVIDUAL MEMBERS AND ITS COMMITTEES

We recently conducted a formal Board Effectiveness Review as part of our efforts to evaluate, identify improvements and thus enhance the effectiveness of the Board, its

Committees, and Individual Directors. This was in line with the requirements mentioned in the Companies Act, 2013 and the listing agreement.

The Corporate HR team of Godrej Industries Limited and Associate Companies (GILAC) worked directly with the Chairman and the Nomination and Remuneration

Committee of the Board, to design and execute this process which was adopted by the Board. Each Board Member completed a confidential online questionnaire, providing vital

feedback on how the Board currently operates and how it could improve its effectiveness.

The survey comprised four sections and compiled feedback and suggestions on:

- Board Processes (including Board composition, strategic orientation and team dynamics)

- Individual Committees

- Individual Board Members

- Chairman

The following reports were created, as part of the evaluation:

- Board Feedback Report

- Individual Board Member Feedback Report

- Chairman's Feedback Report

The overall Board Feedback Report was facilitated by Mr. Bharat Doshi with the Independent Directors. The Directors were vocal about the Board functioning effectively, but also

identified areas that show scope for improvement. The Individual Committees and Board Members’ feedback was shared with the Chairman. Following his evaluation, a Chairman's Feedback Report was also compiled.

9. FINANCE

A. Non-Convertible Debentures

The Unsecured Redeemable Zero Coupon Non-Convertible Debentures issued in October 2012 on private placement basis, aggregating to Rs. 250 crore for a tenor of two years,

having a credit rating of [ICRA] AA (Stable), have been redeemed during the year as per the terms of the issue.

Your Company issued 2,500 Unsecured Redeemable Zero Coupon Non-Convertible Debentures on October 16, 2014 on private placement basis, aggregating to Rs. 250 crore

for a tenor of 1 year and 63 days (428 days). The said Debentures have been given a credit rating of “ICRA AA+ (Stable)” by ICRA.

B. Particulars of Loans, Guarantees and Investment

Following are the particulars of Loans, Guarantees and Investments made by the Company during the year:-

|

Sr. No.

|

Company name

|

Amount USD (Mio)

|

Amount Rs. (Crore)

|

INVESTMENTS: |

1 |

Godrej Consumer Products Mauritius Limited |

7.85 |

47.68 |

2 |

Godrej Global Middle East FZE * |

(1.25) |

(5.74) |

3 |

Godrej Consumer Products Holding (Mauritius) Limited |

1.50 |

8.98 |

4 |

Godrej Household Products (Bangladesh) Pvt. Limited |

1.50 |

8.95 |

5 |

Godrej Consumer Products Mauritius Limited ** |

(0.50) |

(2.28) |

6 |

Godrej Mauritius Africa Holdings Limited |

1.00 |

6.22 |

7 |

Godrej East Africa Holdings Limited |

3.60 |

22.12 |

|

Total |

13.70 |

85.94 |

Note: * Investments transferred to another wholly owned subsidiary.

** Investment in preference capital.

All investments except the investment mentioned in Sr. No 5 above are in equity capital.

No Loans or Corporate Guarantees were given during the year.

10. RELATED PARTY TRANSACTIONS

In compliance with Clause 49 of the Listing Agreement, the

Board has adopted a policy for transactions with Related

Parties (“RPT Policy”). The RPT policy is available on the

Company website, viz. www.godrejcp.com, on the Investors

page, under the section titled “Compliance”.

This may also be accessed through the following link: http://www.godrejcp.com/Resources/pdf/Related-Party-Transactions-Policy.pdf

Apart from the Related Party Transactions in the ordinary course of business and at arm’s length basis, details of which are given in

the notes to the financial statements, there were no other Related Party Transactions requiring disclosure in the Directors’ Report, for

compliance with Section 134(3)(h) of the Companies Act, 2013. Therefore, a Nil Report is annexed as Annexure ‘D’ in the format prescribed i.e. Form AOC-2.

11. ACQUISITIONS & MERGERS

Pursuant to a scheme of amalgamation sanctioned by the Supreme Court of Mauritius, Godrej Kinky Holdings Limited (GKHL) has merged with Godrej Consumer Investment Holding Limited with effect from April 1, 2014.

Your Company entered into the following agreements during the year for various acquisitions:

- With the Darling Group on October 1, 2014 to acquire 100% stake in its hair extensions business in Ghana through its wholly-owned subsidiary, Weave Business Holdings Mauritius Private Limited.

- With Frika Pty Limited, South Africa on January 6, 2015, for the acquisition of 100% equity stake in its hair extensions business in South Africa.

- With the Darling Group on February 24, 2015, for increasing the Company’s shareholding in Darling Group’s South Africa and Mozambique businesses to 90% in line with the intent of gradually scaling up its ownership of the Darling business.

12. SUBSIDIARIES & ASSOCIATES

During the year, the following companies became subsidiaries of your Company:

DGH Phase 3 Mauritius

Weave Ghana Limited

Godrej Easy IP Holding Limited

Darling Trading Company Limited

Godrej Africa Holdings Limited

Godrej Indonesia IP Holdings Limited

Godrej Megasari Holdings Limited

Frika Weave Pty Limited

On account of mergers with other subsidiaries, the following companies ceased to be subsidiaries during the year:

DGH Phase 3 Mauritius

Godrej Weave Holdings Limited

DGH Mauritius Private Limited

Weave Business Holding Mauritius Private Limited

Godrej Consumer Investment Holding Limited

Godrej Kinky Holdings Limited

Inecto Manufacturing Limited, U.K and Issue Group

Uruguay S.A were dissolved during the year.

The details of business of the key subsidiaries are given in the Management Discussion & Analysis section of the Directors’ Report. The performance and financial position of each subsidiary and associate company is given in form AOC 1 which forms part of Consolidated Financial Statements.

The Consolidated Financial Statements of the Company and its subsidiaries, prepared in accordance with Accounting Standard 21 issued by the Institute of Chartered Accountants of India, also forms part of the Annual Report and Accounts of your Company.

Pursuant to the provisions of Section 136 of the Companies Act, 2013, the Company has placed the financial

statements of its subsidiaries on the Company’s

website www.godrejcp.com.

In compliance with the Listing Agreement, the Board has adopted a policy for determining material subsidiaries. This policy is available on the Company’s

website www.godrejcp.com, in the Investors page, under the section titled “Compliance”.

This may also be accessed at the following link:http://www.godrejcp.com/Resources/pdf/Policy-on-Material-Subsidiaries.pdf

13. DISCLOSURE ON CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE EARNINGS AND OUTGO

Annexure ‘E’ to this Report provides information on Conservation of Energy, Technology Absorption and Foreign Exchange Earnings and Outgo, required under Section 134 (3)(m) of the Companies Act, 2013 read with the Companies (Accounts) Rules, 2014 which forms a part of the Directors’ Report.

14. RISK MANAGEMENT POLICY

The Board has constituted a Risk Management Committee. Elements of risks to the Company are given in the Management Discussion & Analysis section of this Report under the heading “Risks & Concerns”.

15. CORPORATE SOCIAL RESPONSIBILITY

Your Company has a policy for meeting its Corporate Social Responsibility (“CSR”). Details of CSR projects are provided in Annexure ‘F’ in the prescribed format.

16. VIGIL MECHANISM

Your Company has adopted a Vigil Mechanism Policy.

The purpose of the policy is to enable employees to raise concerns about unacceptable improper practices and/or any unethical practices being carried out in the organisation

without the knowledge of management. All employees shall be protected from any adverse action for reporting any unacceptable/improper practice and/or any unethical practice, fraud or violation of any law, rule or regulation. This

Whistle Blower policy will also be applicable to the Directors of the Company.

The Audit Committee reviews on a quarterly basis, reports made under this policy and implements corrective actions, wherever necessary.

17. THE SEXUAL HARASSMENT OF WOMEN AT WORKPLACE (PREVENTION, PROHIBITION AND

REDRESSAL) ACT, 2013

In Compliance with Section 4 of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 your Company constituted an

“Internal Complaints Committee” (“Committee”). Twentysix workshops were conducted to create awareness about sexual harassment among employees.

Since the number of complaints filed during the year was NIL the Committee prepared a NIL complaints report. This is in compliance with Section 22 of the Act.

18. AUDIT COMMITTEE

Your Company has an Audit Committee in compliance with Section 177 of the Companies Act, 2013 and the Listing Agreement. The Audit Committee consists of the following

Independent Directors: Mr. Bharat Doshi as Chairman of the Committee and Mr. Narendra Ambwani, Prof. Bala Balachandran, Dr. Omkar Goswami, Mr. Aman Mehta, Mr.

D Shivakumar and Ms. Ireena Vittal as members. Prof. Bala Balachandran has ceased to be a member of the Committee with effect from the close of business hours on March 31, 2015 since he has resigned from the Board.

19. EMPLOYEE STOCK GRANT SCHEME

The shareholders have on March 18, 2011, approved the Employee Stock Grant Scheme (GCPL ESGS 2011). The scheme envisages the issue of up to 2,500,000 fully paid equity shares at a nominal

value of ` 1/- each in the Company to certain eligible employees of the Company and/ or its subsidiaries. In terms of the GCPL ESGS 2011, 174,121 grants are outstanding and not vested as at March 31, 2015.

The eligible employees shall be entitled to exercise the options vested in them, within one month from the date of vesting or such dates as may be determined by the

Nomination and Remuneration Committee. The equityshares vested in the eligible employees shall be allotted on payment of the exercise price of Rs. 1/- per share.

The details of the grants allotted under GCPL ESGS 2011, as also the disclosures in compliance with Section 62 1(b) read with Rule 12(9) of the Companies (Share Capital & Debentures) Rules, 2014 are set out in Annexure ‘G’ to this report.

Under the scheme of amalgamation between your Company

and Godrej Household Products Limited (GHPL), the

Employee Stock Option Scheme of the erstwhile unlisted

GHPL has become part of your Company. The equity shares

of ‘Godrej Industries Limited’ are the underlying equity

shares for the stock option scheme. As at April 1, 2014,

10,40,000 options convertible into 10,40,000 equity shares

of Godrej Industries Limited (GIL) were outstanding. As at

March 31, 2015, 35,000 options convertible into 35,000

equity shares of GIL were outstanding.

The Company has not given any loan to any person under

any scheme for the purpose of or in connection with the

subscription or purchase of shares in the Company or the

Holding Company. Hence there are no disclosures on voting

rights not directly exercised by the employees in respect of

shares to which the scheme relates.

20. DIRECTOR’S RESPONSIBILITY STATEMENT

Pursuant to the provisions contained in Section 134(5) of the Companies Act, 2013, your Directors, based on the representation received from the Operating Management, and after due enquiry, confirm that:

- In the preparation of the annual accounts, the applicable accounting standards have been followed and no material departures have been made from the same;

- they have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit of the Company for that period;

- they have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of this Act for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities;

- they have prepared the annual accounts on a going concern basis;

- they have laid down internal financial controls to be followed by the Company and such internal financial controls are adequate and operating effectively;

- the Directors have devised a proper system to ensure compliance with the provisions of all applicable laws and this system is adequate and operating effectively.

21. UNCLAIMED SHARES

In compliance with Clause 5A of the Listing Agreement with the Stock Exchanges, your Company has transferred the unclaimed shares into a demat account, viz. “Unclaimed-Suspense Account”. As and when an allottee approaches the Company, after proper verification, either credit the shares lying in the Unclaimed Suspense Account to the demat account of the allottee to the extent of the allottee’s entitlement, or deliver the physical certificates after re-materialising them, depending on what has been opted for by the allottee.

|

Particulars

|

No. of Shareholders

|

No. of Shares

|

|

Aggregate number of shareholders and the outstanding shares lying in the Unclaimed Suspense Account at the beginning of the year;

|

5,808

|

882,849

|

|

Number of shareholders and aggregate shares transferred to Unclaimed Suspense Account during the year;

|

52

|

9,112

|

|

Number of shareholders who approached the issuer for transfer of shares from the Unclaimed Suspense Account during the year and aggregate shares transferred;

|

52

|

9,112

|

|

Number of shareholders to whom shares were transferred from the Unclaimed Suspense Account during the year and the aggregate shares transferred;

|

52

|

9,112

|

|

Aggregate number of shareholders and the outstanding shares lying in the Unclaimed Suspense Account at the end of the year.

|

5,756

|

873,737

|

22. LISTING

The shares of your Company are listed at The BSE Limited and The National Stock Exchange of India Limited.

2500 Non-Convertible Debentures of face value Rs. 10 lakh each aggregating Rs. 250 crore issued in October, 2014 on private placement basis, are listed in the whole sale debt segment on The National Stock Exchange of India Limited.

The applicable annual listing fees have been paid to the Stock Exchanges before the due date.

23. EXTRACT OF ANNUAL RETURN

Annexure ‘H’ to this Report provides the Extract of Annual Return to be filed by the Company under the Companies Act, 2013.

24. AUDITORS AND AUDITORS’ REPORT

A. Statutory Auditors

In accordance with Section 139 of the Companies Act, 2013

and rules made thereunder, M/s. Kalyaniwalla & Mistry,

Chartered Accountants, Mumbai, have been appointed

as statutory auditors to hold office from the conclusion of

the 14th Annual General Meeting till the conclusion of the

17th Annual General Meeting which will be held in 2017

(subject to ratification of re-appointment by the members at

every AGM held after the AGM in which the appointment

was made) of the Company, on a remuneration as may be

agreed upon by the Board of Directors and the Auditors.

The notes to the Accounts referred to in the Auditors’ Report

are self-explanatory and therefore do not call for any further

explanation.

B. Cost Auditors

Pursuant to directions from the Department of Company

Affairs, M/s. P. M. Nanabhoy & Co., Cost Accountants have

been appointed as Cost Auditors for the applicable products

of the Company for the year 2014-15. They are required to

submit the report to the Central Government within 180 days

from the end of the accounting year.

C. Secretarial Auditors

The Board has appointed A. N. Ramani & Co., Company

Secretaries, Practising Company Secretary, to conduct

Secretarial Audit for the financial year

2014-15. The

Secretarial Audit Report for the financial year ended March

31, 2015 is annexed herewith marked as Annexure ‘I’ to

this Report. The Secretarial Audit Report does not contain

any qualification, reservation or adverse remark.

25. CORPORATE GOVERNANCE

The Company continues to enjoy a Corporate Governance

Rating of CGR2+ (pronounced as CGR 2 plus) and a

Stakeholder Value Creation and Governance Rating of

SVG1 (pronounced as SVG one). The ‘+’ sign indicates

relatively higher standing within the category indicated

by the rating. The above ratings are on a rating scale

of 1 to 6, where 1 is the highest rating. The two ratings

evaluate whether a Company is being run on the principles

of Corporate Governance and whether the practices

followed by the Company lead to value creation for all its

shareholders.

The CGR2 rating is on a rating scale of CGR1 to CGR6,

where CGR1 denotes the highest rating. The CGR2+ rating

implies that in ICRA’s current opinion, the rated Company

has adopted and follows such practices, conventions and

codes as would provide its financial stakeholders a high

level of assurance on the quality of corporate governance.

The SVG1 rating is on a rating scale of SVG1 to SVG6,

where SVG1 denotes the highest rating. The SVG1 rating

implies that in ICRA’s current opinion, the Company belongs

to the highest category on the composite parameters

of stakeholder value creation and management as also

corporate governance practices.

Pursuant to Clause 49 of the Listing Agreement, the

Management Discussion & Analysis Report and the Report

on Corporate Governance are included in the Annual

Report. The Auditors’ Certificate certifying the Company’s

compliance with the requirements of Corporate Governance

in terms of Clause 49 of the Listing Agreement, is attached

as Annexure ‘J’ and forms a part of this Annual Report.

26. MANAGEMENT DISCUSSION & ANALYSIS

In order to avoid duplication between the Directors’ Report

and Management Discussion & Analysis, your Directors

give a composite summary of the various businesses and

functions of the Company, on the following pages.

Overview

Over the last year, we have seen a revival in the Indian economy, with macroeconomic indicators now starting to trend in the right direction. GDP growth has increased to 7.4% from 6.9% in the previous year. Consumer inflation dropped to 6% from 9.5%. The fiscal deficit target too, has been reduced to 3.9% of the GDP for fiscal year 2016, from 4.1% in fiscal year 2015. The current account deficit and the Government’s subsidy bill, both fell by nearly 50 basis points (as a percentage of GDP) and have consequently, helped in fiscal consolidation.

Steps have also been taken to improve the investment climate in the country. This includes the fast-tracking of projects under the Cabinet Secretariat, increase in the insurance sector FDI limit to 49% from 26%, and the initiation of regulatory reforms in labour, environment clearances and the mining sector. While India continues to be the highest-ranking country in Nielsen’s Consumer Confidence Index, for the sixteenth quarter in a row, demand on the ground is yet to pick up. The ease of lending rates and structural reforms such as the implementation of the Goods & Services Tax and enactment of the land acquisition bill will be key drivers of demand, going ahead.

Depreciating currencies and weakening growth continue to remain significant challenges for our businesses, globally. Our teams are however, navigating them with a sharp focus on costs and constant innovation.

Consequent to the turbulent macroeconomic scenario, the FMCG sector registered a sluggish growth in the first half of fiscal year 2015. Consumer demand in the second half of the year, however, started to show early signs of a recovery. While we see this as a gradual process, we expect the overall Indian economy to pick up pace in fiscal year 2016. Pro-growth initiatives by the government, such as the passing of the Goods & Services Tax Bill, will be greatly beneficial for this.

In this environment, our business has delivered strong, competitive double-digit growth across categories. We have also further strengthened our leadership positions across our core categories. Our robust performance is on the back of the gradual improvement we are seeing in the FMCG growth in India. This is aided by our continued focus on innovations and brand building, supported by competitive marketing investments and enhancements to our go-to-market infrastructure.

International sales as a percentage of consolidated sales

27. INTERNAL CONTROL AND ADEQUACY

We have a proper system of Internal Controls to ensure that all assets are safeguarded and protected against loss from unauthorised use or disposition and that transactions are authorised, recorded and reported correctly.

Our Corporate Audit & Assurance Department which is ISO 9001: 2008 certified, issues well documented operating procedures and authorities, with adequate built-in controls at the beginning of any activity and during the continuation of the process, if there is a major change.

The internal control is supplemented by an extensive programme of internal, external audits and periodic review by the management. This system is designed to adequately ensure that financial and other records are reliable for preparing financial information and other data and for maintaining accountability of assets.

The GCPL Head Office and all major factories and offices across India operate on an Information Security Management System which is ISO/IEC 27001 certified.

28. RISKS AND CONCERNS

With our presence in three continents i.e. Asia, Africa and Latin America, we are exposed to risks which can adversely impact our operating performance, cash flows, financial performance, management performance and overall sustainability. We have an active risk management strategy in place and a Risk Committee, whose role is to identify potential risks, create mitigation strategies and monitor the occurrence of risk.

The risks that may affect us include, but are not limited to:

- Economic conditions.

- Inflationary pressures and other factors affecting demand for our products.

- Increasing costs of raw material, transport and storage.

- Supplier and distributor relationships and retention of distribution channels.

- Competitive market conditions and new entrants to the market.

- Labour shortages and attrition of key staff.

- Exchange rate fluctuation and arbitrage risk.

- Integration risks for acquired companies.

- Compliance and regulatory pressures including changes to tax laws.

- Seasonal fluctuations.

- Political risks associated with unrest and instability in countries where we have a presence or operation

29. OPPORTUNITIES AND THREATS

Close to 40% of our growth now comes from new products and renovations. We believe that there are tremendous long-term growth opportunities in emerging markets. These geographies are home to 80% of the world’s population. Estimates suggest that these markets will contribute to close to 36% of the forecasted increase in the world’s population over the next five years. Close to half of the total global consumption is also slated to come from here. We believe that there are significant opportunities for growth in our core geographies and categories.

On the domestic front, the fundamentals of the FMCG sector remain strong and there is still significant growth potential, given the low penetration and consumption rates for many FMCG categories in the country.

In terms of threats, the key threats are compliance and regulatory pressures including changes to tax law, seasonal fluctuations and unrest and instability in countries where we have a presence or operation, remain our key threats.

OUTLOOK

We expect to see a gradual recovery in the macroeconomic environment and for the Indian economy to consequently, gather pace in fiscal year 2016. While macroeconomic factors remain challenging in some of our international markets, we believe that we are well placed to continue our strong sales and profitability growth momentum. Overall, our focus will be on sustaining and extending leadership in our core categories. We are investing for the longer term and accelerating the pace of new product launches, to capitalise on the uptick in consumer sentiment and demand. We are confident that with our clear strategic focus, differentiated product portfolio, superior execution and top-notch team, we will continue to deliver industry-leading results in the future.

30. ACKNOWLEDGEMENT

Your Directors wish to extend their sincere thanks to the Central and State Governments as also all the Government agencies, banks, customers, shareholders, vendors and other related organisations who, through their continued support and co-operation have helped as partners, in your Company’s progress.

For and on behalf of the Board of Directors

Adi Godrej

Chairman

ANNEXURE ‘A’

GCPL TOTAL REWARDS POLICY

GCPL’s Total Rewards Framework aims at holistically utilising elements such as fixed and variable compensation, long-term incentives, benefits and perquisites and noncompensation

elements (career development, work-life balance and recognition).

Highlights

The rewards framework offers to employees the flexibility to customise different elements, basis need. It is also integrated with GCPL’s performance and talent

management processes and designed to ensure sharply differentiated rewards for our best performers.

The total compensation for a given position is influenced by three factors: position, performance and potential. As a broad principle, for high performers and potential

employees, GCPL strives to deliver total compensation at the 90th percentile of the market.

Total Cash Compensation

Employee’s total cash compensation has three components:

1. ‘Fixed Compensation’ comprises the basic salary and

retirement benefits like provident fund and gratuity.

2. ‘Flexible Compensation’ is a fixed pre-determined component of an employee’s compensation. Employees

can allocate this amount to different components, as

per their grade eligibility, defined at the start of each

financial year.

3. ‘Variable Compensation (Performance Linked Variable

Remuneration)’ rewards employees for delivering

superior business results and individual performance.

It is designed to provide a significant upside earning

potential without cap for over achieving business

results. It has a ‘Collective’ component, linked to the

achievement of specified business results, measured

by Economic Value Added or other related metrics,

relative to the target set for a given financial year and

an ‘Individual’ component, based on an employee’s

performance, as measured by the performance

management process.

Long Term Incentives (Employee Stock Grant Scheme)

This scheme aims at driving a culture of ownership and

focus on long-term results. It is applicable to Godrej

Leadership Forum members, grades Vice President and

above. Under this scheme, performance-based stock

grants are awarded basis performance, measured by

employee’s annual review rating. The value of the stock

grant is proposed by the management and approved by the

compensation committee.

ANNEXURE ‘B’

BOARD DIVERSITY POLICY

Godrej Consumer Products Limited

(the “Company”)

The Company is committed to equality of opportunity in all

aspects of its business and does not discriminate on the

grounds of nationality, race, colour, religion, caste, gender,

gender identity or expression, sexual orientation, disability,

age, or marital status.

The Company recognises merit and continuously seeks

to enhance the effectiveness of its Board. The Company

believes that for effective corporate governance, it is

important that the Board has the appropriate balance of

skills, experience and diversity of perspectives.

Board appointments will be made on a merit basis and

candidates will be considered against objective criteria, with

due regard for the benefits of diversity on the Board. The

Board believes that such merit-based appointments will best

enable the Company to serve its stakeholders.

The Board will review this Policy on a regular basis to

ensure its effectiveness.

ANNEXURE ‘C’

Information pursuant to Section 197(12) of the Companies Act, 2013 read with Rule 5(1) of the Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014

- The ratio of the remuneration of each Director to the median remuneration of the employees of the Company for the financial year 2014-15, the percentage increase in remuneration of each Director, Chief Financial Officer and Company Secretary during the financial year 2014-15 and the comparison of remuneration of each Key Managerial Personnel (KMP) against the performance of the Company are as under:

A. Whole-time Directors, Chief Financial Officer and Company Secretary

|

Sr. No.

|

Name of the KMP

|

% increase in remuneration in the financial year 2014-15

|

Ratio of remuneration of each Director to the median remuneration paid/payable to all employees for FY 2014-15

|

1 |

Adi Godrej |

39** |

264.1:1 |

1 |

Nisaba Godrej |

* |

89.9:1 |

3 |

Vivek Gambhir |

* |

258.1:1 |

4 |

P. Ganesh |

60** |

Not Applicable |

* Not comparable since figures for FY 2013-14 are effective July 1, 2013.

** Remuneration increase includes actual variable bonus paid out based on performance.

Comparison of Remuneration of KMP against performance of the Company : Standalone net profit of the Company during the financial year grew from ` 564 crore to ` 654 crore (an increase of 15.8%)

B. Non-Executive Directors

|

Sr. No.

|

Name of the Director

|

% increase in remuneration in the financial year 2014-15

|

Ratio of remuneration of each Director to the median remuneration paid/payable to all employees for FY 2014-15

|

1 |

Jamshyd Godrej |

46 |

3.8:1 |

2 |

Nadir Godrej |

62 |

4.2:1 |

3 |

Tanya Dubash |

54 |

4.0:1 |

4 |

Narendra Ambwani |

36 |

3.8:1 |

5 |

Bala Balachandran |

38 |

3.6:1 |

6 |

Bharat Doshi |

54 |

4.0:1 |

7 |

Omkar Goswami |

46 |

3.8:1 |

8 |

A. Mahendran |

(96) |

3.4:1 |

9 |

Aman Mehta |

43 |

4.0:1 |

10 |

D. Shivakumar |

36 |

3.8:1 |

11 |

Ireena Vittal |

67 |

4.0:1 |

Note:

- As per the approval received from the shareholders at the Annual General Meeting held on July 28, 2014, Non-

Executive Directors are entitled to a Commission on Profits at a rate not exceeding 1% of the net profits subject to a

maximum of Rs. 15 lac per director, for a period of three financial years beginning from 2014-15. For the financial year

ended on March 31, 2014, Non-Executive Directors were entitled to a Commission on Profits at a rate not exceeding

1% of the net profits subject to a maximum of Rs. 12.50 lac per director. Remuneration to Non-Executive Directors

include sitting fees for attending Board/committee meetings. The sitting fees payable to each Director for attending

Board meetings and Committee meetings during FY 2013-14 was Rs. 20,000 per meeting and Rs. 5,000 per meeting

respectively. The sitting fees payable during FY 2014-15 has been increased to Rs. 1,00,000 for Board meetings and

Rs.. 20,000 for Committee meeting, which is within the limits as per the Companies Act, 2013.

- Mr. A Mahendran was the Managing Director of your Company during the period April 1, 2013 to June 30, 2013 and

was entitled to a remuneration. With effect from July 1, 2013 he is a Non-Executive Director and entitled to Commission

on Profits at the rates mentioned in note 1 above. Hence the change in remuneration is not comparable.

- Median remuneration of all the employees of the Company for the financial year 2014-2015: Rs. 4.98 Lac

- The percentage increase in the median remuneration of employees in the financial year: 10.9%

- The number of permanent employees on the payrolls of company as on March 31, 2015 : 2239.

- Relationship between average increase in remuneration and company performance:

The average increase in remuneration (including performance bonus) during FY 2015 was 29.3% as compared to the

previous financial year. Income from operations of the Company during the financial year grew from Rs. 4,079.84 crore

to Rs. 4,429.80 crore (an increase of 8.6%) and Net Profit of the Company during the financial year grew from Rs. 564.84

crore to Rs. 654.45 crore (an increase of 15.8%).

- Comparision of the remuneration of key managerial personnel against the performance of the Company is given in point 1.

- Variations in the market capitalisation of the Company, price earnings ratio as at the closing date of the current financial

year and previous financial year, and percentage increase over decrease in the market quotations of the shares of

the Company in comparison to the rate at which the company came out with the last public offering in case of listed

companies, and in case of unlisted companies, the variations in the net worth of the company as at the close of the

current financial year and previous financial year.

|

|

As at March 31, 2015 Rs. (Crore)

|

As at March 31, 2014 Rs. (Crore)

|

Percentage increase / (decrease)

|

|

Market capitalisation

|

35,434

|

28,990

|

22%

|

|

Price earnings ratio

|

54

|

51

|

6%

|

The closing market price of the shares of the Company, as at March 31, 2015 in BSE, was Rs. 1,040.80. The Company has not come out with any public offer since its inception in 2001.

- Average percentile increase already made in the salaries of employees other than the managerial personnel in the last

financial year and its comparison with the percentile increase in the managerial remuneration and justification thereof and

point out if there are any exceptional circumstances for increase in the managerial remuneration.

Total managerial remuneration comprises of remuneration of the Whole-time Directors and commission paid to Non-

Executive Directors. The Whole-time Director's remuneration is as per the resolution approved by the shareholders

and will not exceed 5% of the Company’s net profits as permitted by the Companies Act, 2013. The shareholders have

approved Commission on Profits to Non-Executive Directors at a rate not exceeding 1% of the net profit subject to

a maximum amount of Rs. 15 lakh per director. Overall increase in managerial remuneration is within the above limits.

Average percentile increase in salary of employees other than managerial personnel is 28.6%. Percentile increase in

managerial remuneration is given in point 1.

- The key parameters for any variable component of remuneration availed by the directors;

The variable component o

f the remuneration of the Whole-time Directors is determined based on improvement in profitability and optimum utilisation of capital employed over last year.

- The ratio of the remuneration of the highest paid director to that of the employees who are not directors but receive remuneration in excess of the highest paid director during the year.

Since no employee of the Company receives remunerati

on in excess of the highest paid director, i.e. Mr. Adi Godrej, Chairman, the same is not applicable.

- Remuneration is as per the remuneration policy of the company.

ANNEXURE ‘D’

Form AOC-2

Form for disclosure of particulars of contracts/arrangements entered into by the company with related parties referred to in sub-section (1) of Section 188 of the Companies Act, 2013 including certain arm’s length transactions under third proviso thereto

- Details of contracts or arrangements or transactions not at arm’s length basis NIL

- Name(s) of the related party and nature of relationship

- Nature of contracts/arrangements/transactions

- Duration of the contracts/arrangements/transactions

- Salient terms of the contracts or arrangements or transactions including the value, if any

- Justification for entering into such contracts or arrangements or transactions

- date(s) of approval by the Board

- Amount paid as advances, if any :

- Date on which the special resolution was passed in general meeting as required under first proviso to Section 188

- Details of material contracts or arrangement or transactions at arm’s length basis NIL

- Name(s) of the related party and nature of relationship

- Nature of contracts/arrangements/transactions

- Duration of the contracts/arrangements/transactions

- Salient terms of the contracts or arrangements or transactions including the value, if any :

- Date(s) of approval by the Board, if any:

- Amount paid as advances, if any:

For Godrej Consumer Products Limited

sd/-

Adi Godrej

Chairman

ANNEXURE ‘E’

ANNEXURE ‘F’

ANNEXURE ‘G’

ANNEXURE ‘H’

ANNEXURE ‘H-1’

ANNEXURE ‘H-2’

ANNEXURE ‘I’

ANNEXURE TO SECRETARIAL AUDIT REPORT

ANNEXURE ‘J’