1. Financial Highlights and Review of Operations

Your Company's financial performance for the year under review has been encouraging and is summarised below:

Figures in Rs. Crore

Financials |

Consolidated |

Standalone |

Abridged Profit and Loss Statement |

FY 2013-14 |

FY 2012-13 |

FY 2013-14 |

FY 2012-13 |

Sales (Net of Excise Duty) |

7582.57 |

6399.65 |

4024.74 |

3520.93 |

Other Operating Income |

19.84 |

16.65 |

55.10 |

60.09 |

Total Income from Operations |

7602.41 |

6416.30 |

4079.84 |

3581.02 |

Total Expenses other than Depreciation & Finance Cost |

6425.32 |

5401.14 |

3326.87 |

2938.94 |

Profit from Operations before Other Income, Finance Cost & Exceptional Items & Depreciation |

1177.09 |

1015.16 |

752.97 |

642.08 |

Depreciation |

81.85 |

77.00 |

35.52 |

32.27 |

|

Profit from Operations before Other Income, Finance Cost & Exceptional Items

|

1095.24

|

938.16

|

717.45

|

609.81

|

|

Foreign Exchange Gain / (Loss)

|

(26.78)

|

(32.78)

|

(5.94)

|

(12.01)

|

|

Other Income

|

62.71

|

67.78

|

40.00

|

50.65

|

|

Profit before Finance Costs and Exceptional Items

|

1131.17

|

973.16

|

751.51

|

648.45

|

|

Finance Cost

|

107.37

|

77.45

|

38.52

|

15.49

|

|

Profit after Finance Costs but before Exceptional Items

|

1023.80

|

895.71

|

712.99

|

632.96

|

|

Exceptional Items

|

5.87

|

128.90

|

0.00

|

0.00

|

|

Profit Before Tax

|

1029.67

|

1024.61

|

712.99

|

632.96

|

|

Tax Expense

|

210.37

|

179.18

|

148.15

|

122.02

|

|

Net Profit after Tax before Minority Interest

|

819.30

|

845.43

|

564.84

|

510.94

|

|

Share of Profit in Associate Company

|

(0.05)

|

-

|

-

|

-

|

|

Minority Interest

|

(59.52)

|

(49.33)

|

-

|

-

|

|

Net Profit for the period

|

759.73

|

796.10

|

564.84

|

510.94

|

2. Appropriation

Your Directors recommend appropriation as under: Rs. Crore

|

GCPL Standalone

|

FY 2013-14

|

FY 2012-13

|

|

Surplus as at end of previous year

|

1010.09

|

769.82

|

|

Add: Net Profit for the year

|

564.84

|

510.94

|

|

Available for appropriation

|

1574.93

|

1280.76

|

|

Less: Transfer to DRR

|

23.53

|

21.25

|

|

Less: Interim Dividend

|

178.70

|

170.16

|

|

Less: Tax on distributed profits

|

30.37

|

28.13

|

|

Less: Addition on amalgamation of Godrej Hygiene Products Ltd.

|

15.50

|

-

|

|

Less: Transfer to General Reserve

|

56.50

|

51.13

|

|

Total Appropriation

|

304.60

|

270.67

|

|

Surplus Carried Forward

|

1270.33

|

1010.09

|

3. Dividend

For the year 2013-14, three interim dividends were declared on shares of face value Rs. 1/- each - as follows: Rs. 1/- per equity share on August 3, 2013,

Rs. 1/- per equity share on November 11, 2013 and Rs. 1/- per equity share on January 31, 2014.

In addition to the above, the Board of Directors has also declared a fourth interim dividend on April 28, 2014 at the rate of Rs. 2.25/- per equity share on shares of face value Rs. 1/- each. The record date for the same has been fixed as May 7, 2014.

Your Directors recommend that the aforesaid interim dividends aggregating to Rs. 5.25/- per equity share on shares of face value Rs. 1/- each be declared as final dividend for the year ended on March 31, 2014.

4. Non-Convertible Debentures

The Unsecured Redeemable Zero Coupon Non-Convertible Debentures issued in October 2012 on private placement basis aggregating to Rs. 250 crore for a tenor of two years is outstanding as at the year-end and is due for redemption in October 2014. The said Debentures have a credit rating of [ICRA] AA (Stable).

The Unsecured Non-Convertible Debentures of Rs. 50 crore issued in April 2012 on a private placement basis was redeemed by your company in October 2013 on its maturity at the end of 18 months as per the terms of the issue.

5. Subsidiaries & Associates

During the year, your Company acquired balance 49% stake in the Nigeria business of Darling Group and additional 4.63% stake in the South Africa and Mozambique business of the Darling group through Godrej Mauritius Africa Holdings Ltd., a wholly owned subsidiary of your Company.

Your Company entered into an agreement on October 7, 2013, to acquire a 30% stake in Bhabani Blunt Hair Dressing Private limited (b:blunt), a premier hair salon company with one of the strongest consumer franchises in this space.

Pursuant to a Scheme of Amalgamation ("the Scheme"), sanctioned by a Dutch Court, vide its Order dated October 28, 2013, Godrej Indonesia Netherlands Holding B.V. (GINBV) has been merged with Godrej Consumer Holdings (Netherlands) B.V. (GCHNBV) with effect from September 30, 2013.

During the year, Godrej Hygiene Products (GHPL) has merged into your Company with effect from September 7, 2013 pursuant to a scheme of amalgamation sanctioned by the Honurable High Court of Judicature at Bombay vide its order dated August 12, 2013. The appointed date for the scheme was April 1, 2013.

The details of business of the key subsidiaries are given in the Management Discussion and Analysis section of the Directors' Report. In line with the General Circular No. 2 /2011 dated February 8, 2011 issued by the Ministry of Corporate affairs, the Board of Directors of your Company has passed a resolution for giving its consent for not attaching the financial statements of subsidiaries of the Company to the Balance Sheet of the Company for the year ended March 31, 2014.

The Consolidated Financial Statements of the Company and its subsidiaries, prepared in accordance with Accounting Standard 21 issued by the Institute of Chartered Accountants of India, also forms part of the Annual Report and accounts of your Company. A one-page financial summary for all the subsidiaries giving the required information is disclosed in the Annual Report also.

As directed by the aforesaid circular the accounts of the subsidiary companies and the related detailed information will be made available to any shareholder seeking such information at any point of time. The accounts of the subsidiary companies are also available for inspection by any shareholder at the registered office of the Company or at the registered offices of the subsidiary companies.

6. Management Discussion and Analysis

In order to avoid duplication between the Directors' Report and Management Discussion and Analysis, your Directors give below a composite summary of the various business and functions of the Company.

Overview

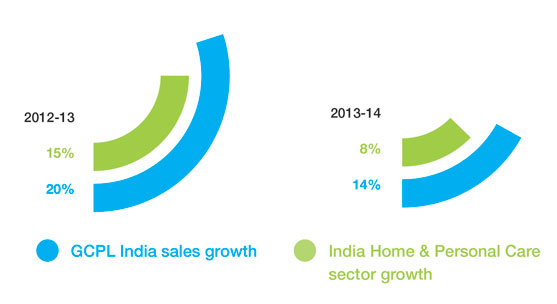

Over the last year, India's economic risks have been intensified by slowing economic growth, political

logjams, high consumer price inflation, a depreciating currency and fluctuating equity markets.

Growth rates over the last three years more than halved. Interest rate hikes translated into capital

investment and growth in manufacturing and services becoming sluggish. We were however

fortunate to have a good monsoon that helped agricultural output. The fast drop in the rupee too was

checked by intervening measures by the RBI.

There have been some positive movements in reaching a consensus on the introduction of the Goods

& Services Tax, which will create a unified market in India and make it easier to do business across

the country, thereby having a significant upside to the investment climate and overall growth. This

and other policy reforms will be needed to lift the economy out of the current slowdown.

Consequent to the turbulent macro economic scenario, the FMCG sector registered a marked slow

down this year. Consumer sentiment took a hit in the wake of decelerating GDP growth and high food

inflation. While the pace of economic recovery remains uncertain, we are hopeful

that consumer sentiment will become more positive and we will see better growth in the sector in the

year ahead. The fundamentals of this sector continue to remain strong and we are confident of the

growth potential of many categories, given their low penetration and consumption rates. Pro-growth

initiatives by the new government will be greatly beneficial.

Strong track record of performance

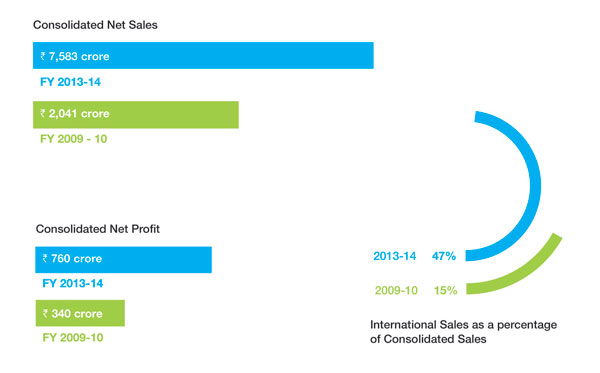

Consolidated Net Sales grew by 18% to Rs. 7,583 crore

Continue to invest strongly in our brands

Advertisement & sales promotion increased by 24%

EBITDA grew by 16% to Rs. 1,177 crore

Profit After Tax (adjusted for exceptionals) grew by 13% to Rs. 754 crore

- Extending leadership in our core categories in india

- Capitalising on international growth potential

- Accelerating innovation and renovation

- Building a future ready sales system

- Making our supply chain best in class

- Building an agile and high performance culture

7. Internal Control and Adequacy

We have a proper system of Internal Controls to ensure that all assets are safeguarded and protected

against loss from unauthorized use or disposition and that transactions are authorized, recorded and

reported correctly.

Our Corporate Audit & Assurance Department which is ISO 9001: 2008 certified, issues well

documented operating procedures and authorities, with adequate built- in controls at the beginning

of any activity and during the continuation of the process, if there is a major change.

The internal control is supplemented by an extensive programme of internal, external audits and

periodic review by the management. This system is designed to adequately ensure that financial and

other records are reliable for preparing financial information and other data and for maintaining

accountability of assets.

The GCPL Head Office and all major factories and offices across India operate on an Information

Security Management System, which is ISO/IEC 27001 certified.

RISKS AND CONCERNS

As we expand our global reach, we will be exposed to an increasing degree of risks. These risks can

adversely impact our operating performance, cash flows, financial performance, management

performance and overall sustainability. We have an active risk management strategy in place and a

Risk Committee, whose role is to identify potential risks, create mitigation strategies and monitor the

occurrence of risk.

The risks that may affect us include, but are not limited to:

- Economic conditions.

- Inflationary pressures and other factors affecting demand for our products.

- Increasing costs of raw material, transport and storage.

- Supplier and distributor relationships and retention of distribution channels.

- Competitive market conditions and new entrants to the market.

- Labour shortages and attrition of key staff.

- Exchange rate fluctuation and arbitrage risk.

- Integration risks for acquired companies.

- Compliance and regulatory pressures including changes to tax laws.

- Seasonal fluctuations.

- Political risks associated with unrest and instability in countries where we have a presence or operation

OPPORTUNITIES AND THREATS

We see significant long-term growth opportunities in all our international markets. Our key

geographies will contribute to close to 36% of the estimated increase in the world's population in the

next five years and consumption in these markets is slated to account for nearly half the global total.

On the domestic front, inspite of significant slowdown in the FMCG industry, we believe that the

fundamentals still remain positive and there is still a lot of headroom for growth given the low

penetration and consumption rates for many FMCG categories in India. With a clear strategic focus,

superior execution and top-notch team, we are confident that we will deliver industry-leading results in the future. In

terms of threats, the key threats are compliance and regulatory pressures including changes to tax

law, seasonal fluctuations and unrest and instability in countries where we have a presence or

operation.

OUTLOOK

The coming year provides us with tremendous opportunity and we are motivated by the thought of

building a stronger GCPL. While there will undoubtedly be challenges, we believe that we have a

sound strategy and strong management team to lead this change.

CAUTIONARY STATEMENT

Some of the statements in this Management Discussion and Analysis, describing the Company's objectives, projections, estimates and expectations may be 'forward looking statements' within the meaning of applicable laws and regulations. These forward looking statements are based on certain expectations, assumptions, anticipated developments and other factors which are not limited to risk and uncertainties regarding fluctuations in earnings, market growth, intense competition and the

pricing environment in the market, consumption level, ability to maintain and manage key customer

relationship and supply chain sources and those factors which may affect our ability to implement

business strategies successfully, namely changes in regulatory enviornments in India and

overseas,political instability, change in international oil prices and input costs and new or changed

priorities of the trade.

8. Directors' Responsibility Statement

Pursuant to the provisions contained in Section 217 (2AA) of the Companies Act, 1956, your Directors, based on the representation received from the Operating Management, and after due enquiry, confirm:

- that in the preparation of the annual accounts, the applicable accounting standards have been followed and no material departures have been made from the same;

- that they have selected such accounting policies and applied them consistently and made

judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit of the Company for that period;

- that they have taken proper and sufficient care for the maintenance of adequate accounting

records in accordance with the provisions of this Act for safeguarding the assets of the Company for preventing and detecting fraud and other irregularities;

- that they have prepared the annual accounts on a going concern basis.

9. Employee Stock Option Plan

The shareholders of the Company vide special resolution passed on March 14, 2007 approved the setting up of Godrej Consumer

Products Limited Employee Stock Option Plan (GCPL ESOP). Pursuant to the approvals received in the above meeting and in

the meeting dated April 24, 2008, the Company can grant 4,500,000 stock options convertible into 4,500,000 equity

shares of the nominal value Rs. 1/- each to the eligible employees/ directors of the Company and of the Company's

subsidiaries.

The GCPL ESOP is administered by a trust set up for this purpose, viz. Godrej Consumer Products

Ltd. Employee Stock Option Trust.

As on March 31, 2014, 10,000 options convertible into 10,000 equity shares of nominal value of Rs. 1/-

each are outstanding in respect of options granted under the GCPL ESOP to employees of the

Company.

The details of the options allotted under GCPL ESOP, as also the disclosures in compliance with

Clause 12 of the Securities and Exchange Board of India (Employee Stock Option Scheme and

Employee Stock Purchase Scheme) Guidelines, 1999 are set out in Annexure A to this report.

Since the exercise price of GCPL options is the last closing price on the stock exchange, there is no

compensation cost in Financial Year 2013-14 based on the intrinsic value of the options.

Under the Scheme of Amalgamation between your Company and Godrej Household Products

Limited (GHPL), the Employee Stock Option Scheme of the erstwhile unlisted GHPL has become part

of your Company. The equity shares of 'Godrej Industries Limited' are the underlying equity shares

for the stock option scheme. As at March 31, 2014, 10,40,000 options convertible into 10,40,000

equity shares of Godrej Industries Ltd. are outstanding.

10. Employee Stock Purchase Plan

The Board of Directors at its meeting held on January 22, 2011 had approved an Employee Stock

Purchase Plan (GCPL ESPL) under the provisions of Section 77 of the Companies Act, 1956. The GCPL ESPL is administered by the GCPL ESOP Trust.

Employees in the cadre of Vice President and above, are eligible to be covered under the plan.

Under the GCPL ESPL, the Company provided a loan to the GCPL ESOP Trust at an interest rate which is not less than the bank rate,

to enable the GCPL ESOP Trust to acquire upto 1,000,000 shares of the Company from the secondary market.

Under the GCPL ESPL, 1,000,000 shares which had vested on March 30, 2012 has been exercised during the current year and

the GCPL ESOP Trust has repaid to the Company, the loan for these shares.

11. Employee Stock Grant Scheme

The shareholders have on March 18, 2011, approved a new Employee Stock Grant Scheme (ESGS

2011). The scheme envisages the issue of up to 2,500,000 fully paid equity shares at a nominal value

of Rs. 1/- each in the Company to certain eligible employees of the Company and / or its subsidiaries. In

terms of the ESGS 2011, 159,058 grants are outstanding and not vested as at March 31, 2014.

The eligible employees shall be entitled to exercise the options vested in them, within one month

from the date of vesting or such dates as may be determined by the HR & Compensation Committee.

The equity shares vested in the eligible employees shall be allotted on payment of the exercise price Rs.

1 per share.

The details of the grants allotted under GCPL ESGS, as also the disclosures in compliance with

Clause 12 of the Securities and Exchange Board of India (Employee Stock Option Scheme and

Employee Stock Purchase Scheme) Guidelines, 1999 are set out in Annexure A to this report.

12. Unclaimed Shares

In compliance with clause 5A of the Listing Agreement with the stock exchanges, your Company has

transferred the unclaimed shares into a demat account, viz. "Unclaimed-Suspense Account". As and

when an allottee approaches the Company, the Company, after proper verification, either credit the

shares lying in the Unclaimed Suspense Account to the demat account of the allottee to the extent of

the allottee's entitlement, or deliver the physical certificates after re-materialising the same,

depending on what has been opted for by the allottee.

|

Particulars

|

No. of Share - holders

|

No. of Shares

|

|

Aggregate number of shareholders and the outstanding shares lying in the Unclaimed Suspense Account at the beginning of the year;

|

5,862

|

894,965

|

|

Number of shareholders and aggregate shares transferred to Unclaimed Suspense Account during the year;

|

-

|

-

|

|

Number of shareholders who approached the issuer for transfer of shares from the Unclaimed Suspense Account during the year and aggregate shares transferred;

|

54

|

12,116

|

|

Number of shareholders to whom shares were transferred from the Unclaimed Suspense account during the year and the aggregate shares transferred;

|

54

|

12,116

|

|

Aggregate number of shareholders and the outstanding shares lying in the Unclaimed Suspense Account at the end of the year.

|

5,808

|

882,849

|

13. Directors

In accordance with Article 130 and 131 of the Articles of Association of your Company, Ms. Tanya Dubash and Mr. Jamshyd Godrej retire by rotation and being eligible, offer themselves for re-appointment.

Mr. Narendra Ambwani, Independent Director is retiring by rotation at the forthcoming Annual General Meeting. In compliance with Section 149 of the Companies Act, 2013, Mr. Narendra Ambwani is being appointed as Independent Director to hold office upto June 30, 2019.

14. Listing

The shares of your Company are listed at The BSE Limited and The National Stock Exchange of India Ltd.

2500 Non-Convertible Debentures of face value Rs. 10 each aggregating Rs. 250 crore issued in October 2012 on private placement basis are listed in the whole sale debt segment in The National Stock Exchange of India Ltd.

The applicable annual listing fees have been paid to the stock exchanges before the due date.

15. Auditors

The Auditors, Kalyaniwalla & Mistry, Chartered Accountants, Mumbai, retire and offer themselves for reappointment.

Pursuant to directions from the Department of Company Affairs, M/s. P. M. Nanabhoy & Co., Cost Accountants have been appointed as Cost Auditors for the applicable products of the Company for the year 2013-14. They are required to submit the report to the Central Government within 180 days from the end of the accounting year.

16. Additional Information

Annexure B to this Report gives the information in respect of Conservation of Energy, Technology absorption and Foreign Exchange earnings and outgo,

required under Section 217(1)(e) of the Companies Act, 1956, read with the Companies (Disclosure of Particulars in the Report of the Board of Directors) Rules, 1988 and forms a part of the Directors' Report.

Information as per Section 217(2A) of the Companies Act, 1956 read with the Companies (Particular of Employees) Rules, 1975 forms part of this Report. As per provisions of Section 219(1)(b)(iv) of the Companies Act, 1956, the Report and Accounts are being sent to the Shareholders of the Company, excluding the statement of particulars of the employee under Section 217(2A) of the Companies Act, 1956. Any shareholder interested in obtaining a copy of the statement may write to the Company Secretary at the Registered Office of the Company.

The notes to the Accounts referred to in the Auditors' Report are self-explanatory and therefore do not call for any further explanation.

17. Corporate Governance

The Company continues to enjoy a Corporate Governance Rating of CGR2+ (pronounced as CGR2 plus) and a Stakeholder Value Creation and Governance Rating of SVG1 (pronounced as SVG one). The + sign indicates relatively higher standing within the category indicated by the rating. The above ratings are on a rating scale of 1 to 6, where 1 is the highest rating. The two ratings evaluate whether a Company is being run on the principles of Corporate Governance and whether the practices followed by the Company lead to value creation for all its shareholders.

The CGR2 rating is on a rating scale of CGR1 to CGR6, where CGR1 denotes the highest rating. The CGR2+ rating implies that in ICRA's current opinion, the rated Company has adopted and follows such practices, conventions and codes as would provide its financial stakeholders a high level of assurance on the quality of corporate governance.

The SVG1 rating is on a rating scale of SVG1 to SVG6, where SVG1 denotes the highest rating. The SVG1 rating implies that in ICRA's current opinion, the Company belongs to the highest category on the composite parameters of stakeholder value creation and management as also corporate governance practices.

Pursuant to clause 49 of the Listing Agreements, the Management Discussion and Analysis Report and the Report on Corporate Governance are included in the Annual Report. The Auditors' Certificate certifying the Company's compliance with the requirements of Corporate Governance in terms of clause 49 of the Listing Agreement, is attached as Annexure C and forms a part of this Annual Report.

18. Acknowledgement

Your Directors wish to place their sincere thanks to the Central and State Governments as also all the Government agencies, banks, customers, shareholders, vendors and other related organisations who, through their continued support and co-operation, have helped, as partners, in your Company's progress.

For and on behalf of the Board of Directors

Adi Godrej

Chairman

Mumbai, April 28, 2014

Annexure A forming part of the Directors' Report

As per the Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999, following information is disclosed in respect of employee stock benefit plans are given below:

|

Sr. No.

|

Heading

|

Godrej Consumer Products Limited Employee Stock Option Plan

|

Godrej Consumer Products Limited

Employee Stock Grant Scheme

|

|

A

|

Options granted

|

3,667,000

|

268,611

|

|

B

|

The pricing formula

|

Market Price plus Interest at such a rate not being less than the Bank Rate then prevailing compoundable on an annual basis for the period commencing from the date of Grant of the Option and ending on the date of intimating Exercise of the Option to the Company

|

Rs. 1 per equity share

|

|

c

|

Options vested upto March 31, 2014

|

2,870,000

|

80,849

|

|

d

|

Options exercised upto March 31, 2014

|

2,810,000

|

80,849

|

|

e

|

The total number of shares arising as a result of exercise of option;

|

Nil - Since no fresh issue of shares by the Company

|

51,385 during FY 2013-14

80,849 upto March 31, 2014

|

|

f

|

Options lapsed upto March 31, 2014

|

847,000 (out of which 762,000 option have been re-granted and included in Sr. no. A above)

|

53,398

|

|

g

|

Variation of terms of options

|

None

|

None

|

|

h

|

Money realised by exercise of options upto March 21, 2014

|

Rs. 102.86 crore

|

Rs. 0.01 crore

|

|

i

|

Total number of options in force

|

10,000

|

134,364

|

|

j

|

Employee wise details of options granted to:

i) senior managerial personnel

ii) any other employee who receives a grant in any one year of option amounting to 5% or more of option granted during that year

iii) identified employees who were granted option, during any one year, equal to or exceeding 1% of the issued capital (excluding outstanding warrants and conversions) of the company at the time of grant

|

Nil - Outstanding

Nil

Nil

|

As per Note 1 below

As per Note 2 below

Nil

|

|

k

|

Diluted Earnings Per Share (EPS) pursuant to issue of shares on exercise of option calculated in accordance with Accounting Standard (AS) 20 'Earnings Per Share'

|

There is no fresh issue of shares arising on account of exercise of options. Hence, not applicable.

|

Rs. 16.59 per share (standalone)

Rs. 22.32 per share (consolidated)

|

|

l

|

Where the Company has calculated the employee compensation cost using the intrinsic value of the stock options, the difference between the employee compensation cost so computed and the employee compensation cost that shall have been recognised if it had used the fair value of the options, shall be disclosed. The impact of this difference on profits and on EPS of the company shall also be disclosed.

|

The Company has calculated the employee compensation cost using the intrinsic value of stock options. As all the options got vested before the current financial year, there is no employee compensation cost accounted during the year. Had the fair value method been used, in respect of stock options granted the employee compensation cost for the year would have been lower by Rs. Nil, Profit after tax lower by Rs. Nil and basic EPS would have been lower by Rs. Nil

|

The Company has calculated the employee compensation cost using the intrinsic value of stock options. Had the fair value method been used, in respect of stock options granted the employee compensation cost for the year would have been higher by

Rs. 0.24 crore, Profit after tax lower byRs. 0.19 crore and basic EPS would have been lower by Rs. 0.006

|

|

m

|

Weighted-average exercise prices and weighted-average fair values of options shall be disclosed separately for options whose exercise price either equals or exceeds or is less than the market price of the stock

|

Exercise price Rs. 259.42 per share plus interest as mentioned in pricing formula

Fair Value Rs. 38.53

|

Exercise price Rs. 1.00 per share

Fair Value Rs. 591.30

|

|

n

|

A description of the method and significant assumptions used during the year to estimate the fair values of options, including the following weighted-average information:

|

The fair value of the options granted has been calculated using Black Scholes Options pricing formula and the significant assumptions made in this regard are as follows:

|

The fair value of the options granted has been calculated using Black – Scholes Options pricing formula and the significant assumptions made in this regard are as follows:

|

|

|

i) risk-free interest rate,

|

7.3% - 7.5%

|

7.4% - 9.4%

|

|

|

ii) expected life,

|

4 years

|

2 years

|

|

|

iii) expected volatility,

|

38.7%

|

32.8%

|

|

|

iv) expected dividends, and

|

1.0% - 3.0%

|

0.6% - 1.2%

|

|

|

v) the price of the underlying share in market at the time of option grant

|

Rs. 129.65 - Rs. 401.05

|

Rs. 376.20 - Rs. 849.85

|

Note 1- Employee wise details of options granted

|

Name of senior managerial persons to whom stock options have been granted

|

Number of Options Outstanding

|

|

Vivek Gambhir

|

17,778

|

|

P. Ganesh

|

6,800

|

|

Naveen Gupta

|

10,200

|

|

Omar Momin

|

2,252

|

|

R. Anand

|

5,471

|

|

Rahul Gama

|

5,473

|

|

Rakesh Sinha

|

9,004

|

|

Sunder Nurani Mahadevan

|

6,002

|

|

Sunil Kataria

|

8,206

|

Note 2 - Employees to whom options amounting to 5% or more of option granted in one year

|

Name of the employee

|

Number of Options Granted

|

Grant Year

|

Status as at March 31, 2014

|

|

Vivek Gambhir

|

17778

|

FY 2013-14

|

Not vested

|

|

Shashank Sinha

|

6005

|

FY 2013-14

|

Lapsed on account of employee leaving services.

|

|

Antonio Cao

|

4436

|

FY 2013-14

|

Lapsed on account of employee leaving services

|

Annexure B forming part of the Directors' Report

INFORMATION PURSUANT TO SECTION 217(1) (e) OF THE COMPANIES ACT, 1956, READ WITH THE COMPANIES (DISCLOSURE OF PARTICULARS IN THE REPORT OF THE BOARD OF DIRECTORS) RULES, 1988 IN RESPECT OF CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION AND FOREIGN EXCHANGE EARNINGS AND OUTGO

A. Conservation of Energy

I. (A) Energy Conservation measures undertaken:

Following steps are taken to reduce specific energy consumption (KWH / MT of production), specific water consumption, waste reduction and specific GHG emission.

At Central-West Cluster (Malanpur Unit)

1) Following equipment replaced with energy efficient equipment:

- Roots Blower for pneumatic conveying of soap noodle

- Air Compressor

- Air Conditioners

- Multiple Cooling tower pumps in FADP # 3 & Chilling Cooling Tower pump with Single higher capacity pump

- Traditional Light with LED light in Chemical Plant # 3 & Soap Making

2) Provided a Heat Exchanger to utilise waste heat of contaminated condensate for Boiler feed water pre-heating.

3) Reduced Lye Fat Ratio (water %) in FSP which resulted in water saving as well as Energy saving as overall feed mass reduced.

4) Optimised process air pressure and steam pressure in soap making to reduce energy consumption.

5) Optimised energy consumption of Brine Chilling plants through unification of multiple chillers and Optimised energy consumption in Soap making through increase in feed rate of Continuous Saponification plant.

6) Condensated water after heat utilisation for cooling tower make up.

7) Provided Auto level controller in cooling towers make up line to avoid water overflow.

At Baddi Units

- Optimised cooling tower fan working through interlocking with temperature controller to reduce power consumption in Thana unit.

- Provided energy-efficient CFL lights in place of conventional lights like HPSV in Thana unit.

- Started recycling treated effluent water for the flushing of toilets in Thana unit.

- Provided float valves in soft water make up line of cooling towers to avoid water overflow in Katha unit.

- Interlocked wrapping machine conveyors to avoid idle running in order to conserve energy.

- Biomass Gasifier provided to use renewable energy for Hot air Generator in Jammu unit.

At North East Units

- Provided natural draught air ventilators in place of exhaust fan.

- Provided CFL lights in place of conventional tube lights.

- Provided/increased transparent roof sheets to use sunlight, thus avoiding the use of electrical luminaries.

- Provided push type water taps to avoid water wastage.

- Reduced wet coil weight, thus reducing the consumption of fuel while drying the coils.

- Reused water drained from water filter and distillation column cooling.

At South Units

- Provided Natural Air draught ventilators in place of exhaust fan. Added more natural air draught ventilators.

- Provided twin cyclone separators in Hot Air Generator to reduce suspended particulate in ambient air.

- Provided CFL in place of traditional fittings.

- A sewage treatment plant was installed, and its treated water used for gardening, thus reducing fresh water consumption.

- Replaced CFB's with plastic trays for component transfers to reduce paper consumption.

Apart from the above, some other common initiatives that were undertaken included productivity improvement, de-bottlenecking of capacities and imparting awareness to all employees for energy, water conservation and waste reduction.

The results are as under:

Specific Energy Consumption (KWH/MT of production) reduced by 5.4% over previous year i.e. 2012-13.

Specific Water Consumption (KL/MT of production) reduced by 5.5% over previous year i.e. 2012-13

Specific GHG emissions (MT of CO2 / MT of production) reduced by 2.5% over previous year i.e. 2012-13

(B) Proposed energy conservation measures:

- Provision of biomass briquette (renewable fuel) fired boiler to replace fossil fuels.

- Provision of Energy efficient soap driers.

- Provision of Energy efficient air conditioners.

- Provision of Energy efficient (steam ejector less) vacuum system for Fat Splitting Plant.

- Provision of energy efficient vacuum system.

- Provision of energy efficient LED lights.

- Provision of additional waste heat recovery system for Flue gases.

- Provision of natural air ventilators for Soap Making Plant.

II. Impact of measures on reduction of energy consumption and consequent impact on the cost of production of goods:

Saving in energy costs during the period under consideration.

B. Technology Absorption

Research & Development (R&D)

The Research & Development function of your Organisation continued to play a key role in ensuring successful commercial launch of AER Gel Twist and Click during the year.

The current year like previous years saw a strong focus on consumer-centric design led innovation, and, in addition, strong adoption to newly defined R&D processes in addressing innovation projects. The commercialisation of the gel technology for AER, with both the Twist and Click formats, is a notable example of a fine innovation in the marketplace, whilst offering a strong differentiated offering to our consumers in the air freshening space.

The current year has also witnessed more launches in the Household Insecticide Category with new product innovation. For the first time we entered into a new format such as 'Fast Card' for better management of mosquitoes, and also technology-led innovation with GK Express, providing a better upgradation of consumer benefits with quicker and more powerful mosquito control using latest technology in device and wick.

Several improvements in R&D systems have helped overall in product quality and process improvements, apart from better optimisation.

I. Specific areas in which R & D carried out by the Company -

- Hair Care and Hair Styling

- Skin Cleansing & Care

- Household Insecticides

- Customer Centric Innovations

- Packaging Development

- Fabric Care

- Hygiene Products

II. Benefits derived as a result of the above R & D efforts-

Strong R&D contribution to Innovation projects led to the successful commercial launches of the aforementioned products in the marketplace this year. It also resulted in better management of products and processes which resulted in revenue generation in the current financial year. In addition, work on few, purely R&D-led ideation projects was also focussed upon and progressed. Strong support towards few Household Insecticides and Personal Care projects was extended to some of our International businesses.

III. Future Plan of Action- R&D shall continue to play a key role in development and successful execution of newer innovations in the marketplace for both the domestic, and, the international business. R&D shall constantly endeavour to deliver superior innovative products adopting newly defined R&D and Innovation processes in order to delight, both, our domestic and international customers by:

- Ensuring successful commercial launches within product categories for the coming year.

- Engaging in providing support on defining global innovation strategies for product categories within our international businesses, and, extending support on relevant product development for international markets.

- Focussing on newer consumer relevant product experiences within product categories.

- Strong emphasis on adherence to newly defined R&D and Innovation processes which has helped streamline deliveries effectively.

- Maintaining strong focus on R&D training needs, and, people as well as, people skills development.

IV. Expenditure on R & D

Rs. Crore

|

|

FY 2013-14 |

FY 2012-13 |

(a) |

Capital |

0.5 |

0.6 |

(b) |

Recurring |

11.5 |

8.9 |

(c) |

Total |

12.0 |

9.5 |

(d) |

Total R & D expenditure as a percentage of total sales turnover

|

0.30%

|

0.27%

|

Technology absorption, adaptation and innovation

-

Efforts, in brief, made towards technology absorption, adaptation and innovation:

Commercialisation of New Products

AER: Launch of gel-based air freshener technology for car with both Twist and Click formats.

-

Benefits derived as a result of the above efforts, e.g. product improvement, cost reduction, product development, import substitution, etc.

R&D-focussed efforts towards commercialising the above innovation in the marketplace have assisted in maintaining innovation momentum, thereby, raising your Company's image and credibility in marketplace. This innovation, whilst providing superior value and delight to our consumers, was maintained optimal on cost with a view to sustain business profitability.

- Imported Technology:

The Company has not imported any technology since its incorporation.

C. Foreign Exchange earnings and outgo:

Rs. Crore

|

|

|

FY 2013-14

|

FY 2012-13

|

|

I.

|

Foreign exchange used

|

195.64

|

290.54

|

|

II.

|

Foreign exchange earned

|

170.63

|

174.62

|

Annexure C forming part of the Directors' Report

Auditors' Certificate on Corporate Governance

To the Members of

Godrej Consumer Products Limited,

Mumbai.

We have examined the compliance of conditions of Corporate Governance by Godrej Consumer Products Limited (the Company) for the year ended on March 31, 2014, as stipulated in Clause 49 of the Listing Agreements of the said Company with the Stock Exchanges in India.

The compliance of conditions of Corporate Governance is the responsibility of the Management. Our examination was limited to procedures and implementation thereof, adopted by the Company for ensuring compliance with the conditions of Corporate Governance. It is neither an audit, nor an expression of opinion on the financial statements of the Company.

In our opinion and to the best of our information and according to the explanations given to us and the representations made by the Directors and the Management, we certify that the Company has complied with the conditions of Corporate Governance as stipulated in the above-mentioned Listing Agreement.

We further state that such compliance is neither an assurance as to the future viability of the Company nor the efficiency or effectiveness with which the Management has conducted the affairs of the Company.

For and on behalf of

Kalyaniwalla & Mistry

Chartered Accountants

Firm Regn. No. 104607W

Roshni Marfatia

Partner

Membership No.: 106548

Mumbai, April 28, 2014